CONSOLIDATED FINANCIAL REPORT | EXPLANATORY NOTES

238

(1)

These comprise Provisions for risks and charges (current and non-current) and Employee benefit obligations.

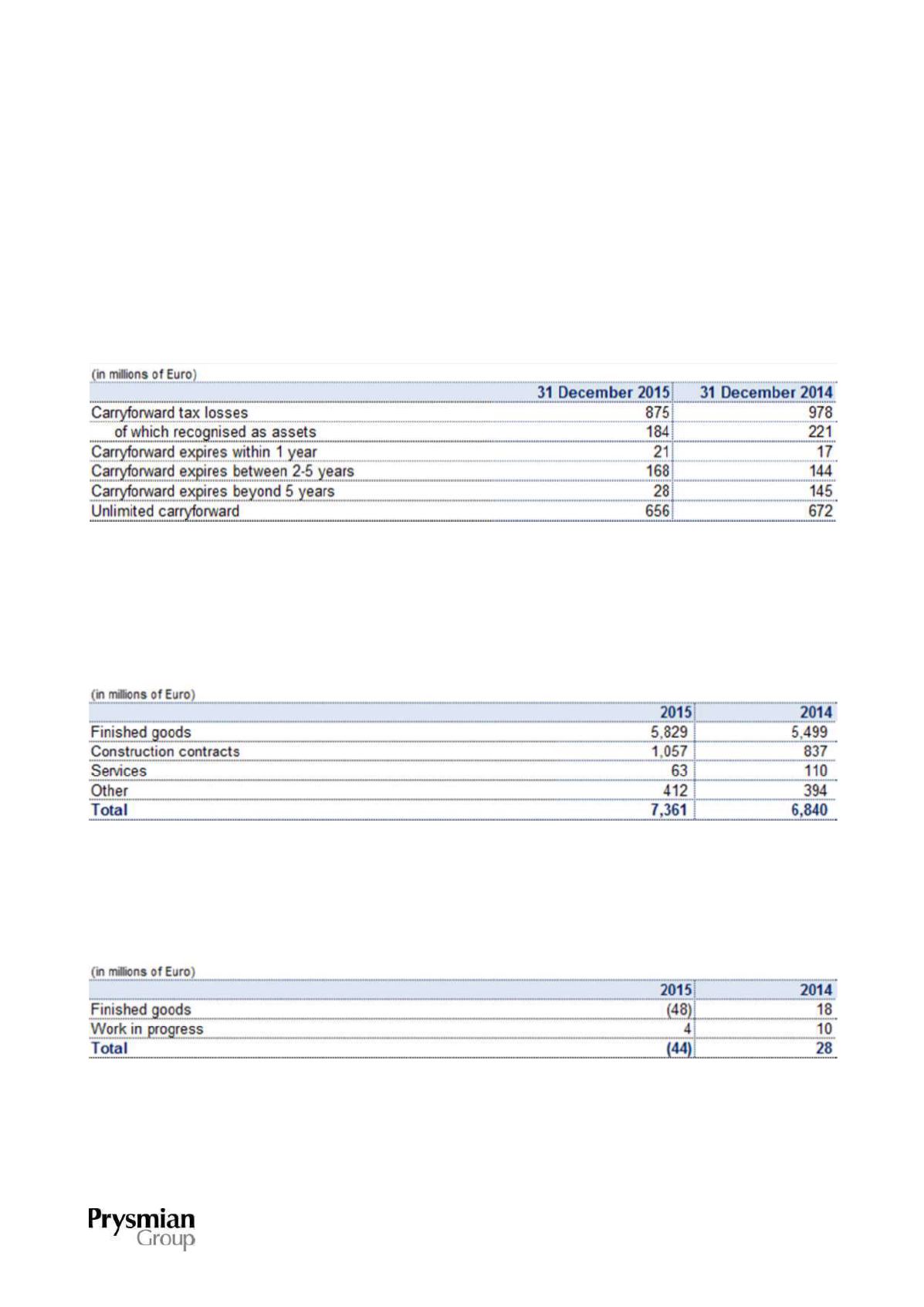

The Group has not recognised any deferred tax assets for carryforward tax losses of Euro 691 million at 31

December 2015 (Euro 757 million at 31 December 2014), or for future deductible temporary differences of

Euro 185 million at 31 December 2015 (Euro 228 million at 31 December 2014). Unrecognised deferred tax

assets relating to these carryforward tax losses and deductible temporary differences amount to Euro 235

million at 31 December 2015 (Euro 298 million at 31 December 2014).

The following table presents details of carryforward tax losses:

17. SALES OF GOODS AND SERVICES

These are detailed as follows:

18. CHANGE IN INVENTORIES OF WORK IN PROGRESS, SEMI-FINISHED AND FINISHED GOODS

This is detailed as follows: