CONSOLIDATED FINANCIAL REPORT | EXPLANATORY NOTES

242

Company's shares on the Milan Stock Exchange over a period of five consecutive business days in July

2016.

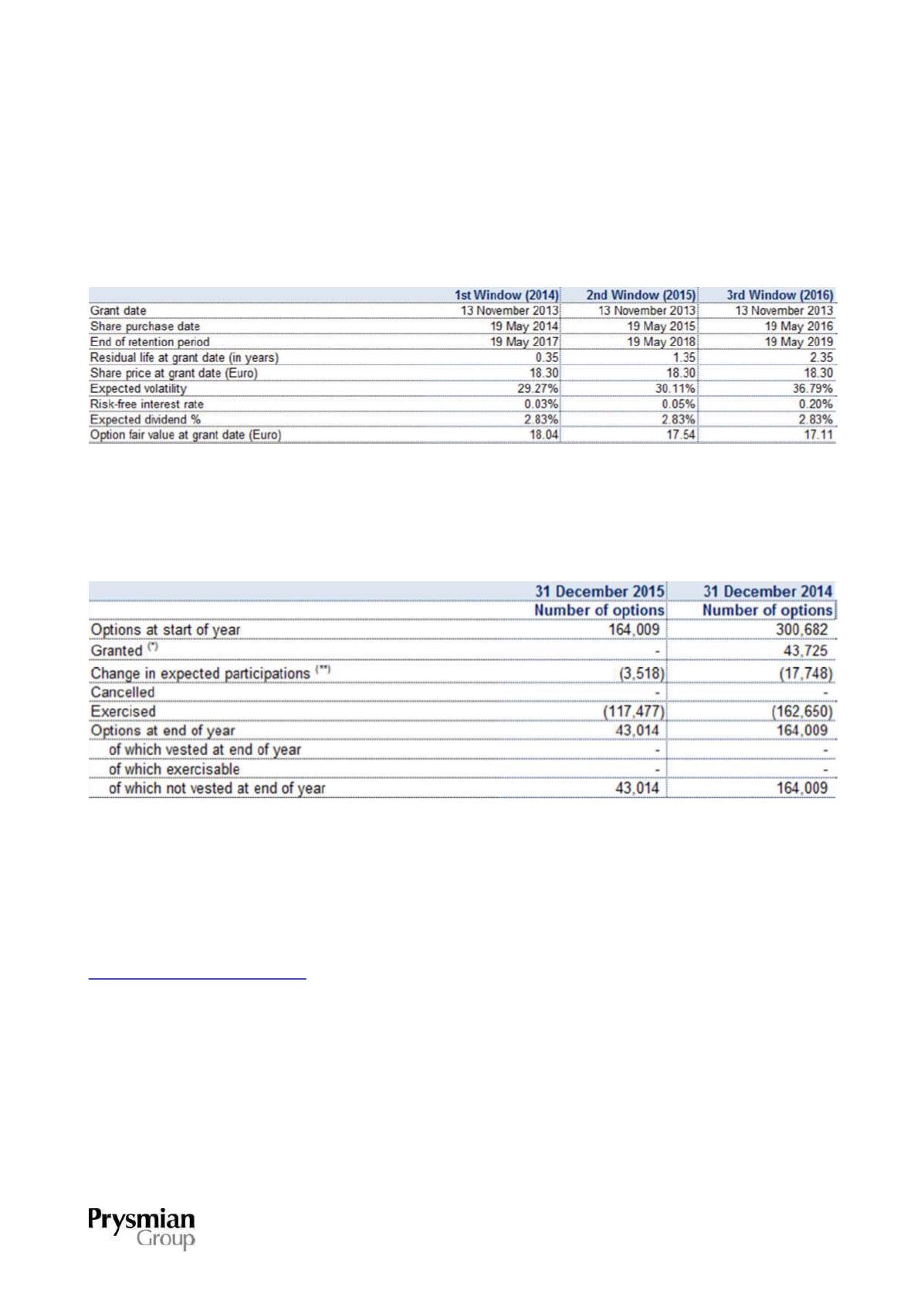

The fair value of the options has been determined using the Montecarlo binomial pricing model, based on the

following assumptions:

A total cost of Euro 2 million for the fair value of options granted under this plan has been recognised as

"Personnel costs" in the income statement for the year ended 31 December 2015.

The following table provides additional details about movements in the plan:

(*)

The number of options refers to participations in the additional purchase windows reserved for Managers (actual numbers for the first

year and expected numbers for the next two years).

(**)

The number of options has been revised for the actual number of participations in the first and second purchase windows.

The information memorandum, prepared under art. 114-bis of Legislative Decree 58/98 and describing the

characteristics of the above plan, is publicly available on the Company's website at

http://www.prysmiangroup.com/ ,from its registered offices and from Borsa Italiana S.p.A.