CONSOLIDATED FINANCIAL REPORT | EXPLANATORY NOTES

247

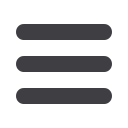

27. TAXES

These are detailed as follows:

The following table reconciles the effective tax rate with the Parent Company's theoretical tax rate:

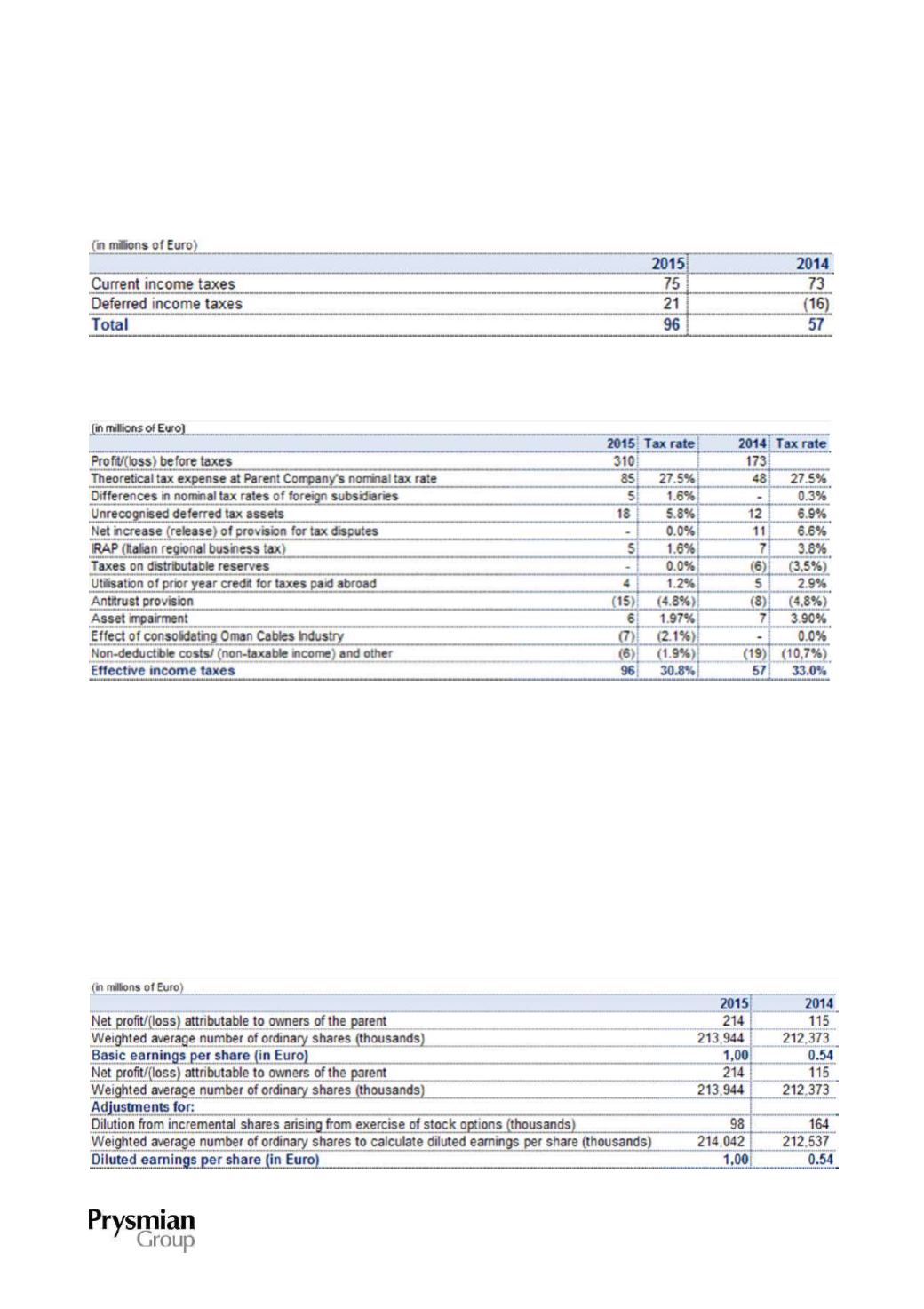

28. EARNINGS/(LOSS) AND DIVIDENDS PER SHARE

Both basic and diluted earnings (loss) per share have been calculated by dividing the net result for the period

attributable to owners of the parent by the average number of the Company's outstanding shares.

Diluted earnings/(loss) per share have been affected by the options relating to participation in the employee

share purchase plan (YES Plan), but they have not been affected by the options relating to the convertible

bond since the bond is currently out of the money, or by the options under the long-term incentive plan 2015-

2017 since aggregate EBITDA at 31 December 2015 has not yet triggered their allotment.