CONSOLIDATED FINANCIAL REPORT | EXPLANATORY NOTES

230

is the discount rate, identified by reference to market yields of AA corporate bonds denominated in GB

pounds.

France

There were five pension plans in operation in France at 31 December 2015, of which four retirement benefit

plans that are unfunded in accordance with French legislation, and one funded plan.

All the generally set the retirement age at 63. All the plans are open to new members, except for the funded

plan which does not admit new members or accrue new liabilities. As at 31 December 2015, the plans had

an average duration of approximately 10.5 years (10.9 years at 31 December 2014).

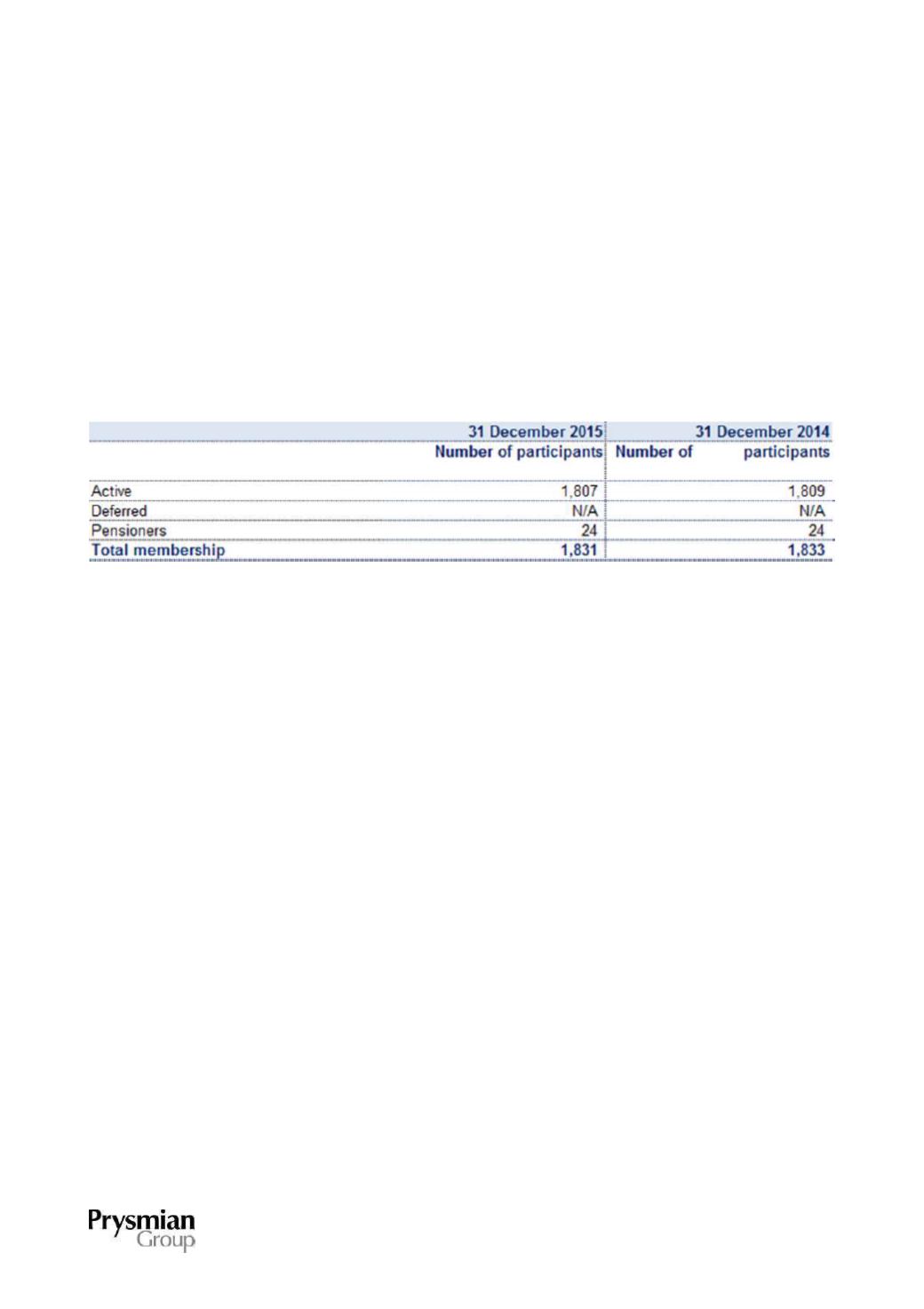

Total plan membership is made up as follows:

In the case of the unfunded plans, the company pays the amount accrued when employees leave the

company.

The principal risk for the Prysmian Group in France is salary growth, which affects the benefits that the

company has to pay the employee. The benefits vest only upon attaining retirement age; consequently, the

cost to the company will depend on the probability that an employee does not leave the company before that

date. There are no life expectancy risks relating to these plans. The liabilities and service costs are sensitive

to the following variables: inflation, salary growth, life expectancy of plan participants and the discount rate,

identified by reference to market yields of AA corporate bonds denominated in Euro.

The main risks for the funded plan are connected to inflation and life expectancy, both of which affect

contribution levels. The plan's assets are entirely invested in insurance funds, whose main risk is that a

mismatch between the expected return and the actual return on plan assets would require contribution levels

to be revised.