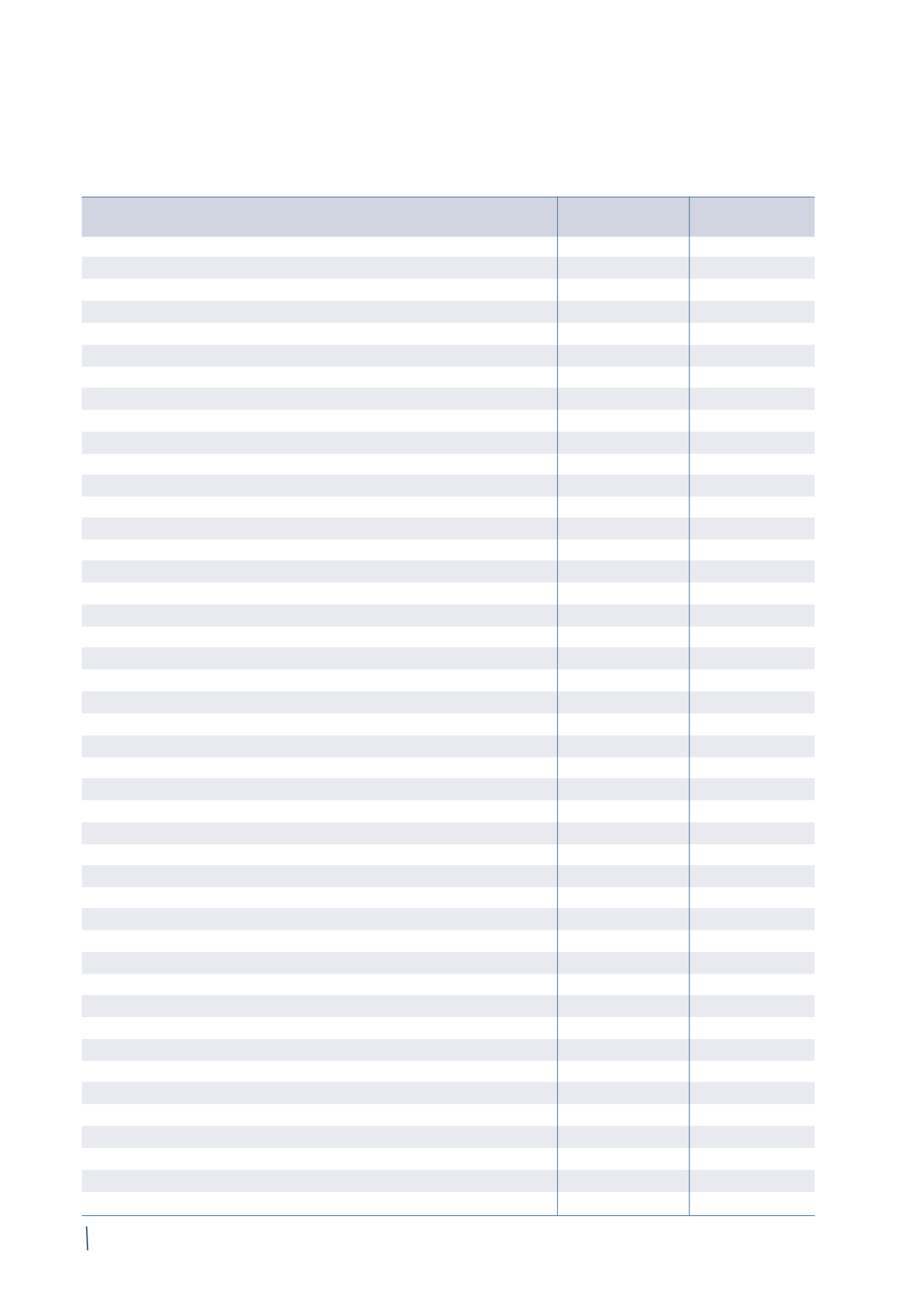

Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

156

31 December 2013

Effects application

31 December 2013

IFRS 10-11

Restated

Non-current assets

Property, plant and equipment

1,441

(51)

1,390

Intangible assets

623

(35)

588

Equity-accounted investments

99

106

205

Available-for-sale financial assets

15

(3)

12

Derivatives

2

-

2

Deferred tax assets

134

(4)

130

Other receivables

29

(1)

28

Total non-current assets

2,343

12

2,355

Current assets

Inventories

920

(39)

881

Trade receivables

1,010

(77)

933

Other receivables

739

(17)

722

Financial assets held for trading

94

(1)

93

Derivatives

23

-

23

Cash and cash equivalents

561

(51)

510

Total current assets

3,347

(185)

3,162

Assets held for sale

12

-

12

Total assets

5,702

(173)

5,529

Equity attributable to the Group:

1,147

-

1,147

Share capital

21

-

21

Reserves

977

-

977

Net profit/(loss) for the year

149

-

149

Equity attributable to non-controlling interests:

48

(12)

36

Share capital and reserves

43

(11)

32

Net profit/(loss) for the year

5

(1)

4

Total equity

1,195

(12)

1,183

Non-current liabilities

Borrowings from banks and other lenders

1,154

(35)

1,119

Other payables

24

(4)

20

Provisions for risks and charges

52

(1)

51

Derivatives

7

-

7

Deferred tax liabilities

100

(3)

97

Employee benefit obligations

308

-

308

Total non-current liabilities

1,645

(43)

1,602

Current liabilities

Borrowings from banks and other lenders

338

(46)

292

Trade payables

1,441

(32)

1,409

Other payables

728

(40)

688

Derivatives

42

-

42

Provisions for risks and charges

279

-

279

Current tax payables

34

-

34

Total current liabilities

2,862

(118)

2,744

Total liabilities

4,507

(161)

4,346

Total equity and liabilities

5,702

(173)

5,529

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AT 31 DECEMBER 2013:

(in millions of Euro)