Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

158

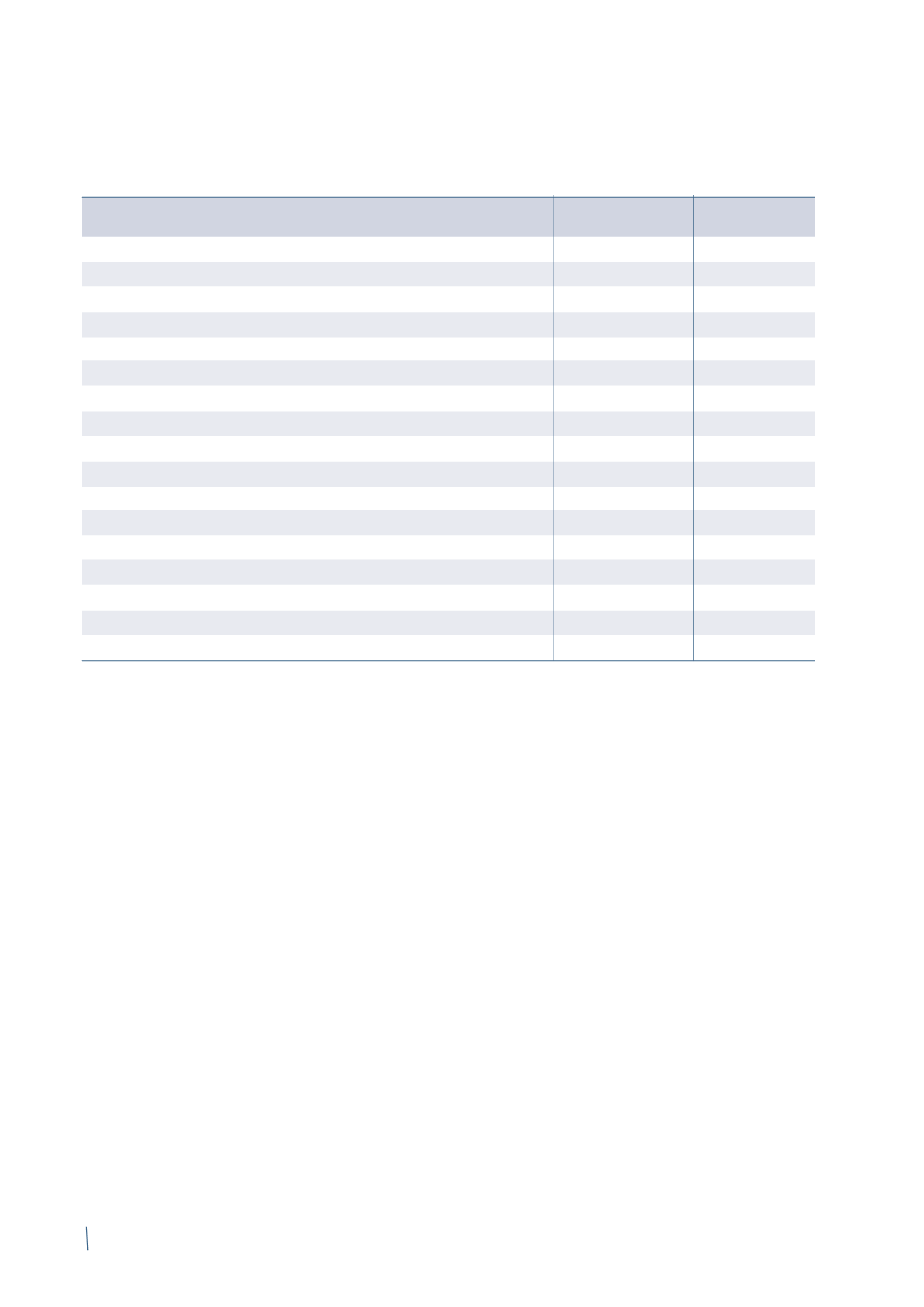

2013

Effects application

2013

Published

IFRS 10-11

Restated

Net profit/(loss) for the year

154

(1)

153

Comprehensive income/(loss) for the year:

- items that may be reclassified subsequently to profit or loss:

Fair value gains/(losses) on cash flow hedges - gross of tax

9

-

9

Fair value gains/(losses) on cash flow hedges - tax effect

(4)

-

(4)

Release of cash flow hedge reserve after discontinuing cash flow hedging - gross of tax

15

-

15

Release of cash flow hedge reserve after discontinuing cash flow hedging - tax effect

(5)

-

(5)

Currency translation differences

(97)

1

(96)

Total items that may be reclassified, net of tax

(82)

1

(81)

- items that will NOT be reclassified subsequently to profit or loss:

Actuarial gains/(losses) on employee benefits - gross of tax

3

-

3

Actuarial gains/(losses) on employee benefits - tax effect

(2)

-

(2)

Total items that will NOT be reclassified, net of tax

1

-

1

Total comprehensive income/(loss) for the year

73

-

73

Attributable to:

Owners of the parent

71

-

71

Non-controlling interests

2

-

2

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME AT 31 DECEMBER 2013:

(in millions of Euro)