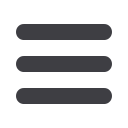

161

2014

2013 (*)

-5%

+5%

-5%

+5%

Euro

(1.70)

1.54

(1.59)

1.44

US Dollar

(0.91)

0.82

(2.05)

1.85

Other currencies

(0.80)

0.72

(0.71)

0.64

Total

(3.41)

3.08

(4.35)

3.93

2014

2013 (*)

-10%

+10%

-10%

+ 10%

Euro

(3.59)

2.93

(3.35)

2.74

US Dollar

(1.91)

1.57

(4.32)

3.53

Other currencies

(1.68)

1.37

(1.49)

1.22

Total

(7.18)

5.87

(9.16)

7.49

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

Zealand Dollar; none of these exposures, taken individually,

accounted for more than 1.45% of the overall exposure to

transactional exchange rate risk in 2014 (1.6% in 2013).

It is the Group’s policy to hedge, where possible, exposures in

currencies other than the accounting currencies of its indivi-

dual companies. In particular, the Group hedges:

• Definite cash flows: invoiced trade flows and exposures

arising from loans and borrowings;

• Projected cash flows: trade and financial flows arising

from firm or highly probable contractual commitments.

The above hedges are arranged using derivative contracts.

The following sensitivity analysis shows the effects on net

profit of a 5% and 10% increase/decrease in exchange rates

versus closing exchange rates at 31 December 2014 and 31

December 2013.

(in millions of Euro)

(in millions of Euro)