Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

164

[c] Price risk

The Group is exposed to price risk in relation to purchases and

sales of strategic materials, whose purchase price is subject to

market volatility. The main raw materials used by the Group

in its own production processes consist of strategic metals

such as copper, aluminium and lead. The cost of purchasing

such strategic materials accounted for approximately 51.2%

of the Group’s total cost of materials in 2014 (56.3% in 2013),

forming part of its overall production costs.

In order to manage the price risk on future trade transactions,

the Group negotiates derivative contracts on strategic metals,

setting the price for projected future purchases.

Although the ultimate aim of the Group is to hedge risks to

which it is exposed, these contracts do not qualify as hedging

instruments for accounting purposes.

The derivative contracts entered into by the Group are ne-

gotiated with major financial counterparties on the basis of

strategic metal prices quoted on the London Metal Exchange

(“LME”), the New York market (“COMEX”) and the Shanghai

Futures Exchange (“SFE”).

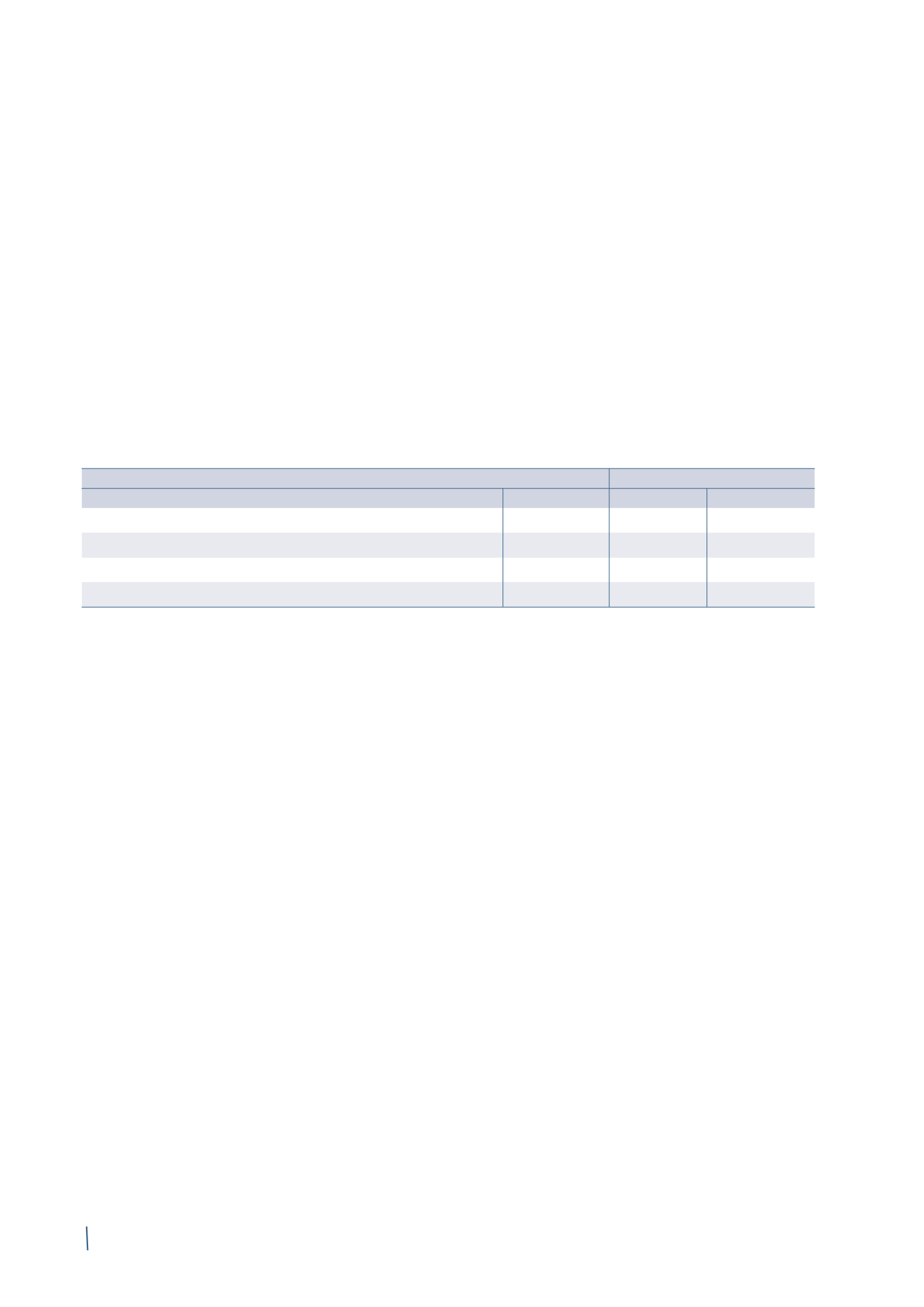

The following sensitivity analysis shows the effect on net

profit and consolidated equity of a 10% increase/decrease in

strategic material prices versus prices at 31 December 2014

and 31 December 2013, assuming that all other variables

remain equal.

2014

2013 (*)

-10%

+10%

-10%

+10%

LME

(12.63)

12.63

(13.85)

13.85

COMEX

0.21

(0.21)

(0.78)

0.78

SFE

(5.42)

5.42

(4.88)

4.88

Total

(17.84)

17.84

(19.51)

19.51

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

The potential impact shown above is solely attributable to

increases and decreases in the fair value of derivatives on

strategic material prices which are directly attributable to

changes in the prices themselves. It does not refer to the

impact on the income statement of the purchase cost of

strategic materials.

[d] Credit risk

Credit risk is connected with trade receivables, cash and cash

equivalents, financial instruments, and deposits with banks

and other financial institutions.

Customer-related credit risk is managed by the individual

subsidiaries and monitored centrally by the Group Finance

Department. The Group does not have significant concen-

trations of credit risk. It nonetheless has procedures aimed

at ensuring that sales of products and services are made to

reliable customers, taking account of their financial position,

track record and other factors. Credit limits for major

customers are based on internal and external assessments

within ceilings approved by local country management. The

utilisation of credit limits is periodically monitored at local

level.

During 2014 the Group had a global insurance policy in place

to provide coverage for part of its trade receivables against

any losses.

As for credit risk relating to the management of financial and

cash resources, this risk ismonitored by the Group Finance De-

partment, which implements procedures intended to ensure

that Group companies deal with independent, high standing,

reliable counterparties. In fact, at 31 December 2014 (like at

31 December 2013) almost all the Group’s financial and cash

resources were held with investment grade counterparties.

Credit limits relating to the principal financial counterparties

are based on internal and external assessments, within

ceilings defined by the Group Finance Department.

(in millions of Euro)