165

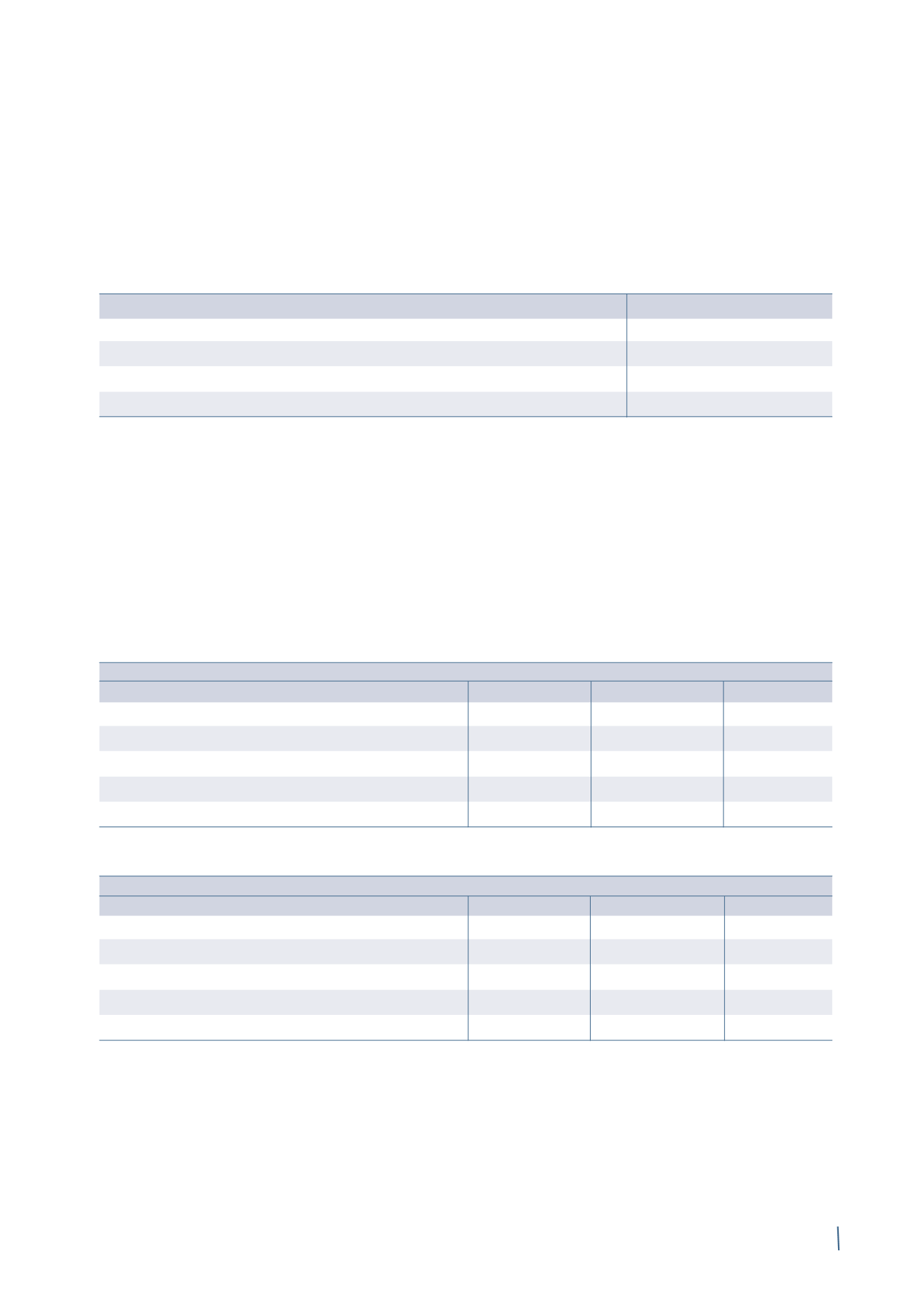

[e] Liquidity risk

Prudent management of the liquidity risk arising from the

Group’s normal operations involves the maintenance of

adequate levels of cash and cash equivalents and short-term

securities as well as ensuring the availability of funds by

having an adequate amount of committed credit lines.

The Group Finance Department uses cash flow forecasts to

monitor the projected level of the Group’s liquidity reserves.

The amount of liquidity reserves at the reporting date is as

follows:

31 December 2014

31 December 2013 (*)

Cash and cash equivalents

494

510

Financial assets held for trading

76

93

Unused committed lines of credit

1,470

897

Total

2,040

1,500

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

Unused committed lines of credit at 31 December 2014 refer

to the Revolving Credit Facility 2011 and Syndicated Revolving

Credit Facility 2014 (Euro 1,400 million) and to the Revolving

Credit Facility 2014 (Euro 70 million); at 31 December 2013,

they had comprised Euro 797 million for the Revolving Credit

Facilities 2010 and 2011 and Euro 100 million for the EIB loan.

The following table includes an analysis, by due date, of

payables, other liabilities, and derivatives settled on a net

basis; the various due date categories refer to the period

between the reporting date and the contractual due date of

the obligations.

31 December 2014

Due within 1 year Due between 1 - 2 years Due between 1 - 5 years

Due after 5 years

Borrowings from banks and other lenders

585

433

355

25

Finance lease obligations

3

3

4

12

Derivatives

47

5

-

-

Trade and other payables

2,242

6

3

4

Total

2,877

447

362

41

31 December 2013 (*)

Due within 1 year Due between 1 - 2 years Due between 1 - 5 years

Due after 5 years

Borrowings from banks and other lenders

325

448

686

3

Finance lease obligations

3

3

4

11

Derivatives

42

3

4

-

Trade and other payables

2,097

3

6

11

Total

2,467

457

700

25

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

(in millions of Euro)

(in millions of Euro)

(in millions of Euro)