Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

162

When assessing the potential impact of the above, the

assets and liabilities of each Group company in currencies

other than their accounting currency were considered, net of

any derivatives hedging the above-mentioned flows.

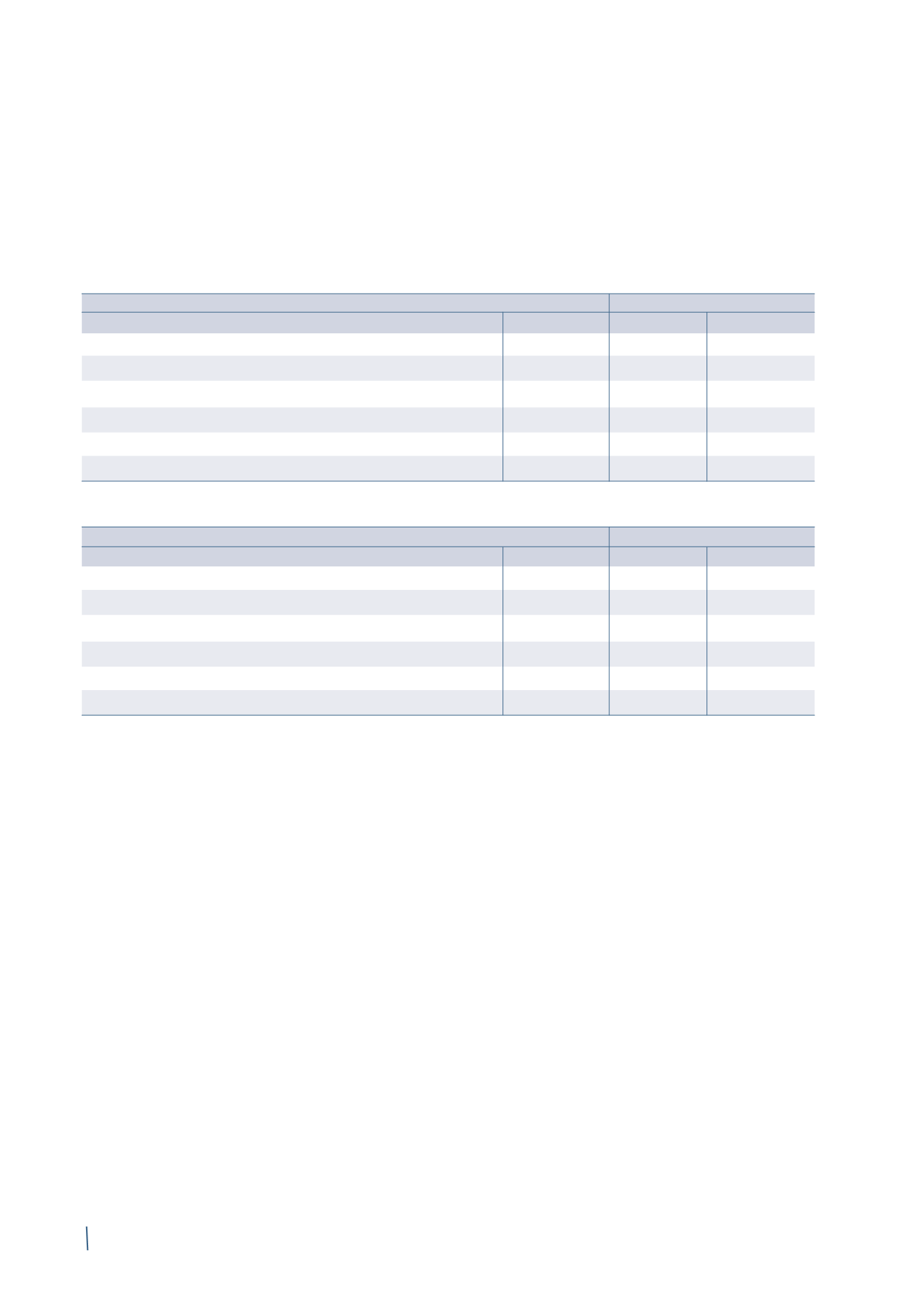

The following sensitivity analysis shows the post-tax effects

on equity reserves of an increase/decrease in the fair value

of designated cash flow hedges following a 5% and 10%

increase/decrease in exchange rates versus closing exchange

rates at 31 December 2014 and 31 December 2013.

2014

2013 (*)

-5%

+5%

-5%

+5%

US Dollar

0.85

(0.94)

1.31

(1.45)

United Arab Emirates Dirham

1.85

(2.04)

0.38

(0.42)

Qatari Riyal

2.71

(2.99)

1.86

(2.05)

Saudi Riyal

-

-

-

-

Other currencies

0.58

(0.64)

0.48

(0.53)

Total

5.99

(6.61)

4.03

(4.45)

2014

2013 (*)

-10%

+10%

-10%

+10%

US Dollar

1.62

(1.98)

2.50

(3.06)

United Arab Emirates Dirham

3.53

(4.31)

0.72

(0.88)

Qatari Riyal

5.17

(6.31)

3.54

(4.33)

Saudi Riyal

-

-

0.01

(0.01)

Other currencies

1.10

(1.34)

0.92

(1.12)

Total

11.42

(13.94)

7.69

(9.40)

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

The above analysis ignores the effects of translating the equity of Group companies whose functional currency is not the Euro.

(in millions of Euro)

(in millions of Euro)