Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

168

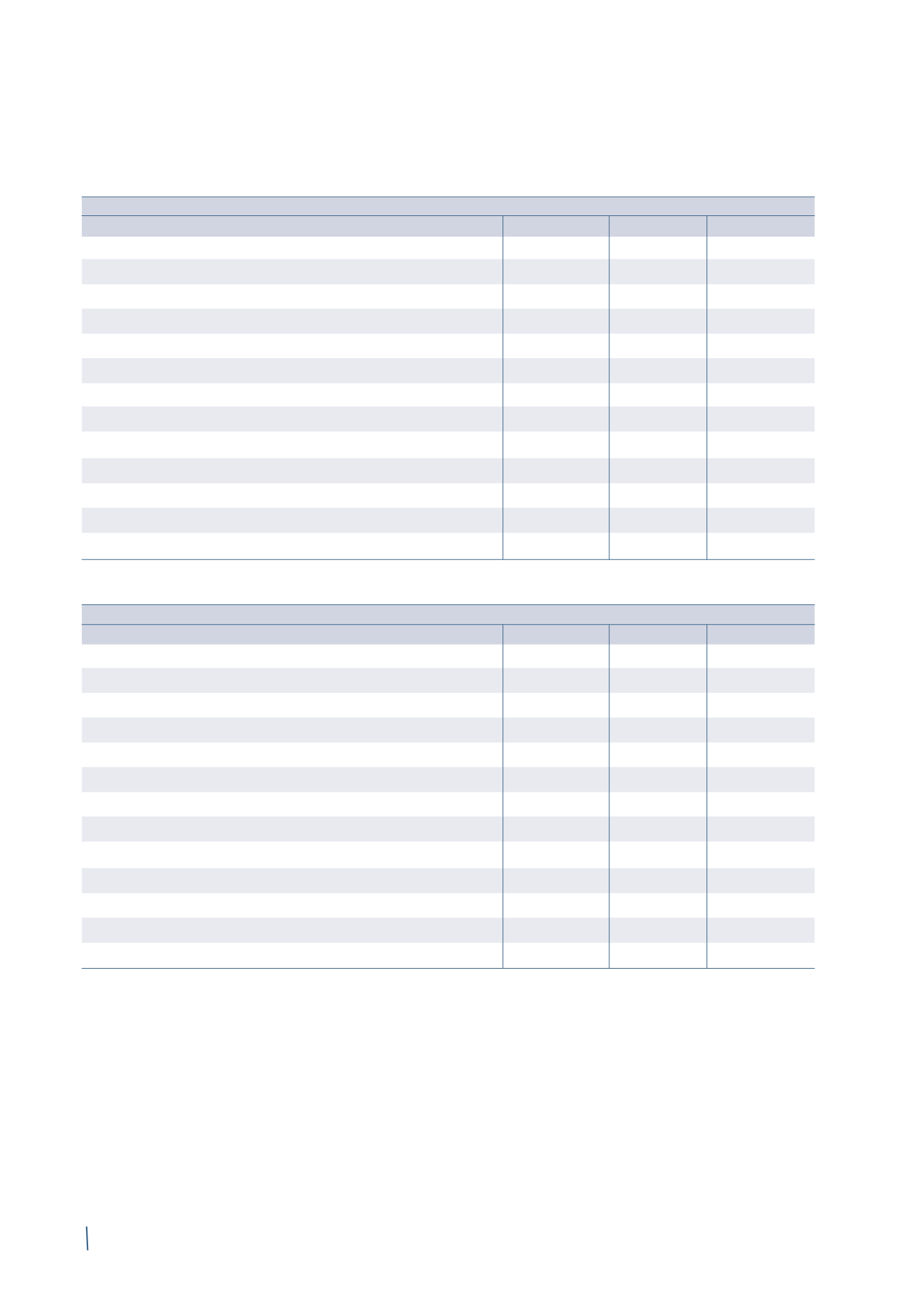

The following tables present the assets and liabilities that are measured at fair value:

31 December 2014

Level 1

Level 2

Level 3

Total

Assets

Financial assets at fair value through profit or loss:

Derivatives

-

19

-

19

Financial assets held for trading

67

9

-

76

Hedging derivatives

-

11

-

11

Available-for-sale financial assets

-

-

12

12

Total assets

67

39

12

118

Liabilities

Financial liabilities at fair value through profit or loss:

Derivatives

1

27

-

28

Hedging derivatives

-

24

-

24

Total liabilities

1

51

-

52

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

31 December 2013 (*)

Level 1

Level 2

Level 3

Total

Assets

Financial assets at fair value through profit or loss:

Derivatives

5

15

-

20

Financial assets held for tradin

86

7

-

93

Hedging derivatives

-

5

-

5

Available-for-sale financial assets

-

-

12

12

Total assets

91

27

12

130

Liabilities

Financial liabilities at fair value through profit or loss:

Derivatives

18

18

-

36

Hedging derivatives

-

13

-

13

Total liabilities

18

31

-

49

Financial assets classified in fair value Level 3 reported no

significant movements in either 2014 or 2013.

Given the short-term nature of trade receivables and

payables, their book values, net of any allowance for doubtful

accounts, are treated as a good approximation of fair value.

During 2014 there were no transfers of financial assets

and liabilities between the different levels of the fair value

hierarchy.

(in millions of Euro)

(in millions of Euro)