173

F.1

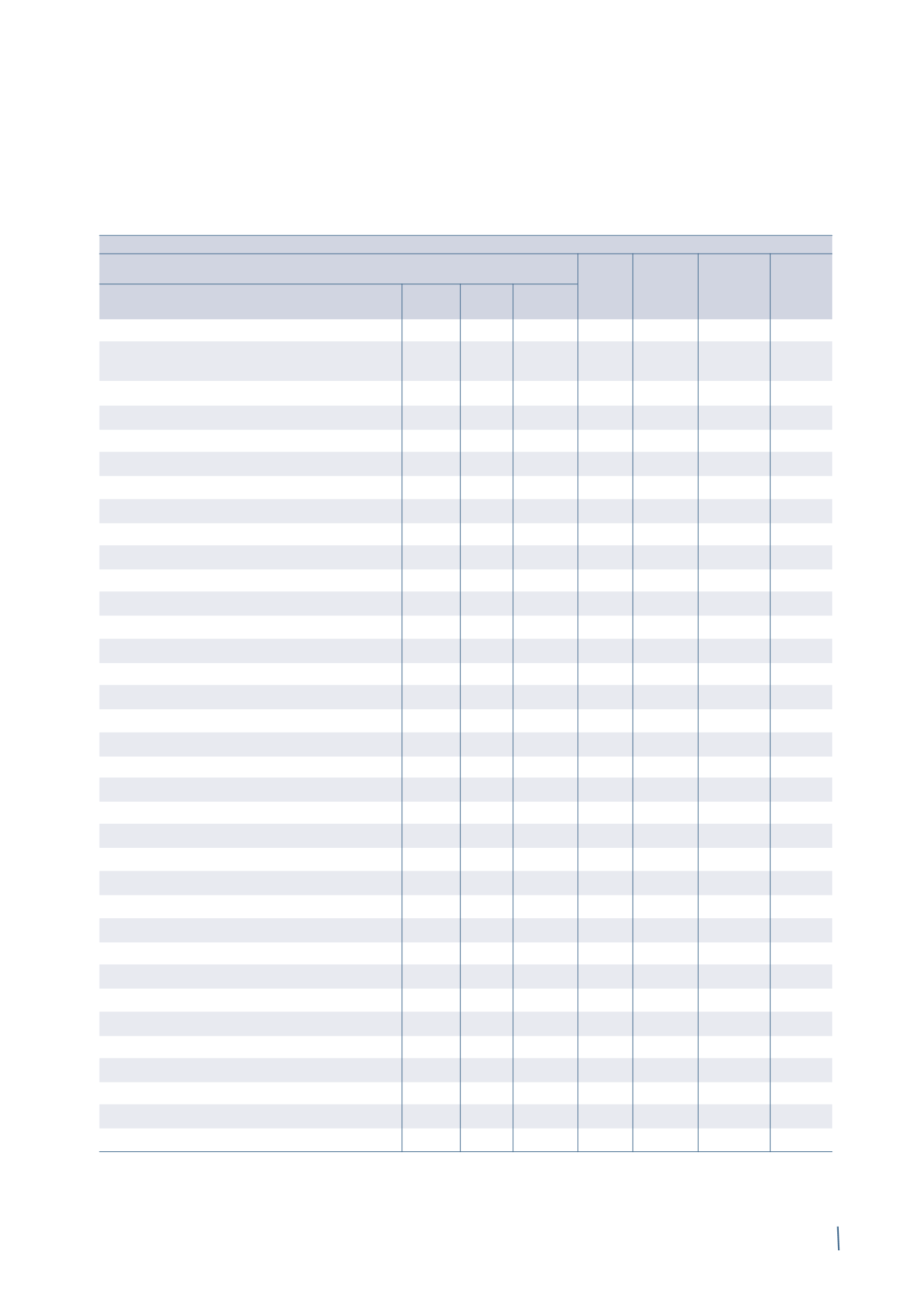

OPERATING SEGMENTS

(1) Sales of the operating segments and business areas are reported net of intercompany transactions and net of transactions between operating segments,

consistent with the presentation adopted in the regularly reviewed reports.

(2) This refers to the acquisition in November 2012 of Global Marine Systems Ltd (now renamed Prysmian PowerLink Services Ltd) from Global Marine

Systems Ltd.

The following tables present information by operating segment.

2014

Energy Products

Energy

Telecom Corporate

Total

Projects

Group

E&I Industrial

Other

Total

& NWC

Products

Sales

(1)

2,677

1,708

106

4,491

1,355

994

-

6,840

Adjusted EBITDA before share of net profit/(loss)

of equity-accounted companies

91

125

5

221

154

91

-

466

% of sales

3.4% 7.4%

4.9% 11.4%

9.1%

6.8%

Adjusted EBITDA (A)

108

126

5

239

154

116

-

509

% of sales

4.1% 7.4%

5.3% 11.3% 11.7%

7.4%

EBITDA (B)

90

121

(16)

195

195

116

(10)

496

% of sales

3.4% 7.1%

4.3% 14.4% 11.6%

7.2%

Amortisation and depreciation (C)

(34)

(26)

(2)

(62)

(40)

(42)

-

(144)

Adjusted operating income (A+C)

74

100

3

177

114

74

-

365

% of sales

2.8% 5.9% 2.8% 3.9% 8.4%

7.4%

5.3%

Fair value change in metal derivates (D)

7

Fair value stock options (E)

(3)

Impairment and impairment reversal of assets (F)

(18)

(25)

(1)

(44)

Operating income (B+C+D+E+F)

312

% of sales

4.5%

Finance costs

339

Finance income

(479)

Taxes

(57)

Net profit/(loss) for the year

115

% of sales

1.7%

Attributable to:

Owners of the parent

115

Non-controlling interests

-

Reconciliation of EBITDA to ADJUSTED EBITDA

EBITDA (A)

90

121

(16)

195

195

116

(10)

496

Non-recurring expenses/(income):

Company reorganisation

17

5

16

38

1

6

3

48

Antitrust

-

-

-

-

(31)

-

-

(31)

Environmental remediation and other costs

-

-

-

-

-

-

-

-

Effect of YOFC dilution

-

-

-

-

-

(8)

-

(8)

Gains on asset disposals

-

-

-

-

-

-

-

-

Acquisition price adjustment

(2)

-

-

-

-

(22)

-

-

(22)

Other net non-recurring expenses

1

-

5

6

11

2

7

26

Total non-recurring expenses/(income) (B)

18

5

21

44

(41)

-

10

13

Adjusted EBITDA (A+B)

108

126

5

239

154

116

-

509

(in millions of Euro)