179

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

Gross investments in intangible assets amount to Euro 18

million in 2014, of which Euro 11 million for development of

the “SAP Consolidation” project, intended to harmonise the

information system across the Group.

As at 31 December 2014, the Prysmian Group had capitali-

sed Euro 380 million in Goodwill; this Goodwill reflects the

effects of:

• the adoption of IFRS 10 and IFRS 11: this has resulted

in the restatement of the Group’s consolidated figures

with effect from 1 January 2013. In particular, goodwill

has been allocated to the value of the investments in

Yangtze Optical Fibre and Cable Joint Stock Limited Co.

and Yangtze Optical Fibre and Cable (Shanghai) Co. Ltd,

for which changed their method of consolidation from

proportional and line-by-line respectively to the equity

method. The reallocation was performed on the basis of

the value of net invested capital at 1 January 2013.

• the redefinition of the operating segments after

adopting the new organisational structure: this has

resulted in reallocating goodwill previously allocated to

the Energy segment to the new operating segments:

Energy Products and Energy Projects. The reallocation

was performed on the basis of the value of net invested

capital at 1 January 2014 (the date of the organisational

change).

At 31 December 2014, the development costs for the SURF

business capitalised by the Brazilian subsidiary Prysmian

Surflex Umbilicais e Tubos Flexiveis do Brasil Ltda were

tested for impairment. This has resulted in the recognition

of an impairment loss of Euro 21 million in 2014.

Goodwill impairment test

As reported earlier, the Chief Executive Officer reviews

operating performance by macro type of business. Until

31 December 2013, the types of businesses identified

were Energy and Telecom. From 1 January 2014 the Group

embarked on a process of organisational change, in keeping

with the new model in which the operating segments are:

Energy Products, Energy Projects and Telecom. Goodwill has

therefore been monitored internally at the level of these

operating segments.

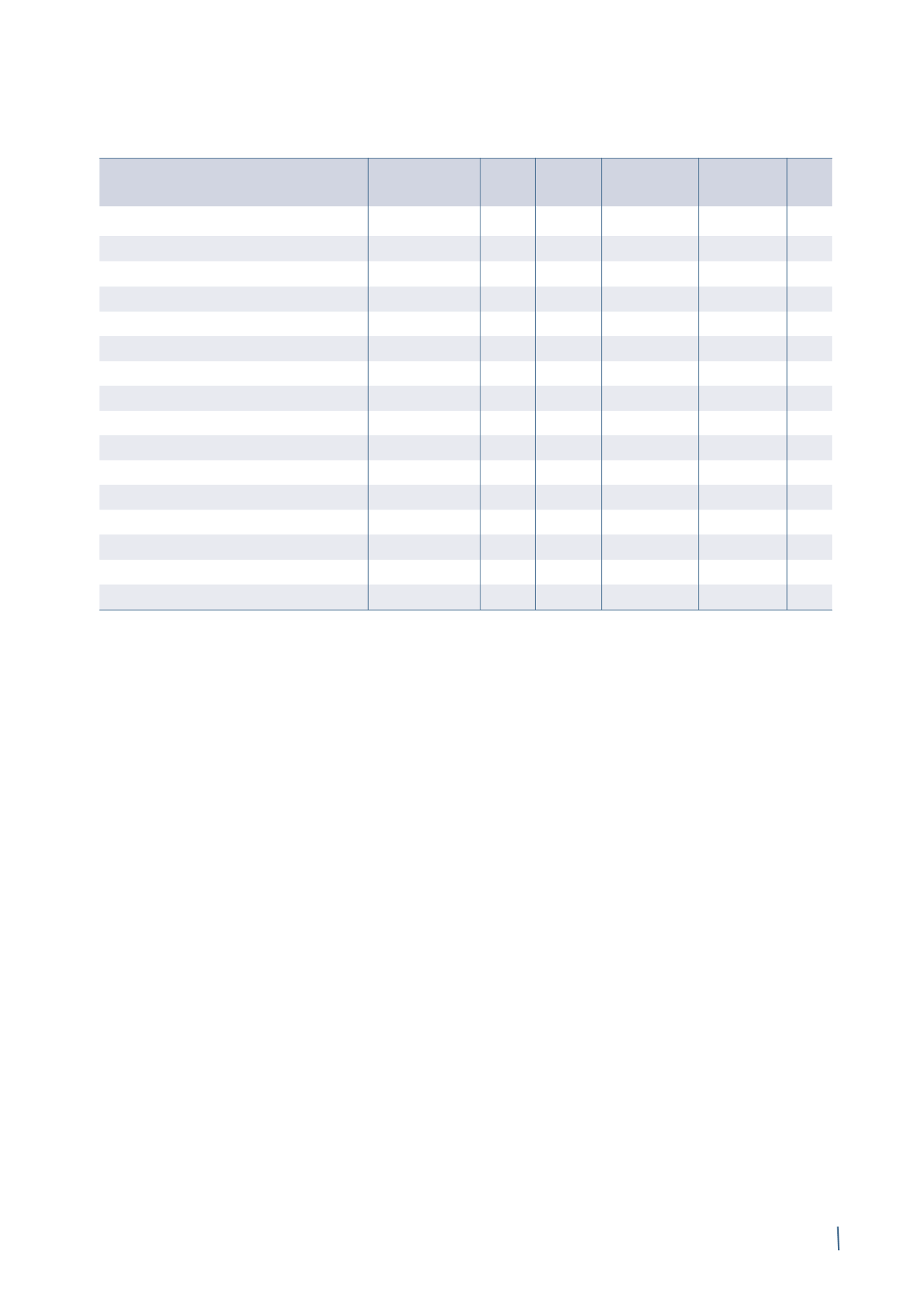

Patents

Concessions,

Goodwill

Software Other intangible

Intangibles in Total

licences, trademarks

assets

progress

and similar rights

and advances

Balance at 31 December 2012 (*)

27

4

377

34

147

19 608

Movements in 2013:

- Business combinations

-

-

2

-

(1)

-

1

- Investments

1

1

-

1

-

7

10

- Internally generated intangible assets

-

-

-

6

-

2

8

- Disposals

-

-

-

-

-

-

-

- Amortisation

(7)

(1)

-

(10)

(14)

-

(32)

- Impairment

-

-

-

-

-

-

-

- Currency translation differences

-

-

(2)

(1)

(2)

(2)

(7)

- Other

(2)

1

-

2

3

(4)

-

Total movements

(8)

1

-

(2)

(14)

3 (20)

Balance at 31 December 2013 (*)

19

5

377

32

133

22 588

Of which:

- Historical cost

45

54

397

76

195

22

789

- Accumulated amortisation and impairment (26)

(49)

(20)

(44)

(62)

-

(201)

Net book value

19

5

377

32

133

22 588

(in millions of Euro)