Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

182

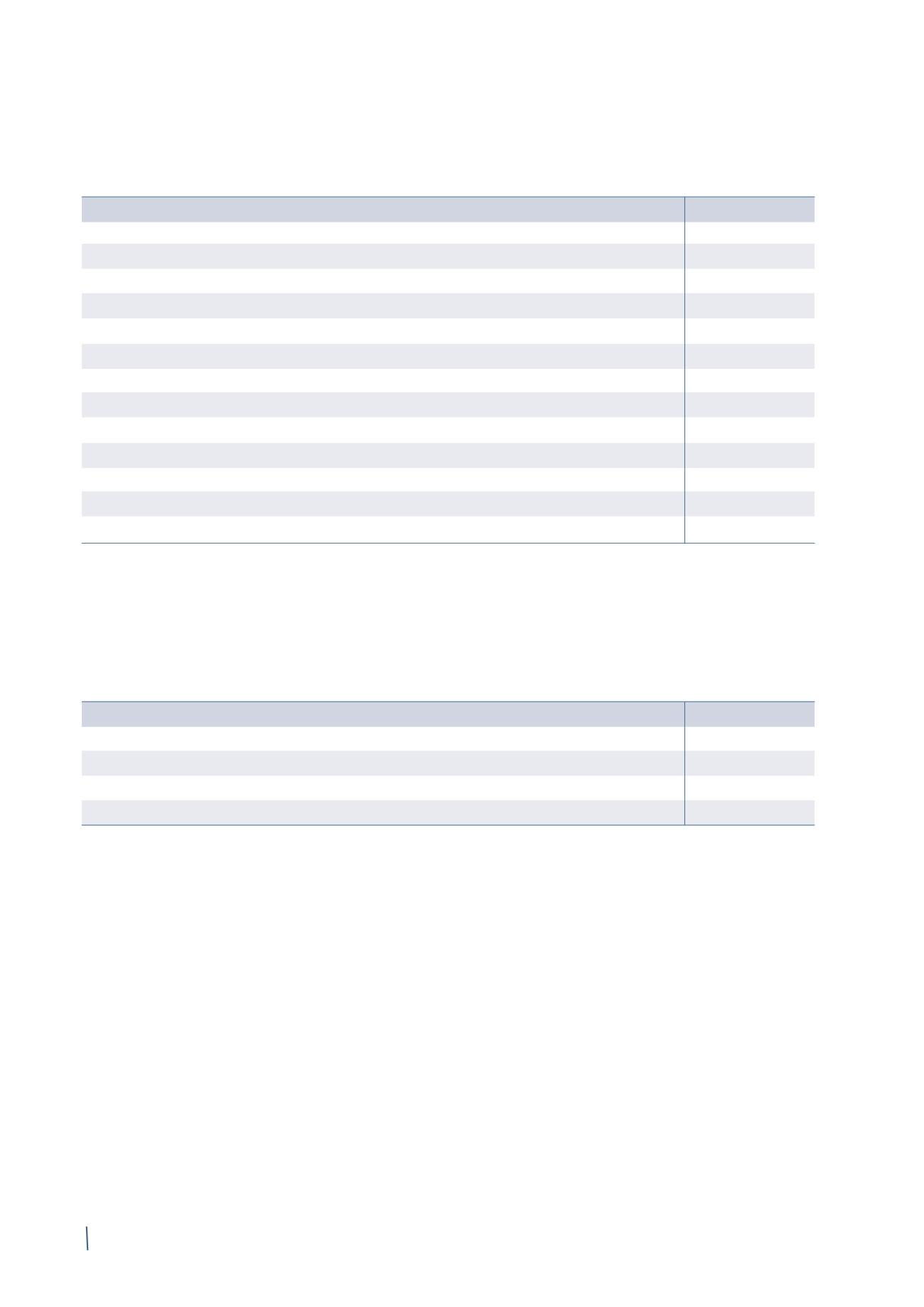

Details of investments in equity-accounted companies are as follows:

31 December 2014

31 December 2013 (*)

Yangtze Optical Fibre and Cable Joint Stock Limited Company

109

-

Oman Cables Industry (SAOG)

67

55

Kabeltrommel Gmbh & Co.K.G.

8

8

Elkat Ltd.

8

10

Rodco Ltd.

3

2

Eksa Sp.Zo.o

3

3

Total investments in associates

198

78

Yangtze Optical Fibre and Cable Joint Stock Limited Company

-

104

Yangtze Optical Fibre & Cable (Shanghai) Co. Ltd.

21

17

Power Cables Malaysia Sdn Bhd

5

5

Precision Fiber Optics Ltd.

1

1

Total investments in joint ventures

27

127

Total investments in equity-accounted companies

225

205

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

Investments in associates

Information about the nature of the main investments in associates:

Company name

Registered office

% owned

Yangtze Optical Fibre and Cable Joint Stock Limited Company

China

28.12%

Oman Cables Industry (SAOG)

Sultanate of Oman

34.78%

Kabeltrommel Gmbh & Co.K.G.

Germany

43.18%

Elkat Ltd.

Russia

40.00%

Yangtze Optical Fibre and Cable Joint Stock Limited Company,

a Chinese company formed in 1988, is a joint venture between

three partners: China Telecommunications Corporation,

Wuhan Yangtze Communications Industry Group Company

Ltd. and the Prysmian Group. The company is one of the

industry’s most important manufacturers of optical fibre

and cables. The company’s products and solutions are sold in

more than 50 countries, including the United States, Japan,

the Middle East and Africa.

The prospectus for the public offering and the listing of the

company’s shares was published on 26 November 2014.

Following closure of the offering period, the company’s

shares commenced trading on the Main Board of the Hong

Kong Stock Exchange on 10 December 2014. The offering

involved an increase in the company’s share capital, with

a consequent dilution of the Prysmian Group’s holding to

28.12%. This dilution has resulted in the recognition of a

non-recurring gain of Euro 8 million. In accordance with the

IFRS 10 definition of control, the value of the investment

has been reclassified from investments in joint ventures to

investments in associates.

At 31 December 2014, the fair value of the investment in

(in millions of Euro)