Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

180

The amount of goodwill allocated on the basis of net invested

capital at 1 January 2014 has been compared with the recove-

rable amount of each operating segment, determined on the

basis of value in use.

Forecast cash flows have been calculated using the after-tax

cash flows expected by management for 2015, prepared on

the basis of results achieved in previous years and the outlook

for the markets concerned. The operating segment cash

flow forecasts have been extended to the period 2016-2017

based on 3% projected growth. A terminal value has been

estimated to reflect CGU value after this period; this value

has been determined assuming a 2% growth rate. The rate

used to discount cash flows has been determined on the basis

of market information about the cost of money and asset-

specific risks (Weighted Average Cost of Capital, WACC). The

outcome of the test has shown that the recoverable amount

of the individual CGUs is higher than their net invested capital

(including the share of allocated goodwill). In particular, in

percentage terms, recoverable amount exceeds carrying

amount by 523% for the Energy Projects operating segment,

by 121% for the Energy Products operating segment and by

70% for the Telecom operating segment. It should be noted

that the discount rate at which recoverable amount is equal

to carrying amount is 37.5% for the Energy Projects operating

segment, 13.4% for the Energy Products operating segment

and 10.8% for the Telecom operating segment (compared

with a WACC of 7.1% used for all operating segments), while,

in order to determine the same match for growth rates, the

growth rate would have to be negative for all segments.

The Group has verified that, if impairment had been calcu-

lated on the basis of the previous structure, the recoverable

amount of the individual CGUs would nonetheless have been

higher than their net invested capital (including the portion of

allocated goodwill).

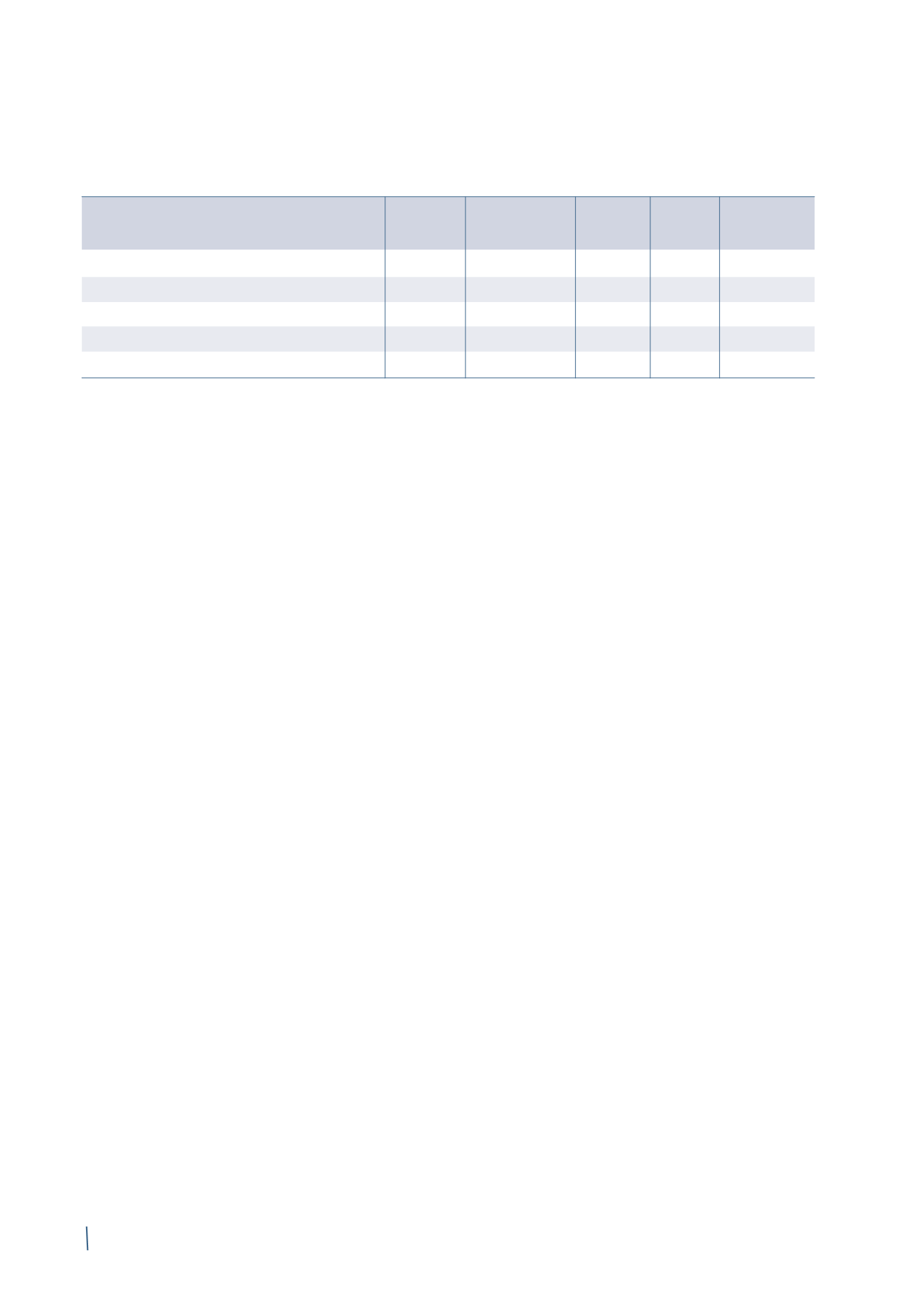

31 December 2013

Effects 31 December 2013 (*)

New Currency 31 December 2014

application

operating

translation

IFRS 10 - 11

segments differences

Energy goodwill

290

-

290

(290)

-

-

Energy Products goodwill

-

-

-

213

-

213

Energy Projects goodwill

-

-

-

77

3

80

Telecom goodwill

104

(17)

87

-

-

87

Total goodwill

394

(17)

377

-

3

380

(*) The figures at 31 December 2013 have been amended compared with those previously published following the adoption of IFRS 10 and 11. Further details can

be found in Section C. Restatement of comparative figures.

(in millions of Euro)

The amount of goodwill allocated to each operating segment is reported in the following table: