Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

178

2.

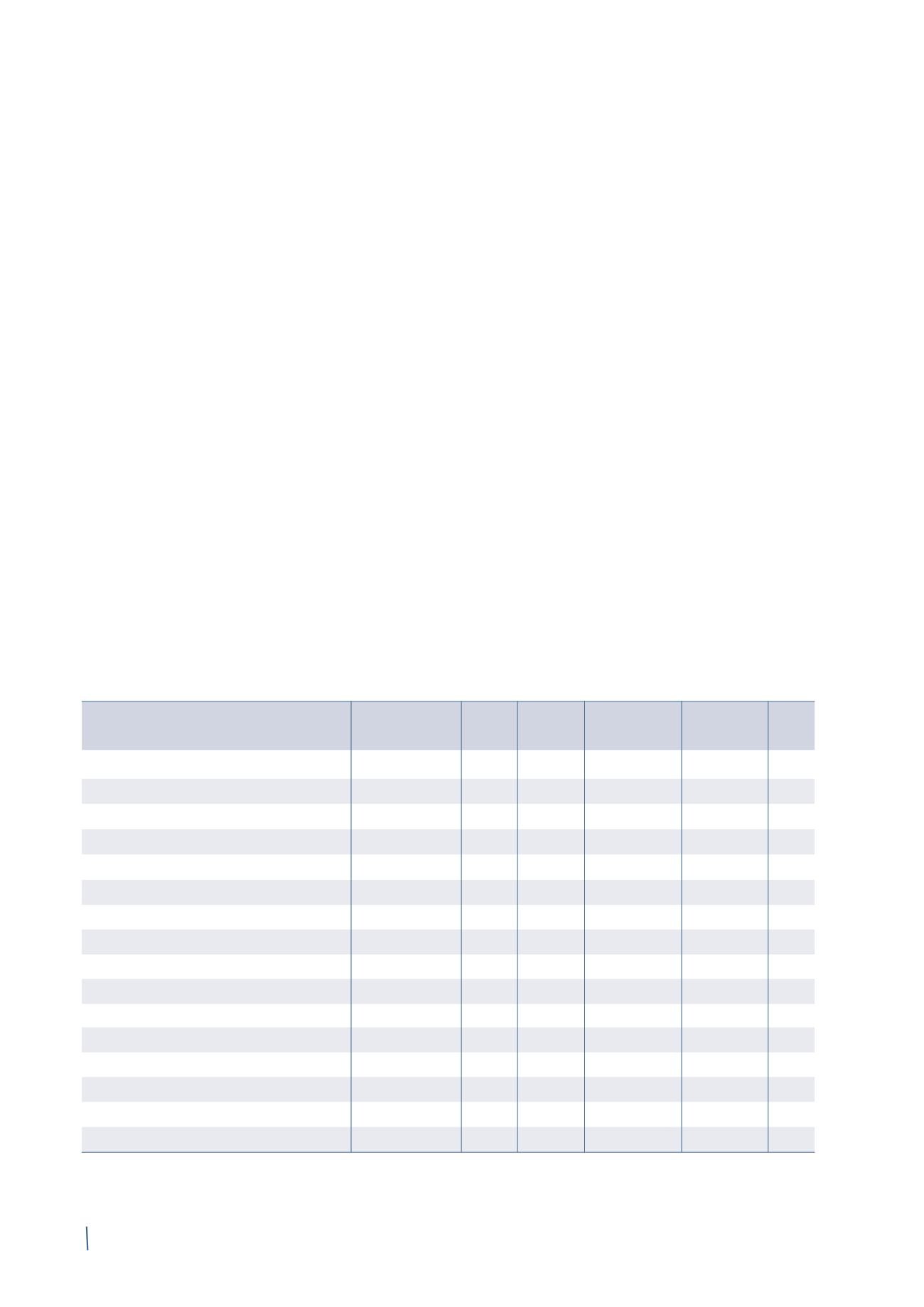

INTANGIBLE ASSETS

Details of this line item and related movements are as follows:

Patents

Concessions,

Goodwill

Software Other intangible

Intangibles in Total

licences, trademarks

assets

progress

and similar rights

and advances

Balance at 31 December 2013 (*)

19

5

377

32

133

22 588

Movements in 2014:

- Business combinations

-

-

-

-

-

-

-

- Investments

-

-

-

-

1

8

9

- Internally generated intangible assets

-

-

-

4

-

5

9

- Disposals

-

-

-

-

-

-

-

- Amortisation

(7)

(1)

-

(7)

(15)

-

(30)

- Impairment

-

-

-

-

(2)

(19)

(21)

- Currency translation differences

1

-

3

-

-

-

4

- Other

-

1

-

4

-

(3)

2

Total movements

(6)

-

3

1

(16)

(9)

(27)

Balance at 31 December 2014

13

5

380

33

117

13

561

Of which:

- Historical cost

46

55

400

84

196

32

813

- Accumulated amortisation and impairment (33)

(50)

(20)

(51)

(79)

(19)

(252)

Net book value

13

5

380

33

117

13

561

reporting date; this has resulted in the recognition of Euro

2 million in impairment for the Italy CGU and Euro 5 million

for the Oceania CGU. In this particular case, the cash flow

forecasts for 2015-2017 have been determined by projecting

forward the cash flows expected by management in 2015 (at

constant growth rates); the WACC (Weighted Average Cost

of Capital as defined in the paragraph “Goodwill impairment

test”), used to discount cash flows for determining value in

use for the Italy CGU is 6.7% and 7.9% for the Oceania CGU.

The perpetuity growth rate (G) projected after 2017 is 2%.

Furthermore, the Group has tested other assets for impai-

rment which, although belonging to larger CGUs for which

there was no specific evidence of impairment, presented

impairment indicators in relation to particular market cir-

cumstances. This has led to the recognition of Euro 11 million

in additional impairment losses in 2014, mainly due to:

• impairment of Euro 5 million recognised against the

Wuppertal site (Germany);

• impairment of Euro 5 million recognised against the

rotating platform loaded aboard the AMT Explorer cable

barge, which capsized at sea in July 2014. The insurance

reimbursement for the same amount has been recogni-

sed in “Other income”.

In addition, the creation of territorial organisations has led

to the redefinition of the CGUs; this has meant that the

conditions no longer applied under which some assets had

been impaired in previous years, resulting in the write-back

of Euro 18 million to income. Given this change, the Group has

verified that if impairment had been calculated on the basis

of the previous structure, the effects would not have been

substantially different from those recognised in the 2014

income statement.

“Buildings” include assets under finance lease with a net

book value of Euro 17 million at 31 December 2014, largely

unchanged since 31 December 2013. The maturity dates of

finance leases are reported in Note 12. Borrowings from banks

and other lenders; such leases generally include purchase

options.

(in millions of Euro)

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.