Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

174

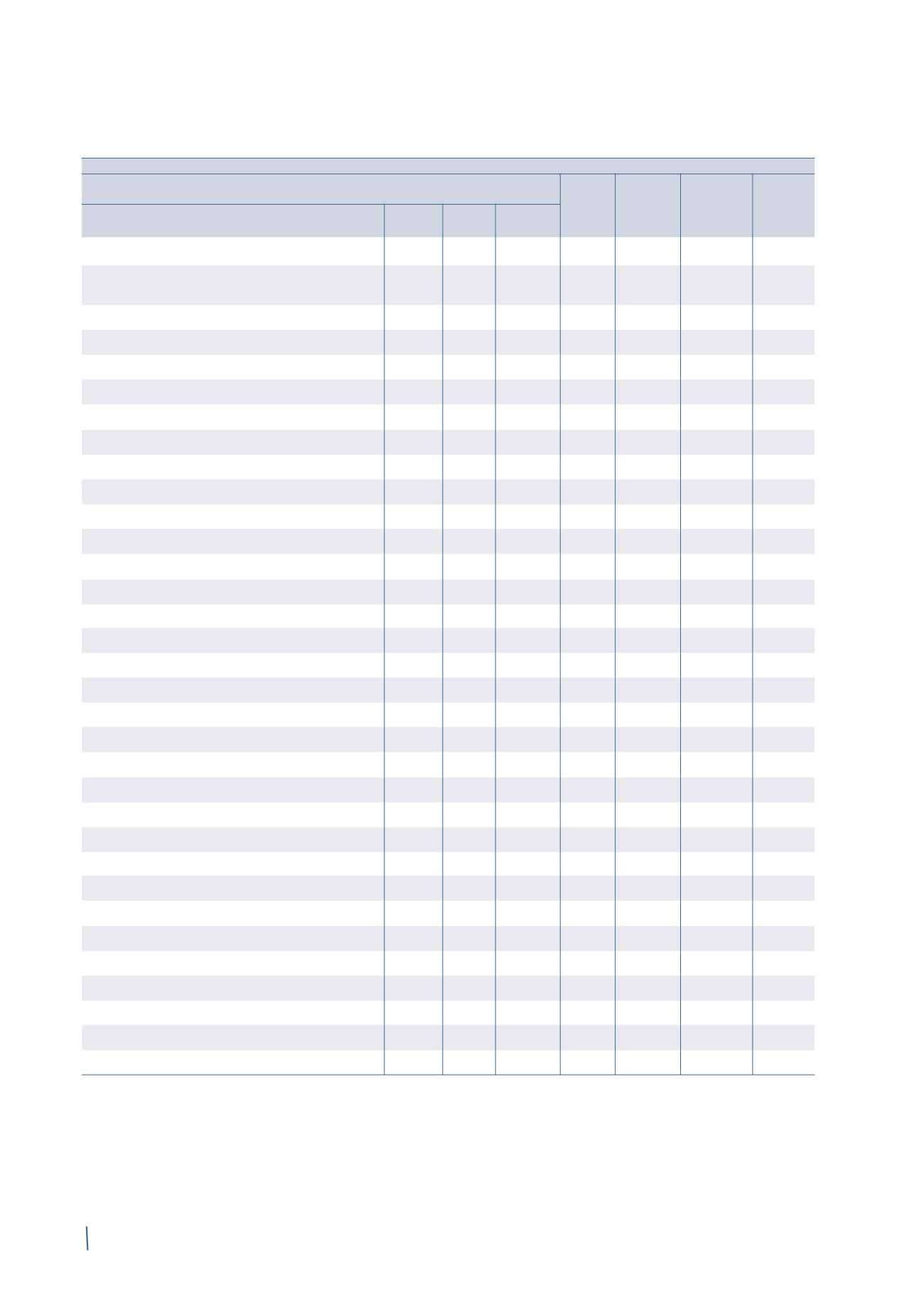

2013 (*)

Energy Products

Energy

Telecom Corporate

Total

Projects

Group

E&I Industrial

Other

Total

& NWC

Products

Sales

(1)

2,747

1,788

114

4,649

1,360

986

-

6,995

Adjusted EBITDA before share of net profit/(loss)

of equity-accounted companies

113

141

5

259

232

87

-

578

% of sales

4.1% 7.9%

5.6% 17.0% 8.8%

8.3%

Adjusted EBITDA (A)

127

141

8

276

231

106

-

613

% of sales

4.6% 7.9%

5.9% 17.0% 10.8%

8.8%

EBITDA (B)

122

138

(10)

250

234

86

(7)

563

% of sales

4.4% 7.7%

5.4% 17.2% 8.7%

8.1%

Amortisation and depreciation (C)

(37)

(25)

(4)

(66)

(39)

(43)

-

(148)

Adjusted operating income (A+C)

90

116

4

210

192

63

-

465

% of sales

3.3% 6.5% 3.5% 4.5% 14.1% 6.4%

6.7%

Fair value change in metal derivatives (D)

(8)

Fair value stock options (E)

(14)

Impairment of assets (F)

(11)

(3)

(11)

(25)

Operating income (B+C+D+E+F)

368

% of sales

5.3%

Finance costs

285

Finance income

(435)

Taxes

(65)

Net profit/(loss) for the year

153

% of sales

2.2%

Attributable to:

Owners of the parent

149

Non-controlling interests

4

Reconciliation of EBITDA to ADJUSTED EBITDA

EBITDA (A)

122

138

(10)

250

234

86

(7)

563

Non-recurring expenses/(income):

Company reorganisation

15

3

11

29

4

13

4

50

Antitrust

-

-

-

-

(6)

-

-

(6)

Environmental remediation and other costs

-

1

(4)

(3)

-

-

-

(3)

Gains on asset disposals

(1)

(1)

-

(2)

(2)

(1)

-

(5)

Other net non-recurring expenses

(9)

-

11

2

1

8

3

14

Total non-recurring expenses/(income) (B)

5

3

18

26

(3)

20

7

50

Adjusted EBITDA (A+B)

127

141

8

276

231

106

-

613

(*) The previously published prior year comparative figures have been restated following the introduction of IFRS 10 and IFRS 11 and a new method of classifying

the share of net profit /(loss) of associates and joint ventures. Further details can be found in Section C. Restatement of comparative figures.

(1) Sales of the operating segments and business areas are reported net of intercompany transactions and net of transactions between operating segments,

consistent with the presentation adopted in the previous years.

(in millions of Euro)