177

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

Gross investments in property, plant and equipment amount

to Euro 145 million in 2014.

The investments made during 2014 are analysed as follows:

• Euro 62 million, approximately 43% of the total, for

structural projects. These projects mainly relate to:

the conversion of the cable ship owned by Prysmian

PowerLink Services Ltd to allow it to perform different

types of installation work; the purchase of the Pikkala

site in Finland, to ensure production capacity for the

Submarine business and other high value-added busines-

ses; and lastly, work on buildings and production lines for

compliance with the latest regulations;

• Euro 46 million, approximately 32% of the total, for

projects to increase production capacity and develop new

products. In particular, these investments concerned: the

Arco Felice plant in Naples and the Drammen plant in

Norway for the realisation of the Exxon Mobile and Baltic

2 submarine projects; the Sorocaba plant in Brazil for the

construction of preforms needed in optical fibre manufac-

turing; the Abbeville plant in the United States to cope

with the growth in local demand for the E&I business;

• Euro 31 million, approximately 21% of the total, for

projects to improve industrial efficiency. In particular

these projects have involved the installation of a trige-

neration system at the Battipaglia plant in Italy in order

to generate electricity and reuse exhaust gases for air

conditioning, which will significantly reduce energy costs;

lastly, other investments to improve efficiency and reduce

optical fibre manufacturing costs have been made at the

plants in Douvrin (France), Eindhoven (Netherlands) and

Battipaglia (Italy);

• Euro 6 million, approximately 4% of the total, for projects

to improve the R&D facilities.

There are liens for Euro 10 million against the value of

machinery in connection with long-term loans (Euro 12 million

at 31 December 2013).

When closing the present financial year, the Prysmian Group

reviewed whether there was any evidence that its CGUs might

be impaired, and then tested for impairment those CGUs

potentially at “risk”.

This test has led to the full impairment of Plant and

machinery, Equipment, Other assets and Assets under con-

struction for the CGU Energy Products - Italy (Euro 16 million)

and for the CGU Energy Products - Oceania (Euro 7 million).

The net book value of the Land and Buildings of the Italy and

Oceania CGUs has been compared with their fair value at the

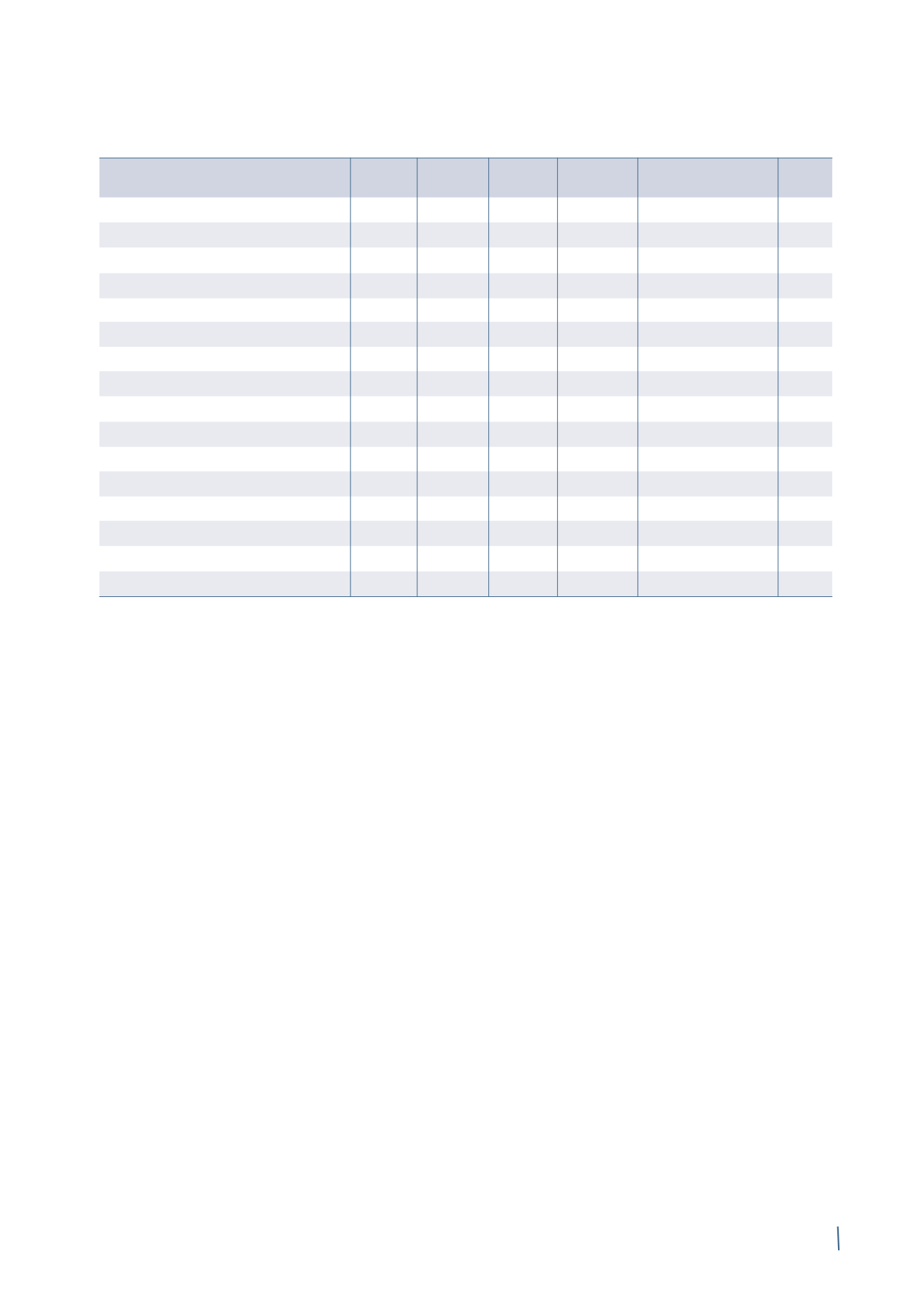

Land Buildings

Plant and Equipment

Other assets

Assets under

Total

machinery

construction and advances

Balance at 31 December 2012 (*)

246

543

502

21

54

118 1,484

Movements in 2014:

- Investments

13

15

16

2

2

70

118

- Disposals

(1)

(2)

(1)

-

-

-

(4)

- Depreciation

-

(25)

(76)

(6)

(9)

-

(116)

- Impairment

(3)

(11)

(9)

(1)

-

(2)

(26)

- Impairment reversals

-

1

-

-

-

-

1

- Currency translation differences

(8)

(18)

(25)

-

(4)

(7)

(62)

- Reclassifications to Assets held for sale (3)

(8)

-

-

-

-

(11)

- Other

-

6

47

3

5

(55)

6

Total movements

(2)

(42)

(48)

(2)

(6)

6

(94)

Balance at 31 December 2013 (*)

244

501

454

19

48

124 1,390

Of which:

- Historical cost

250

668

1.023

68

93

126

2,228

- Accumulated depreciation and impairment (6)

(167)

(569)

(49)

(45)

(2)

(838)

Net book value

244

501

454

19

48

124 1,390

(in millions of Euro)