Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

166

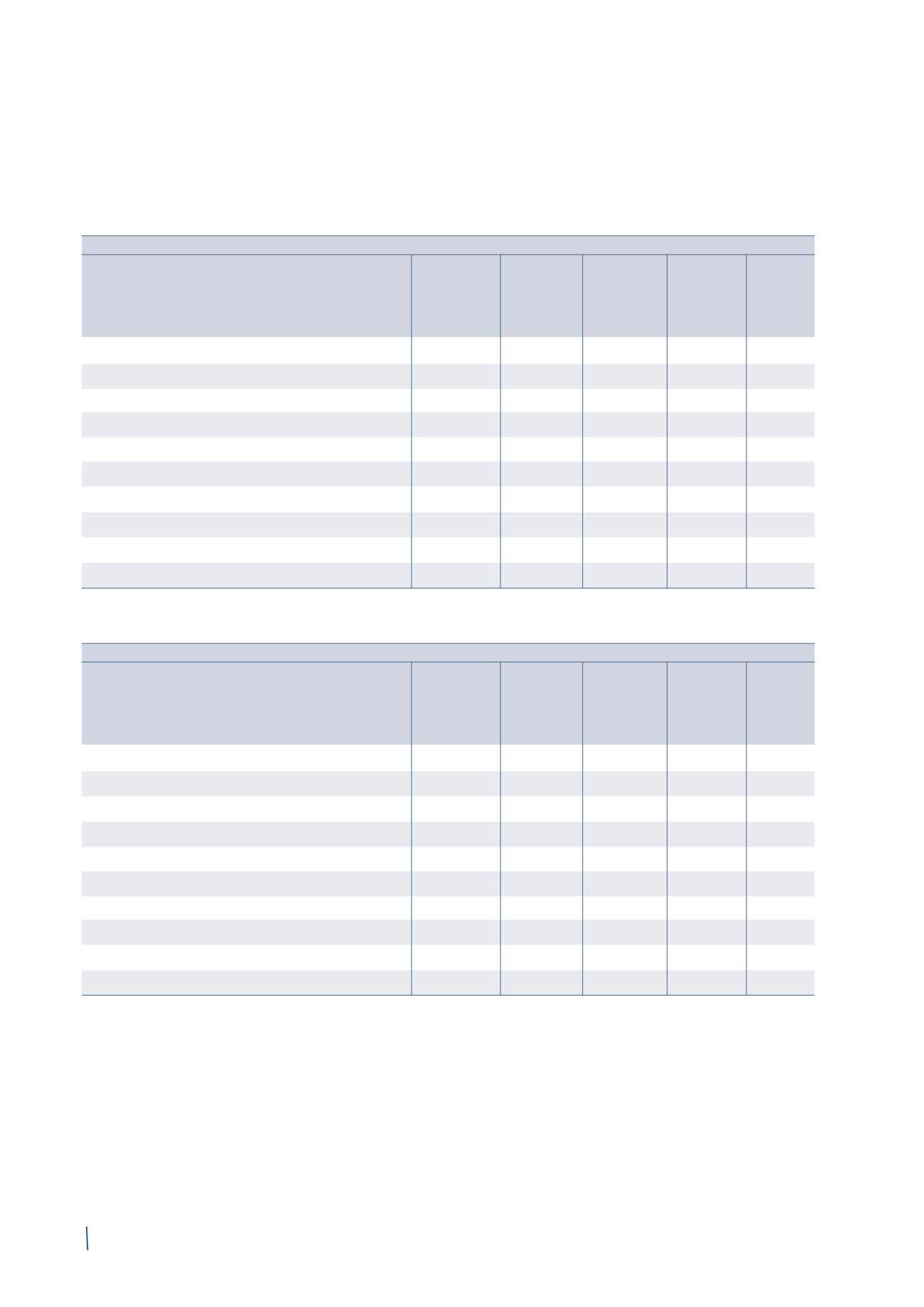

In completion of the disclosures about financial risks, the

following is a reconciliation between the classes of financial

assets and liabilities reported in the Group’s consolidated

statement of financial position and the categories used by

IFRS 7 to identify financial assets and liabilities:

31 December 2014

Financial assets at

Loans and

Available-

Financial

Financial

Hedging

fair value through

receivables

for-sale

liabilities

liabilities derivatives

profit or loss

financial

at fair value

carried at

assets

through

amortised

profit or loss

cost

Available-for-sale financial assets

-

-

12

-

-

-

Trade receivables

-

952

-

-

-

-

Other receivables

-

793

-

-

-

-

Financial assets held for trading

76

-

-

-

-

-

Derivatives (assets)

19

-

-

-

-

11

Cash and cash equivalents

-

494

-

-

-

-

Borrowings from banks and other lenders

-

-

-

-

1,385

-

Trade payables

-

-

-

-

1,415

-

Other payables

-

-

-

-

840

-

Derivatives (liabilities)

-

-

-

28

-

24

31 December 2013 (*)

Financial assets at

Loans and

Available-

Financial

Financial

Hedging

fair value through

receivables

for-sale

liabilities

liabilities derivatives

profit or loss

financial

at fair value

carried at

assets

through

amortised

profit or loss

cost

Available-for-sale financial assets

-

-

12

-

-

-

Trade receivables

-

933

-

-

-

-

Other receivables

-

750

-

-

-

-

Financial assets held for trading

93

-

-

-

-

-

Derivatives (assets)

20

-

-

-

-

5

Cash and cash equivalents

-

510

-

-

-

-

Borrowings from banks and other lenders

-

-

-

-

1,411

-

Trade payables

-

-

-

-

1,409

-

Other payables

-

-

-

-

708

-

Derivatives (liabilities)

-

-

-

36

-

13

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

(in millions of Euro)

(in millions of Euro)