Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

190

Other receivables

“Prepaid finance costs”, of Euro 8 million at 31 December

2014, refer to prepaid expenses in connection with the Group’s

Revolving Credit Facilities, of which Euro 3 million classified

as current assets and Euro 5 million classified as non-current

assets. These prepaid expenses relate to the Revolving Credit

Facilities 2011, the Revolving Credit Facilities 2014 and the

Syndicated Revolving Credit Facility 2014. The corresponding

figure for prepaid finance costs at 31 December 2013 was

Euro 5 million, all of which classified as current assets in

connection with the Revolving Credit Facilities 2010 and the

Revolving Credit Facilities 2011.

“Construction contracts” represent the value of contracts in

progress, determined as the difference between the costs

incurred plus the related profit margin, net of recognised

losses, and the amount invoiced by the Group.

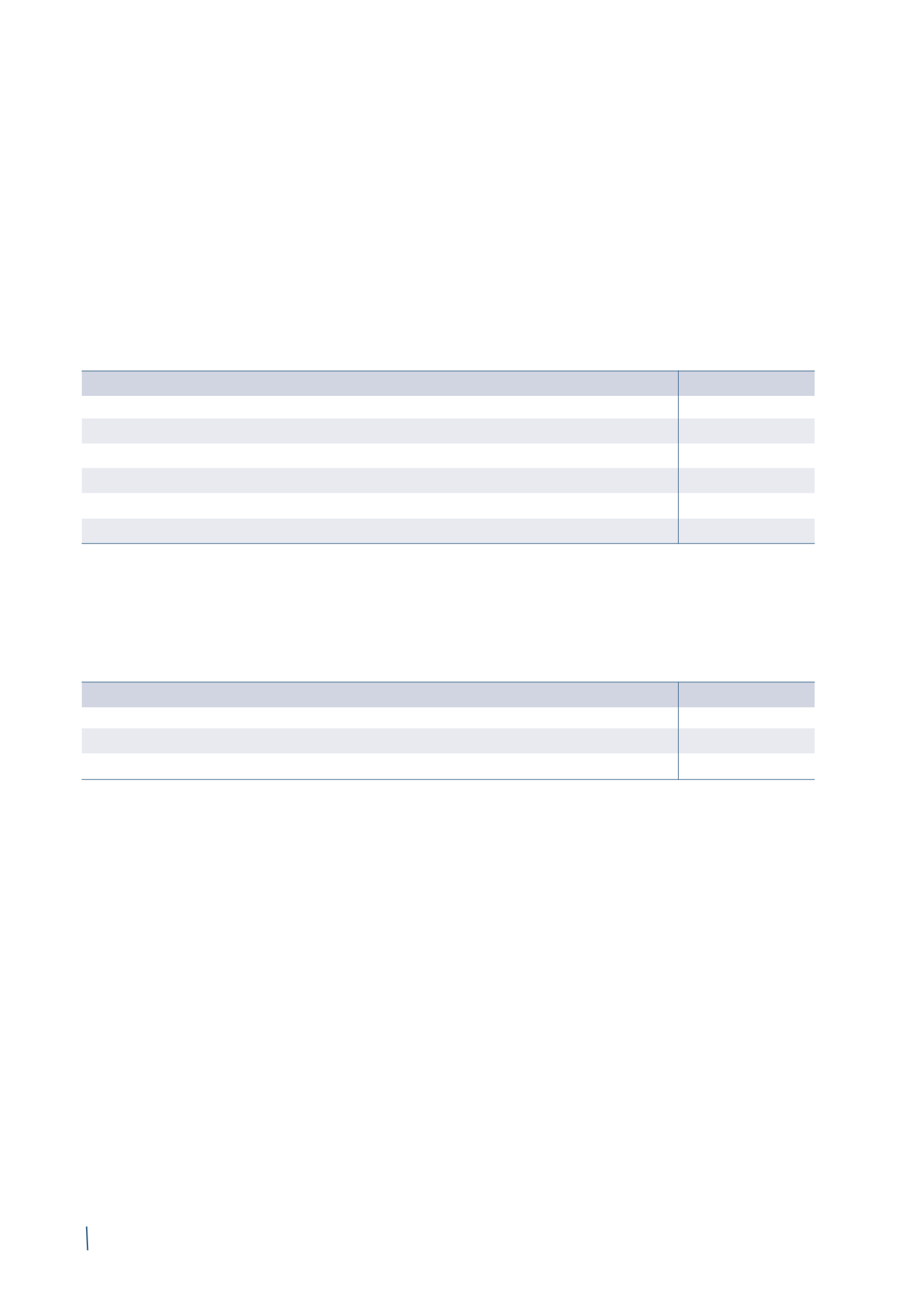

The following table shows how these amounts are reported

between assets and liabilities:

31 December 2014

31 December 2013 (*)

Construction contract revenue to date

4,277

3,361

Amounts invoiced

(4,116)

(3,041)

Net amount receivable from customers for construction contracts

161

320

Of which:

Other receivables for construction contracts

447

475

Other payables for construction contracts

(286)

(155)

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

The following table shows the revenue and costs incurred in 2014 and 2013:

2014

2013 (*)

Revenue

837

912

Costs

(722)

(709)

Gross margin

115

203

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

(in millions of Euro)

(in millions of Euro)