Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

194

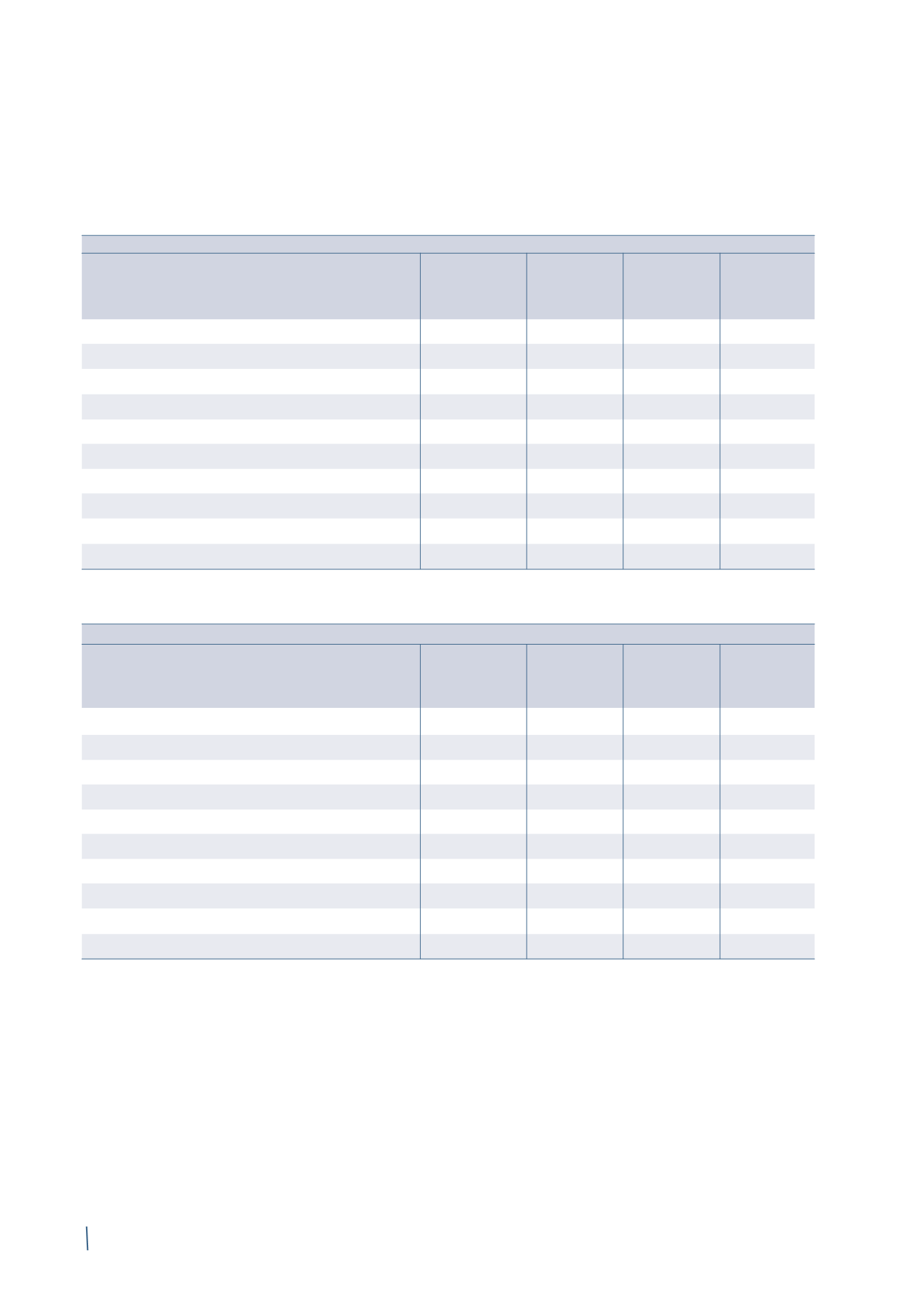

The following tables show the impact of offsetting assets

and liabilities for derivative instruments, done on the basis of

master netting arrangements (ISDA and similar agreements).

They also show the effect of potential offsetting in the event

of currently unforeseen default events:

31 December 2014

Gross derivatives

Amounts

Derivatives

Amounts not

Net derivatives

offset

recognised in

offset

(1)

statement of

financial position

Assets

Forward currency contracts

24

-

24

(14)

10

Interest rate swaps

-

-

-

-

-

Metal derivatives

6

-

6

(4)

2

Total assets

30

-

30

(18)

12

Liabilities

Forward currency contracts

38

-

38

(14)

24

Interest rate swaps

3

-

3

-

3

Metal derivatives

11

-

11

(4)

7

Total liabilities

52

-

52

(18)

34

31 December 2013 (*)

Gross derivatives

Amounts

Derivatives

Amounts not

Net derivatives

offset

recognised in

offset

(1)

statement of

financial position

Assets

Forward currency contracts

19

-

19

(7)

12

Interest rate swaps

-

-

-

-

-

Metal derivatives

6

-

6

(3)

3

Total assets

25

-

25

(10)

15

Liabilities

Forward currency contracts

12

-

12

(7)

5

Interest rate swaps

18

-

18

-

18

Metal derivatives

19

-

19

(3)

16

Total liabilities

49

-

49

(10)

39

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

(1) Derivatives potentially offsettable in the event of default events under master agreements.

(in millions of Euro)

(in millions of Euro)