197

11.

SHARE CAPITAL AND RESERVES

Consolidated equity is the same as at 31 December 2013,

mainly reflecting the effect of:

• positive currency translation differences of Euro 32million;

• the release of a positive Euro 3 million, net of tax, from the

cash flow hedge reserve as a result of discontinuing cash

flow hedge accounting, following early repayment of the

Term Loan Facility 2010;

• the negative post-tax change of Euro 6 million in the fair

value of derivatives designated as cash flow hedges;

• the positive change of Euro 3 million in the share-based

compensation reserve linked to the stock option plan;

• the negative change of Euro 31 million in the reserve for

actuarial gains on employee benefits;

• the negative change of Euro 6 million in the scope of

consolidation due to the acquisition of the remaining 34%

of AS Draka Keila Cables;

• the purchase of treasury shares for Euro 20 million;

• the net profit for the year of Euro 115 million;

• the distribution of Euro 90 million in dividends.

At 31 December 2014, the share capital of Prysmian S.p.A.

comprises 216,712,397 shares with a total value of Euro

21,671,239.70.

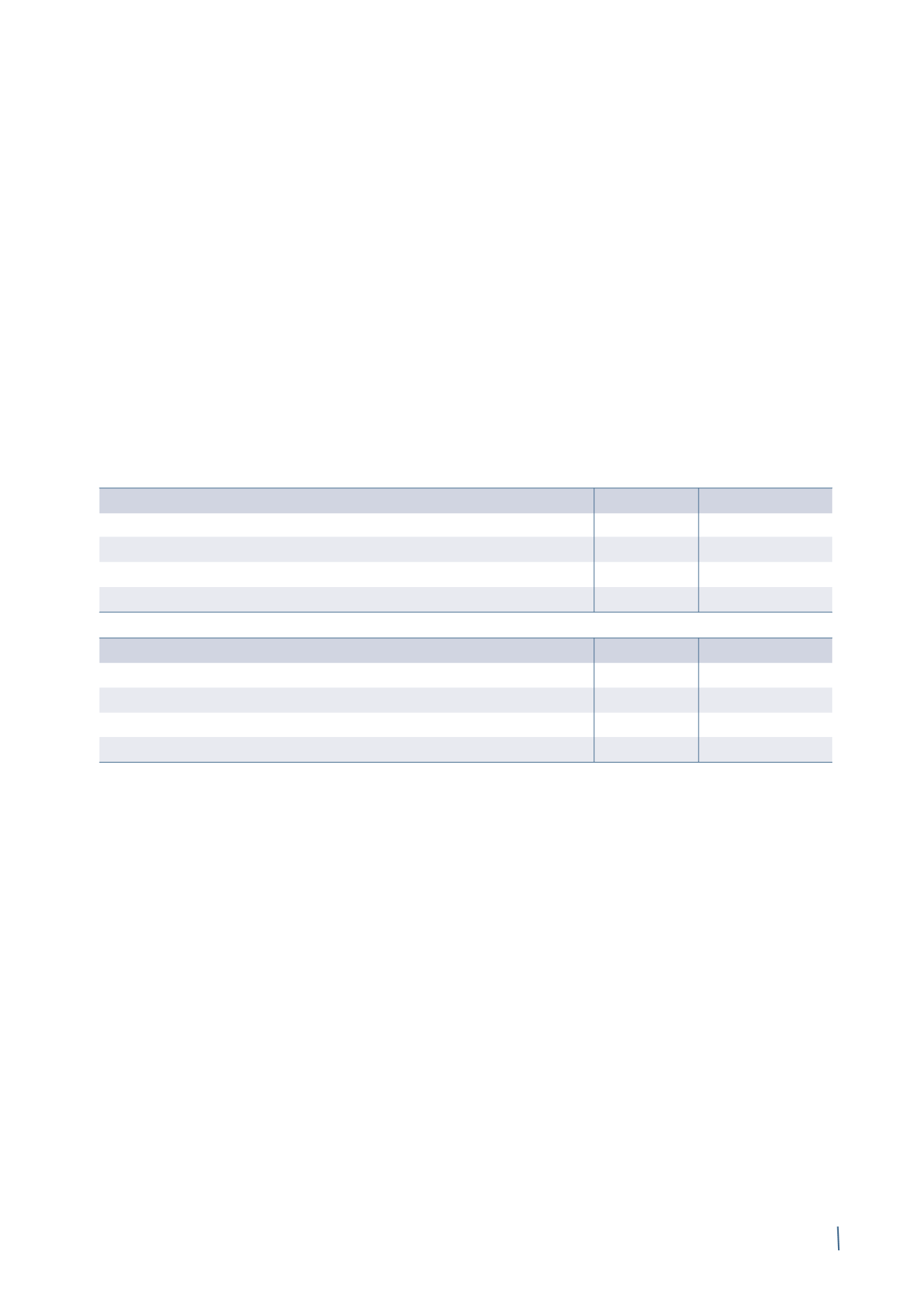

Movements in the ordinary shares and treasury shares of

Prysmian S.p.A. are reported in the following table:

Ordinary shares

Treasury shares

Total

Balance at 31 December 2012

214,508,781

(3,039,169)

211,469,612

Capital increase

(1)

82,929

-

82,929

Treasury shares

-

-

-

Balance at 31 December 2013

214,591,710

(3,039,169)

211,552,541

Ordinary shares

Treasury shares

Total

Balance at 31 December 2013

214,591,710

(3,039,169)

211,552,541

Capital increase

(2)

2,120,687

-

2,120,687

Treasury shares

(3)

-

208,851

208,851

Balance at 31 December 2014

216,712,397

(2,830,318)

213,882,079

(1) Capital increase following exercise of part of the options under the Stock Option Plan 2007-2012.

(2) Capital increase following exercise of the options under the Long-term incentive plan 2011-2013.

(3) The movement in treasury shares reflects the allotment of 187,299 shares under the Group employee share purchase plan (YES Plan), the allotment of

1,411,552 shares under the Long-term incentive plan 2011-2013, and the purchase of 1,390,000 shares.