Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

198

Treasury shares

The treasury shares held at the beginning of the year were

acquired under the shareholders’ resolution dated 15 April

2008, which gave the Board of Directors the authority for an

18-month maximum period to buy up to 18,000,000 ordinary

shares. The number of treasury shares increased in 2011

following the acquisition of Draka Holding N.V. (now renamed

Draka Holding B.V.), which holds 10,669 Prysmian S.p.A.

shares.

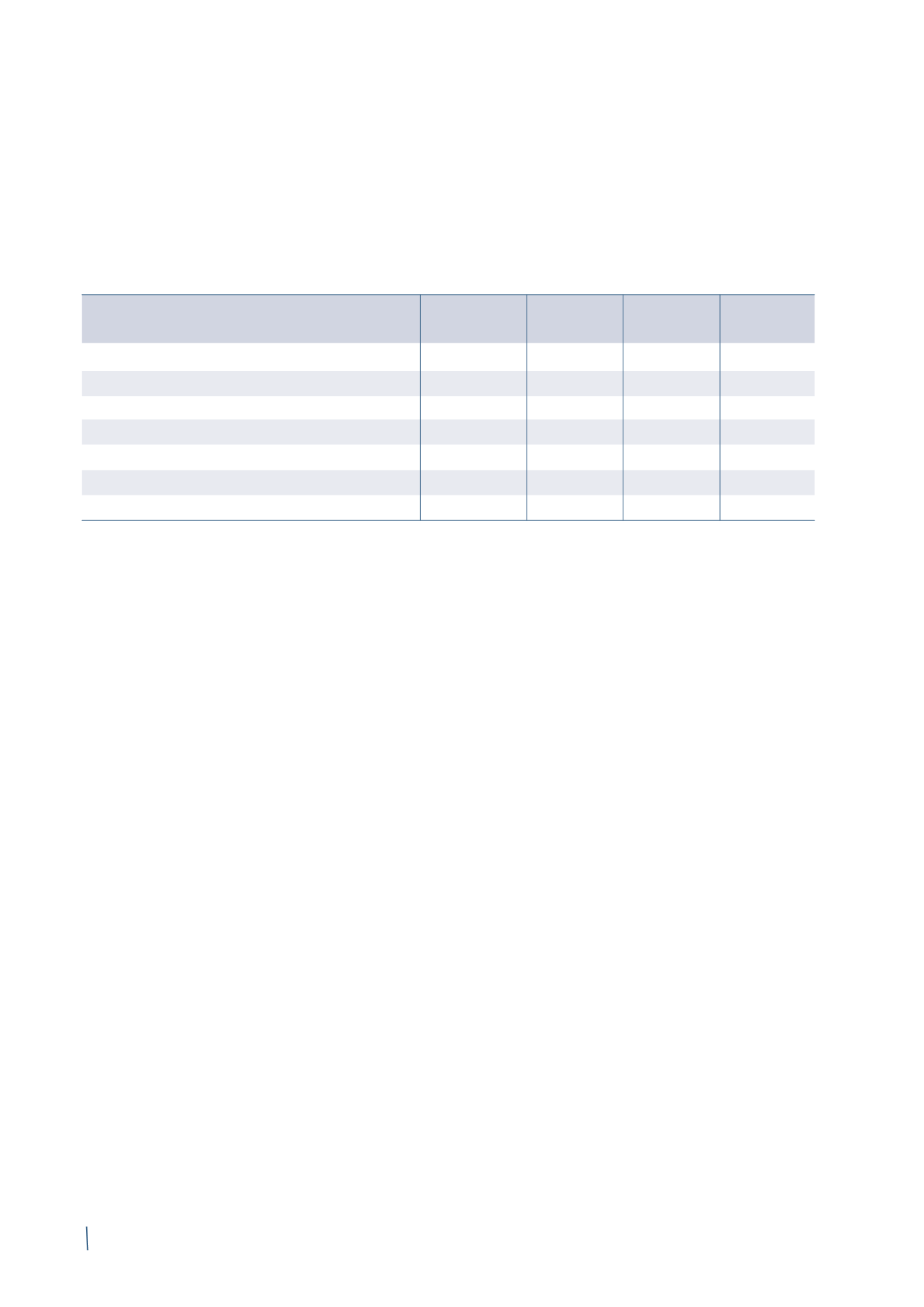

Movements in treasury shares are shown in the following

table:

Number

Total

% of share

Average unit

Total

of shares

nominal value

capital

value (in Euro)

carrying value

(in Euro)

(in Euro)

At 31 December 2012

3,039,169

303,917

1.42%

9,963

30,279,078

- Purchases

-

-

-

-

-

- Sales

-

-

-

-

-

At 31 December 2013

3,039,169

303,917

1.42%

9,963

30,279,078

- Purchases

1,390,000

139,000

-

14,356

19,954,278

- Allotments under stock option plans

(1)

(1,598,851)

(159,885)

-

10,139

(16,209,987)

At 31 December 2014

2,830,318

283,032

1.31%

12,021

34,023,369

(1) This consists of the allotment of 162,650 shares under the Group employee share purchase plan (YES Plan), the sale of 24,649 shares to employees under the

same plan and the allotment of 1,411,552 shares under the Long-term incentive plan 2011-2013.

The Shareholders’ Meeting held on 16 April 2014 authorised

a new share buy-back and disposal programme, and revoked

the previous programme at the same time.

The new programme provides the opportunity to purchase,

on one or more occasions, a maximum number of ordinary

shares whose total cannot exceed 10% of share capital,

equal to 18,420,002 ordinary shares as at the date of the

Shareholders’ Meeting, after deducting the treasury shares

already held by the Company.

Purchases may not exceed the amount of undistributed

earnings and available reserves reported in the most

recently approved annual financial statements of the Parent

Company. The authorisation to buy back treasury shares will

last for 18 months commencing from the date of the Sha-

reholders’ Meeting; the authorisation to dispose of treasury

shares has no time limit.

During the months of May, June and July 2014, the number

of treasury shares decreased by 187,299 for those shares

allotted to employees that had signed up to the first phase

of the YES employee share purchase plan.

During the last few months of 2014, the number of treasury

shares decreased by another 1,411,552 after allotting shares

under the Long-term incentive plan 2011-2013. More details

can be found in Note 21. Personnel costs. In addition,

during the months of November and December 2014, the

Parent Company also purchased 1,390,000 shares under the

buy-back programme authorised by the shareholders.