201

31 December 2014

Total lines

Used

Unused

Credit Agreements:

Term Loan Facility 2010

-

-

-

Term Loan Facility 2011

400

(400)

-

Revolving Credit Facility 2010

-

-

-

Revolving Credit Facility 2011

400

-

400

Syndicated Revolving Credit Facility 2014

1,000

-

1,000

Total Credit Agreements

1,800

(400)

1,400

EIB Loan

100

(100)

-

Revolving Credit Facility 2014

100

(30)

70

Total

2,000

(530)

1,470

31 December 2013 (*)

Total lines

Used

Unused

Credit Agreements:

Term Loan Facility 2010

184

(184)

-

Term Loan Facility 2011

400

(400)

-

Revolving Credit Facility 2010

400

(3)

397

Revolving Credit Facility 2011

400

-

400

Syndicated Revolving Credit Facility 2014

-

-

-

Total Credit Agreements

1,384

(587)

797

EIB Loan

100

-

100

Revolving Credit Facility 2014

-

-

-

Total

1,484

(587)

897

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

The Revolving Credit Facilities are intended to finance

ordinary working capital requirements.

Bonds

The Prysmian Group has the following bonds outstanding as

at 31 December 2014:

Non-convertible bond issued in 2010

On 31 March 2010, Prysmian S.p.A. completed the placement

of an unrated bond with institutional investors on the

Eurobond market for a total nominal amount of Euro 400

million. The bond, with an issue price of Euro 99.674, has a

5-year term and pays a fixed annual coupon of 5.25%. The

bond settlement date was 9 April 2010. The bond has been

admitted to the Luxembourg Stock Exchange’s official list

and is traded on the related regulated market.

The fair value of the non-convertible bond at 31 December

2014 is Euro 410 million (Euro 417 million at 31 December

2013). Fair value has been determined with reference to the

quoted price in the relevant market (Level 1 of the fair value

hierarchy).

Convertible bond

On 4 March 2013, the Board of Directors approved the

placement of an Equity Linked Bond, referred to as

“€300,000,000 1.25 per cent. Equity Linked Bonds due

2018”, maturing on 8 March 2018 and reserved for qualified

investors.

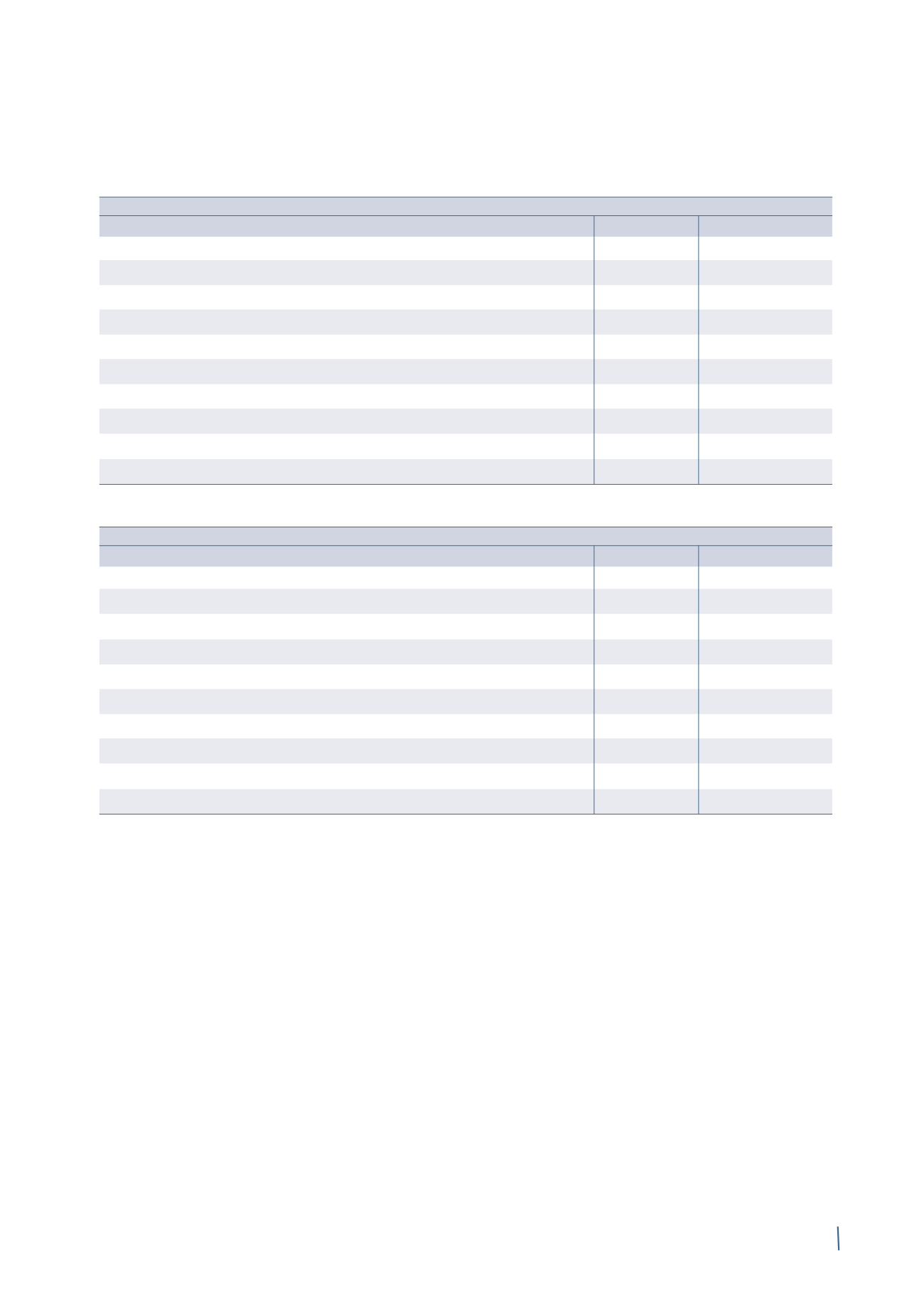

The following tables summarise the committed lines available to the Group at 31 December 2014 and 31 December 2013:

(in millions of Euro)

(in millions of Euro)