Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

202

On 16 April 2013, the Shareholders’ Meeting authorised the

convertibility of the Bond at a value of Euro 22.3146 per

share. As a result, the shareholders approved the proposal to

increase share capital for cash, in single or multiple issues,

with the exclusion of pre-emptive rights under art. 2441, par.

5 of the Italian Civil Code, by a maximum nominal amount

of Euro 1,344,411.30, by issuing, in single or multiple instal-

ments, up to 13,444,113 ordinary shares of the Company with

the same characteristics as its other outstanding ordinary

shares.

The Company will be entitled to redeem the bonds early and

in full in the cases detailed in the Bond Regulations, in line

with market practice, including:

(i) at nominal value (plus accrued interest), starting from 23

March 2016, if the trading price of the Company’s ordinary

shares rises to more than 130% of the conversion price in

a given period of time;

(ii) at nominal value (plus accrued interest), if at least 85%

of the original nominal amount of the Bond is converted,

redeemed and/or repurchased;

(iii) at nominal value (plus accrued interest), if specific

changes take place in the tax regime applying to the

Bonds.

In the event of a change of control, every bondholder will be

entitled to request early redemption at nominal value plus

accrued interest.

The convertible Bond has a 5-year maturity ending on 8 March

2018 and pays a fixed annual coupon of 1.25%. The placement

of the Bonds was completed on 8 March 2013, while their

settlement took place on 15 March 2013.

On 3 May 2013, the Company sent a physical settlement

notice to holders of the Bonds, granting them the right, with

effect from 17 May 2013, to convert them into the Company’s

existing or new ordinary shares.

On 24 May 2013, the securities were admitted to trading on

the unregulated Third Market (a multilateral trading facility

or MTF) on the Vienna Stock Exchange.

The accounting treatment for the convertible Bond has

resulted in the recognition of an equity component of Euro 39

million and a debt component of Euro 261 million, determined

at the bond issue date.

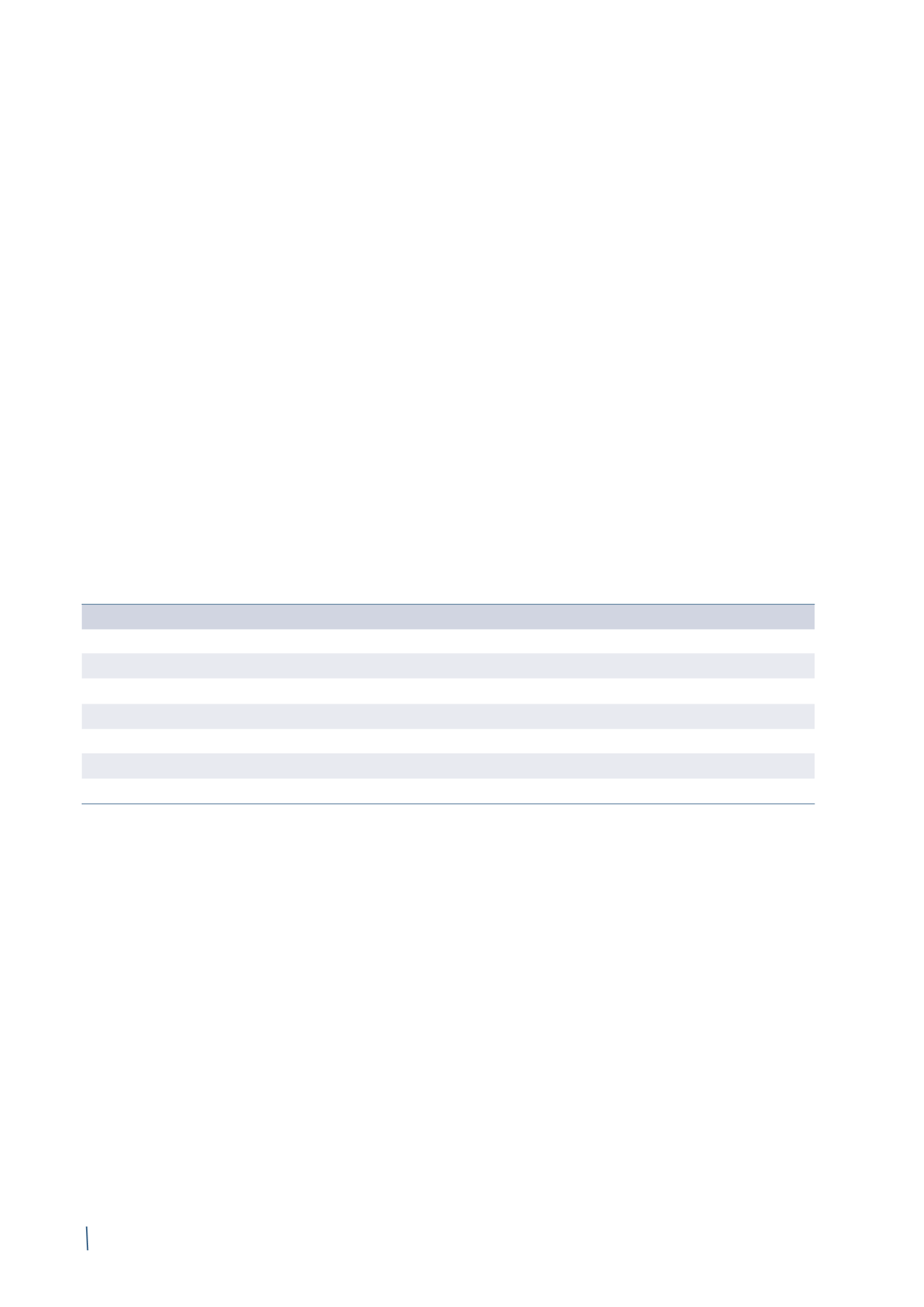

Issue value of convertible bond

300

Equity reserve for convertible bond

(39)

Issue date net balance

261

Interest - non-monetary

13

Interest - monetary accrued

7

Interest - monetary paid

(5)

Related costs

(4)

Balance at 31 December 2014

272

The fair value of the convertible bond (equity component

and debt component) is Euro 306 million at 31 December

2014 (Euro 339 million at 31 December 2013), of which the

fair value of the debt component is Euro 264 million (Euro

265 million at 31 December 2013). In the absence of trading

on the relevant market, fair value has been determined using

valuation techniques that refer to observable market data

(Level 2 of the fair value hierarchy).

(in millions of Euro)