207

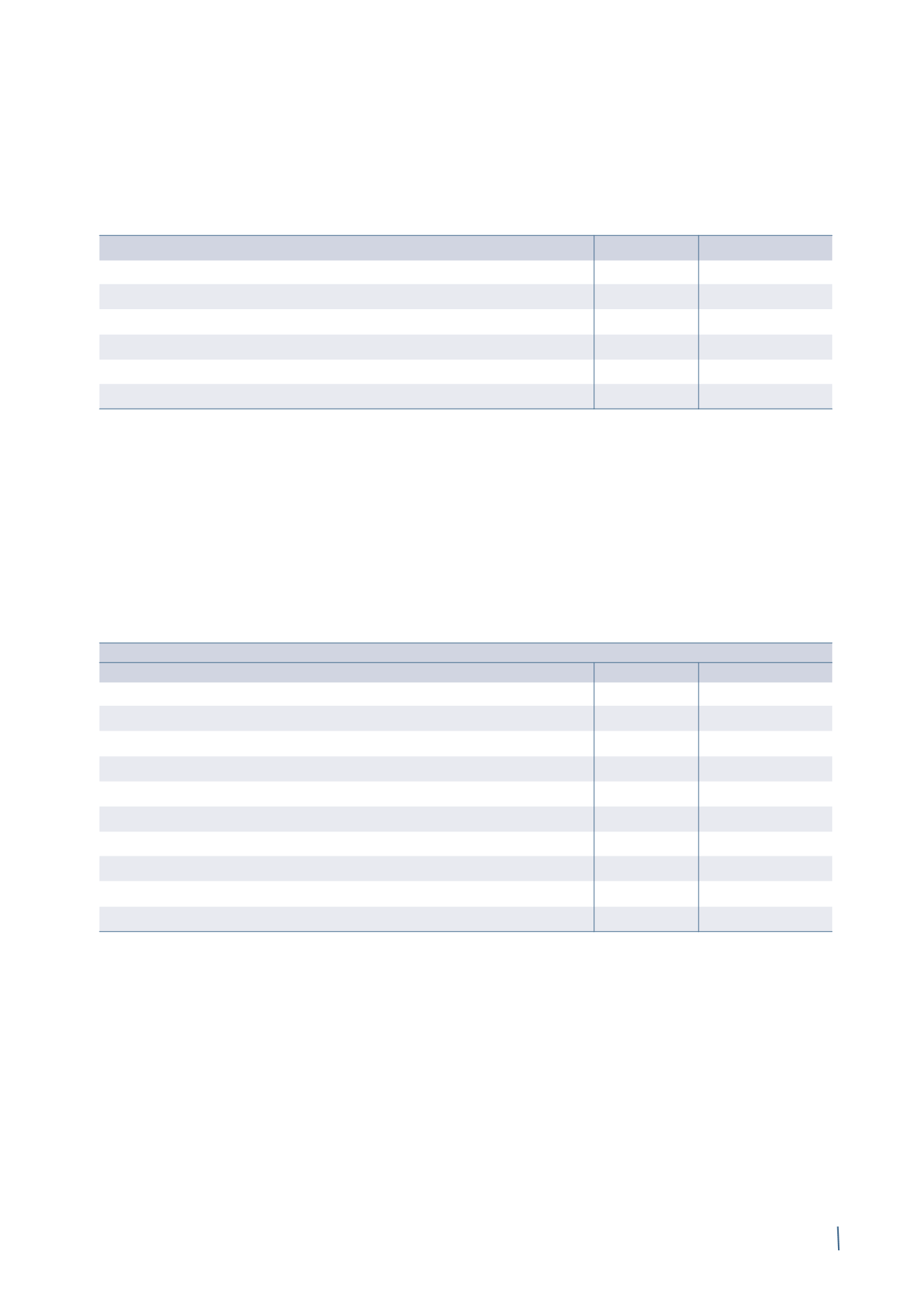

The following table presents a reconciliation of the Group’s net

financial position to the amount that must be reported under

CONSOB Communication DEM/6064293 issued on 28 July

2006 and under the CESR recommendation dated 10 February

2005 “Recommendations for the consistent implementation

of the European Commission’s Regulation on Prospectuses”:

Note

31 December 2014

31 December 2013 (*)

Net financial position - as reported above

802

805

Long-term financial receivables

5

2

4

Long-term bank fees

5

5

-

Net forward currency contracts on commercial transactions

8

11

(7)

Net metal derivatives

8

5

13

Recalculated net financial position

825

815

31 December 2014

Non-current

Current

Total

Trade payables

-

1,415

1,415

Total trade payables

-

1,415

1,415

Other payables:

Tax and social security payables

7

144

151

Advances from customers

-

381

381

Payables to employees

-

64

64

Accrued expenses

-

100

100

Other

6

138

144

Total other payables

13

827

840

Total

13

2,242

2,255

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

13.

TRADE AND OTHER PAYABLES

These are detailed as follows:

(in millions of Euro)

(in millions of Euro)