213

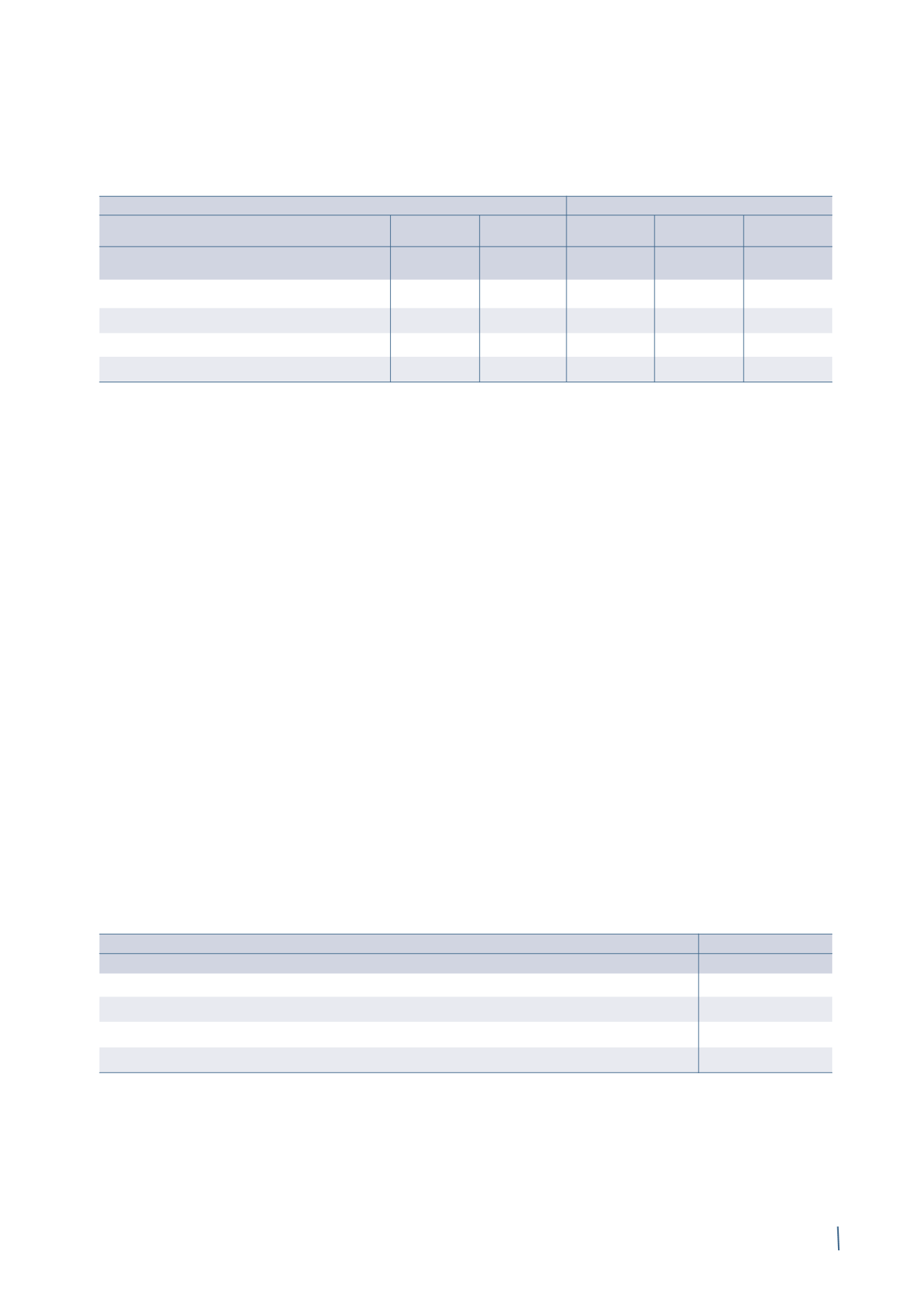

Total plan membership is made up as follows:

31 December 2014

31 December 2013

Draka

Prysmian

Total

Draka

Prysmian

Total

pension fund pension fund

pension fund pension fund

Number of

Number of

Number of

Number of

Number of

Number of

participants

participants

participants

participants

participants

participants

Active

-

-

-

-

-

-

Deferred

563

615

1.178

583

630

1,213

Pensioners

411

327

738

395

312

707

Total membership

974

942

1,916

978

942

1,920

Both plans operate under trust law and are managed and

administered by a Board of Trustees on behalf of members

and in accordance with the terms of the Trust Deed and Rules

and current legislation. The assets that fund the liabilities are

held by the Trust, for both plans.

For the purposes of determining the level of funding, the

Trustees appoint an actuary to value the plans every three

years, with annual updates. The latest valuations of the Draka

pension fund and the Prysmian pension fund were conducted

on 25 March 2013 and 31 December 2011 respectively. The

valuation for the Prysmian Fund at 31 December 2014 will be

carried out and completed by 31 March 2016.

Even the contribution levels are set every three years at the

time of performing the valuation to determine the level of

plan funding. Currently, the contribution levels are set at

Euro 1.8 million a year for the Draka pension fund (Euro 1.7

million at 31 December 2013) and Euro 0.2 million a year for

the Prysmian pension fund (unchanged since the prior year).

The Trustees decide on the investment strategy in agreement

with the company. The strategies differ for both plans.

In particular, the Draka pension fund has invested a large

proportion of its assets in equities; the fund’s investment

split is as follows: 20% in equities, 38% in bonds and 42%

in other financial instruments. The Prysmian pension fund

has invested its assets as follows: 56% in bonds and the

remaining 44% in other financial instruments.

The main risk for the Prysmian Group in Great Britain is that

mismatches between the expected return and the actual

return on plan assets would require contribution levels to be

revised.

The liabilities and service costs are sensitive to the following

variables: inflation, salary growth, life expectancy of plan par-

ticipants and future growth in benefit levels. Another variable

to consider when determining the amount of the liability is

the discount rate, identified by reference to market yields of

AA corporate bonds denominated in GB pounds.

The Netherlands

During 2014, the liabilities accrued after 1996 relating to the

pension plan managed by Stichting Pensioenfonds Draka

Holding, to which three Dutch legal entities were party, were

transferred to Pensioenfonds van de Metalektro - PME, an

industry-wide multi-employer plan. Liabilities accrued before

1996 have remained with the employer companies and are

fully covered. The rules of the plan were the same for all the

participating entities and involved the payment of benefits

according to an average length of service and a general reti-

rement age of 65.

Total plan membership is made up as follows:

31 December 2014

31 December 2013

Number of participants Number of participants

Active

411

402

Deferred

512

608

Pensioners

1,084

1,038

Total membership

2,007

2,048