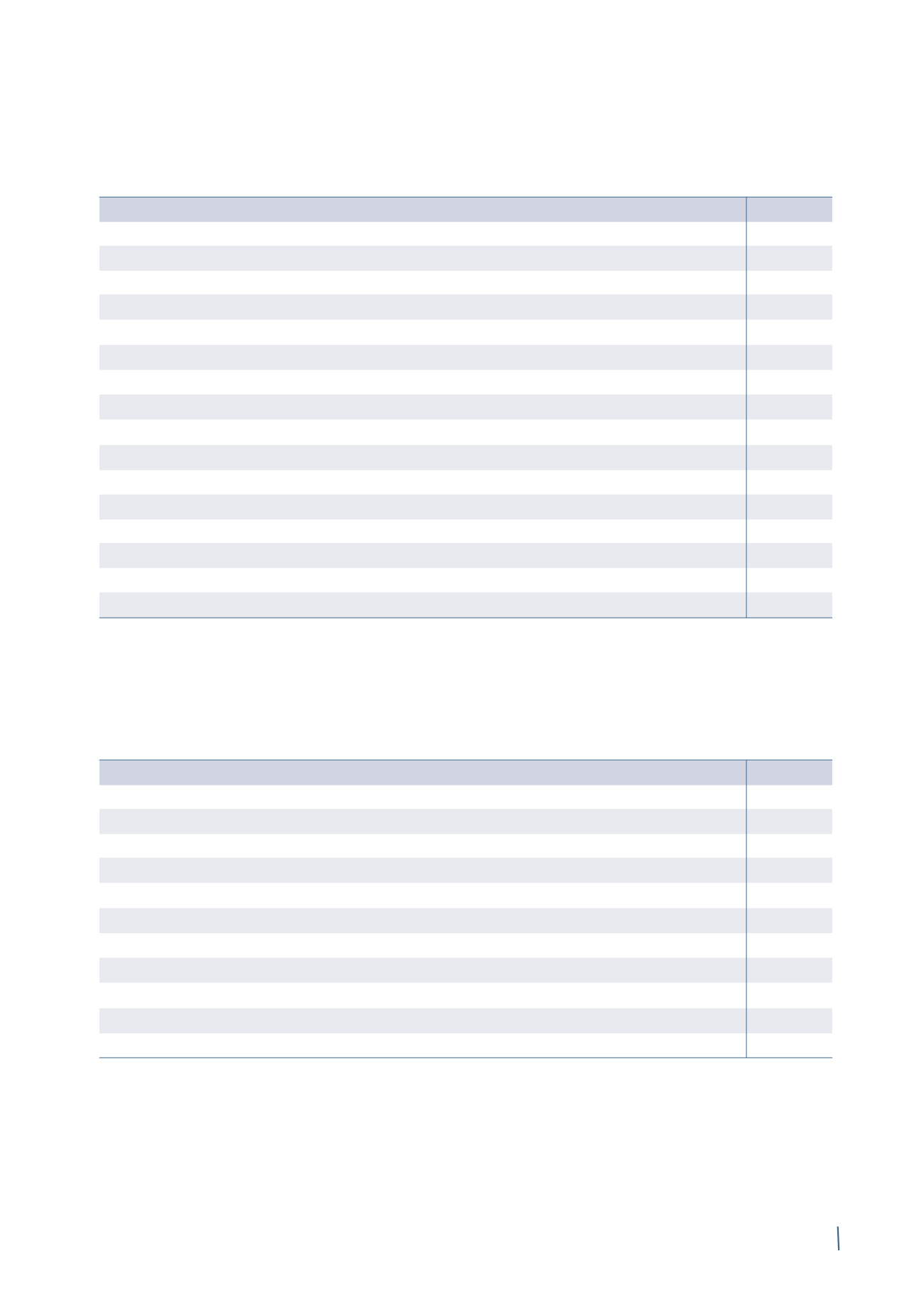

215

2014

2013 (*)

Opening defined benefit obligation

470

483

Business combinations

-

-

Current service costs

3

4

Interest costs

17

17

Plan participants’ contributions

-

-

Administrative costs and taxes

-

1

Actuarial (gains)/losses recognised in equity - Salary increase assumptions

(4)

(1)

Actuarial (gains)/losses recognised in equity - Demographic assumptions

6

6

Actuarial (gains)/losses recognised in equity - Financial assumptions

66

5

Disbursements from plan assets

(12)

(11)

Disbursements paid directly by the employer

(8)

(8)

Plan settlements

(84)

(11)

Currency translation differences

15

(9)

Reclassifications and legislative amendments to existing plans

(3)

(6)

Total movements

(4)

(13)

Closing defined benefit obligation

466

470

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

Changes during the year in pension plan assets are analysed as follows:

2014

2013 (*)

Opening plan assets

243

243

Business combinations

-

-

Interest income on plan assets

9

9

Actuarial gains/(losses) recognised in equity

23

10

Contributions paid in by the employer

14

14

Contributions paid in by plan participants

-

-

Disbursements

(20)

(19)

Plan settlements

(89)

(9)

Currency translation differences

11

(5)

Total movements

(52)

-

Closing plan assets

191

243

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

Changes during the year in pension plan obligations are analysed as follows:

(in millions of Euro)

(in millions of Euro)