219

EMPLOYEE INDEMNITY LIABILITY

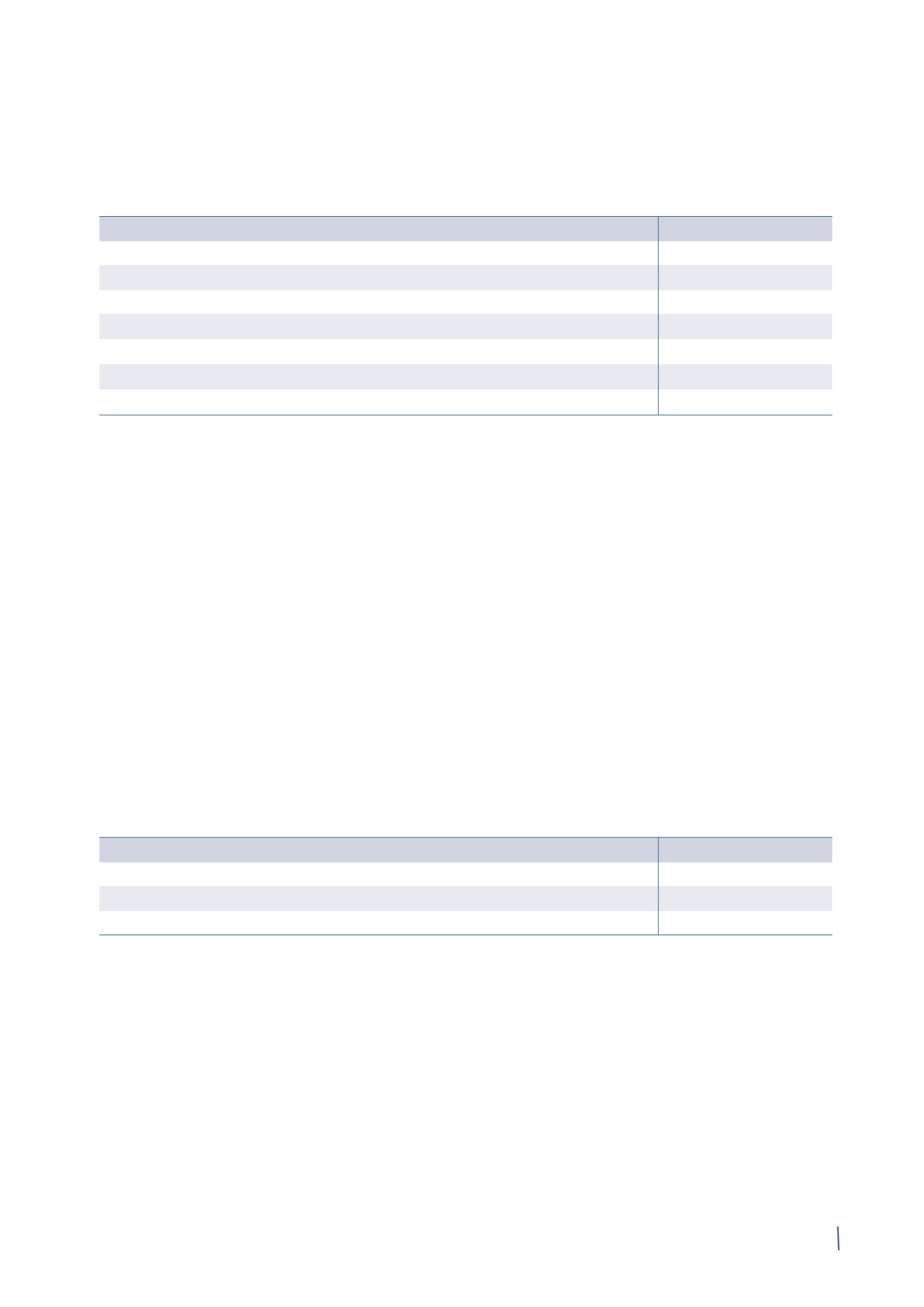

Employee indemnity liability refers only to Italian companies and is analysed as follows:

2014

2013 (*)

Opening balance

22

25

Personnel costs

-

-

Interest costs

-

1

Actuarial (gains)/losses recognised in equity

3

(1)

Disbursements

(1)

(3)

Total movements

2

(3)

Closing balance

24

22

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

The net actuarial losses recognised at 31 December 2014

(Euro 3 million) mainly relate to the change in the associa-

ted economic parameters (the discount and inflation rates).

Under Italian law, the amount due to each employee accrues

with service and is paid when the employee leaves the

company. The amount due upon termination of employment

is calculated on the basis of the length of service and the

taxable remuneration of each employee. The liability

is adjusted annually for the official cost of living index

and statutory interest, and is not subject to any vesting

conditions or periods, or any funding obligation; there are

therefore no assets that fund this liability.

During 2014 the rate for the substitute tax paid by companies

on the revaluation of employee indemnity was raised from

11% to 17%. This has resulted in a decrease of Euro 0.4

million in the liability.

The benefits relating to this plan are paid to participants in

the form of capital, in accordance with the related rules. The

plan also allows partial advances to be paid against the full

amount of the accrued benefit in specific circumstances.

The main risk is the volatility of the inflation rate and the

interest rate, as determined by the market yield on AA

corporate bonds denominated in Euro. Another risk factor

is the possibility that members leave the plan or that higher

advance payments than expected are requested, resulting

in an actuarial loss for the plan, due to an acceleration of

cash flows.

The actuarial assumptions used to value employee

indemnity liability are as follows:

31 December 2014

31 December 2013

Interest rate

1.50%

3.00%

Expected future salary increase

2.00%

2.00%

Inflation rate

2.00%

2.00%

(in millions of Euro)