Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

214

The transfer of the liabilities described above means the

Group no longer has to pay into this plan.

The remaining liabilities at 31 December 2014 are fully

covered and so do not represent a risk factor for the

Prysmian Group.

The liabilities and service costs are sensitive to the following

variables: inflation, salary growth, life expectancy of plan

participants and future growth in benefit levels. Another

variable to consider when determining the amount of the

liability is the discount rate, identified by reference to

market yields of AA corporate bonds denominated in Euro.

During 2014 the local legislation regarding pension benefits

underwent significant change. As from 1 January 2014, the

retirement age was raised from 65 to 67, with the contribu-

tion rate going from 2.2% to 1.84%.

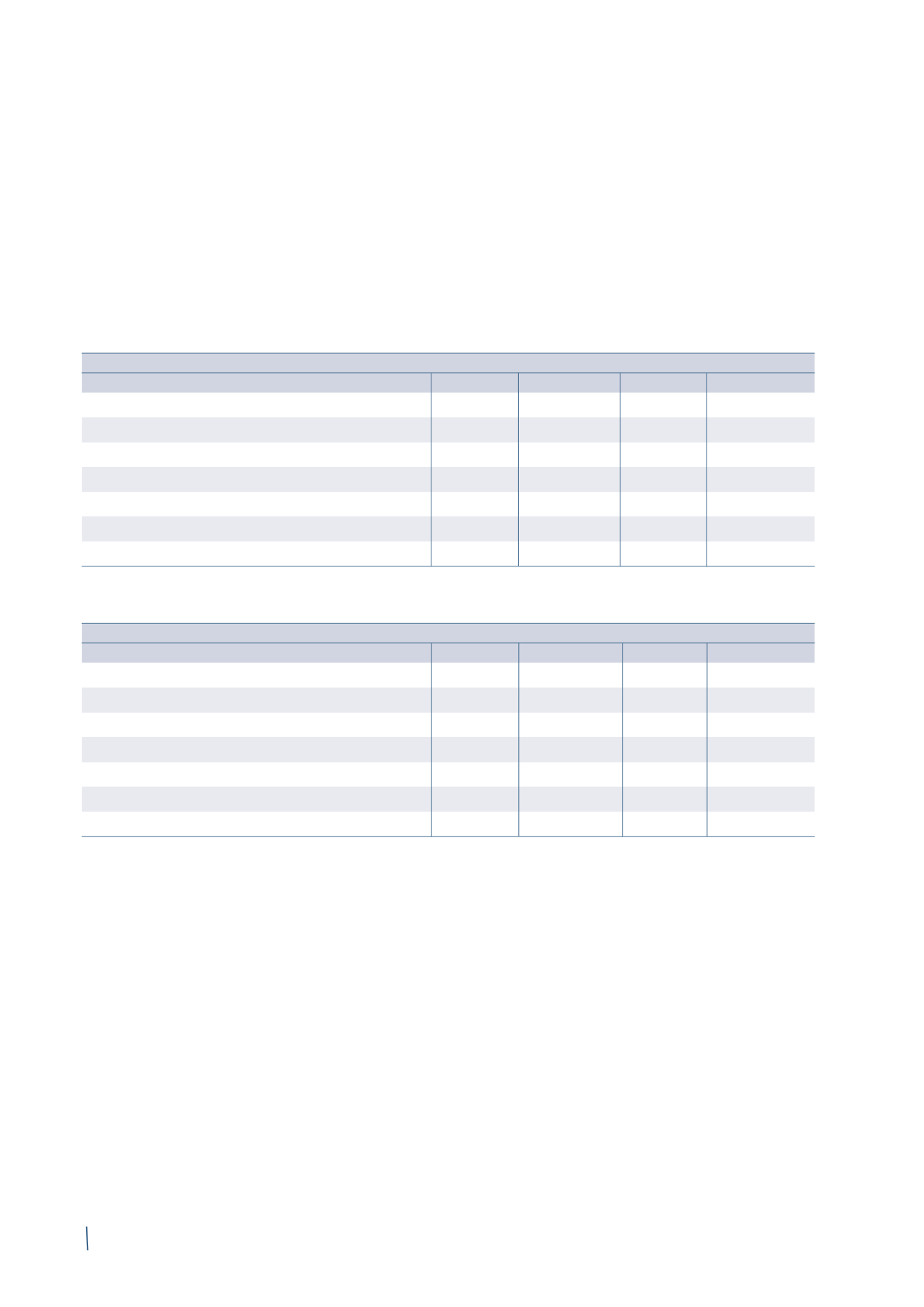

Pension plan obligations and assets are analysed as follows

at 31 December 2014:

31 December 2014

Germany

Great Britain The Netherlands Other countries

Total

Funded pension obligations:

Present value of obligation

-

190

27

50

267

Fair value of plan assets

-

(126)

(27)

(38)

(191)

Asset ceiling

-

-

-

-

-

Unfunded pension obligations:

Present value of obligations

167

-

-

32

199

Total

167

64

-

44

275

31 December 2013 (*)

Germany

Great Britain The Netherlands Other countries

Total

Funded pension obligations:

Present value of obligation

-

156

97

45

298

Fair value of plan assets

-

(108)

(99)

(36)

(243)

Asset ceiling

-

-

2

1

3

Unfunded pension obligations:

Present value of obligations

143

-

-

29

172

Total

143

48

-

39

230

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

At 31 December 2014, “Other countries” mainly refer to:

• United States: funded pension obligations have a present

value of Euro 31 million compared with a fair value of

Euro 23 million for plan assets;

• Norway: funded pension obligations have a present value

of Euro 3 million compared with a fair value of Euro 1

million for plan assets;

• Canada: funded pension obligations have a present value

of Euro 10 million compared with a fair value of Euro 9

million for plan assets;

• France: pension obligations have a present value of Euro

24 million compared with a fair value of Euro 3 million for

plan assets;

• Sweden: unfunded pension obligations have a present

value of Euro 8 million.

(in millions of Euro)

(in millions of Euro)