Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

216

At 31 December 2014, pension plan assets consisted of

equities (13.3% versus 47.5% in 2013), government bonds

(21.8% versus 33.7% in 2013), corporate bonds (19.5% versus

2014

2013 (*)

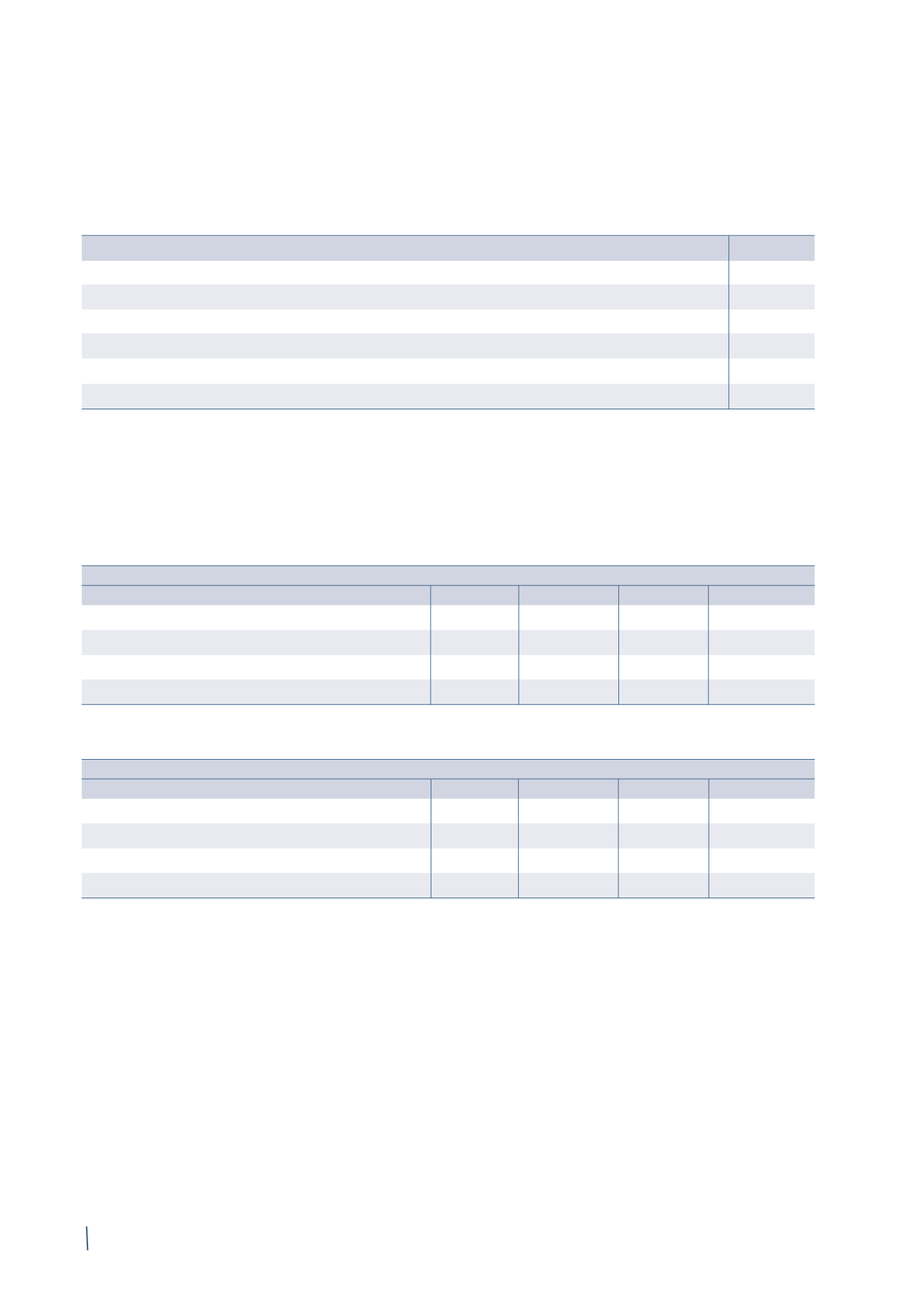

Opening asset ceiling

3

1

Interest costs

-

-

Changes in assets recognised in equity

(3)

2

Currency translation differences

-

-

Total movements

(3)

2

Closing asset ceiling

-

3

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

13.7% in 2013), and other assets (45.4% versus 5.1% in 2013).

Movements in the asset ceiling over the period are as follows:

Pension plan costs recognised in the income statement are analysed as follows:

2014

Germany

Great Britain The Netherlands Other countries

Total

Personnel costs

1

-

7

(1)

7

Interest costs

4

7

2

4

17

Expected returns on plan assets

-

(5)

(2)

(2)

(9)

Total pension plan costs

5

2

7

1

15

2013 (*)

Germany

Great Britain The Netherlands Other countries

Total

Personnel costs

1

-

1

1

3

Interest costs

5

6

3

3

17

Expected returns on plan assets

-

(4)

(3)

(2)

(9)

Total pension plan costs

6

2

1

2

11

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

More details can be found in Note 21. Personnel costs.

(in millions of Euro)

(in millions of Euro)

(in millions of Euro)