Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

220

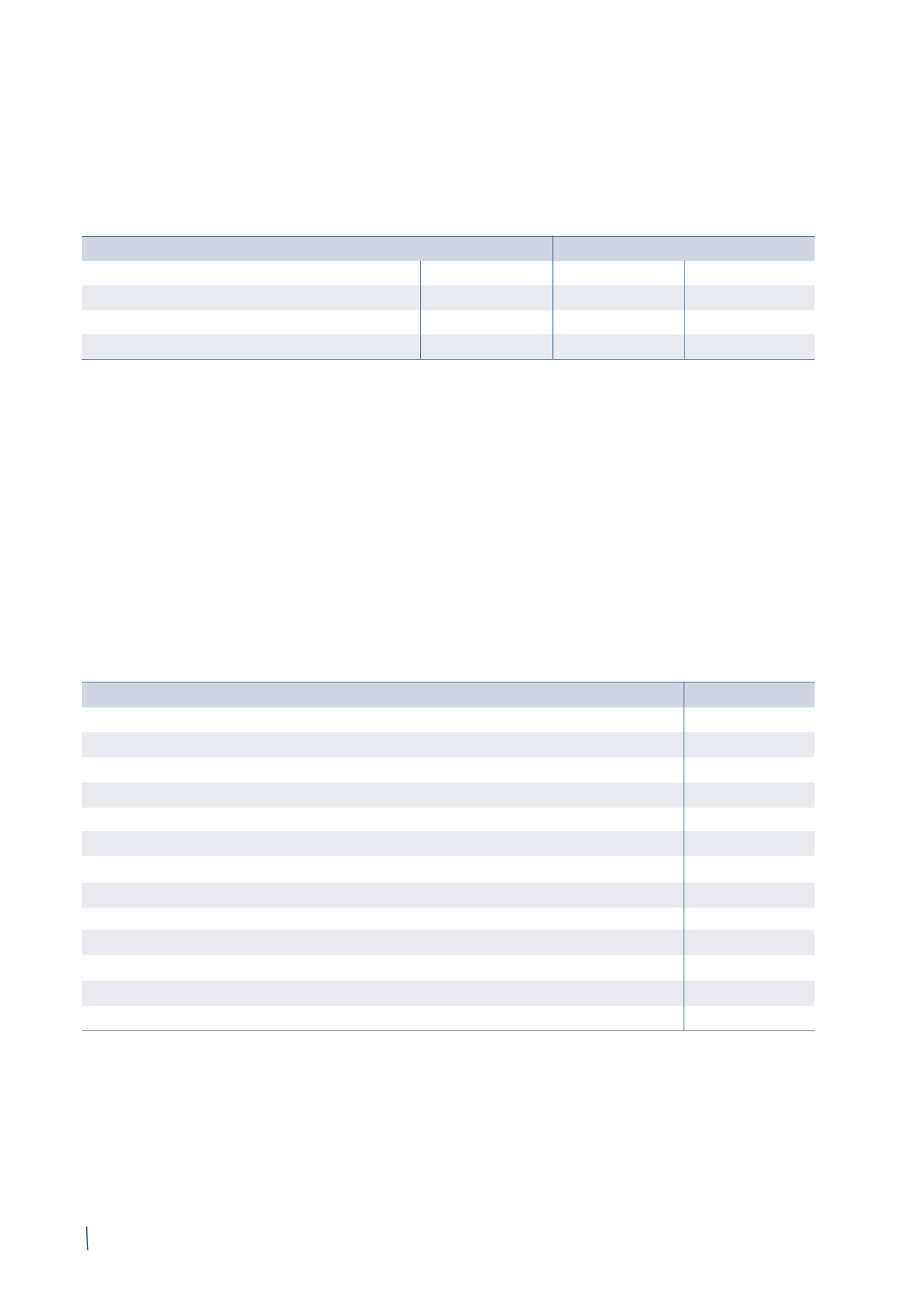

The following table presents a sensitivity analysis of the

effects of an increase/decrease in the most significant

actuarial assumptions used to determine the present value

of benefit obligations, namely the interest rate and inflation

rate:

MEDICAL BENEFIT PLANS

Some Group companies provide medical benefit plans for

retired employees. In particular, the Group finances medical

benefit plans in Brazil, Canada and the United States. The

plans in the United States account for approximately 90%

of the total obligation for medical benefit plans (80% at 31

December 2013).

Apart from interest rate and life expectancy risks, medical

benefit plans are particularly susceptible to increases in the

cost of meeting claims. None of the medical benefit plans

has any assets to fund the associated obligations, with

benefits paid directly by the employer.

As noted earlier, the US medical benefit plans account for

the majority of the benefit obligation. These plans are not

subject to the same level of legal protection as pension

plans. The enactment of important health care legislation

in the United States (the Affordable Care Act, also known

as “ObamaCare”) could result in a reduction of costs and

risks associated with these plans, as plan members move to

individual forms of insurance. Currently the new reform has

had no impact on liabilities and costs.

The obligation in respect of medical benefit plans is analysed

as follows:

2014

2013 (*)

Opening balance

23

28

Business combinations

-

-

Personnel costs

1

1

Interest costs

1

1

Plan settlements

-

-

Actuarial (gains)/losses recognised in equity - Salary increase assumptions

(4)

(2)

Actuarial (gains)/losses recognised in equity - Demographic assumptions

-

1

Actuarial (gains)/losses recognised in equity - Financial assumptions

3

(4)

Reclassifications

-

-

Disbursements

(1)

(1)

Currency translation differences

2

(1)

Total movements

2

(5)

Closing balance

25

23

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

31 December 2014

31 December 2013

decrease - 0.50%

increase + 0.50%

decrease - 0.50%

increase + 0.50%

Interest rate

+5.21%

-4.80%

+5.23%

-4.80%

decrease - 0.25%

increase + 0.25%

decrease - 0.25%

increase + 0.25%

Inflation rate

-1.57%

+1.60%

-2.58%

+2.64%

(in millions of Euro)

(in millions of Euro)