223

16.

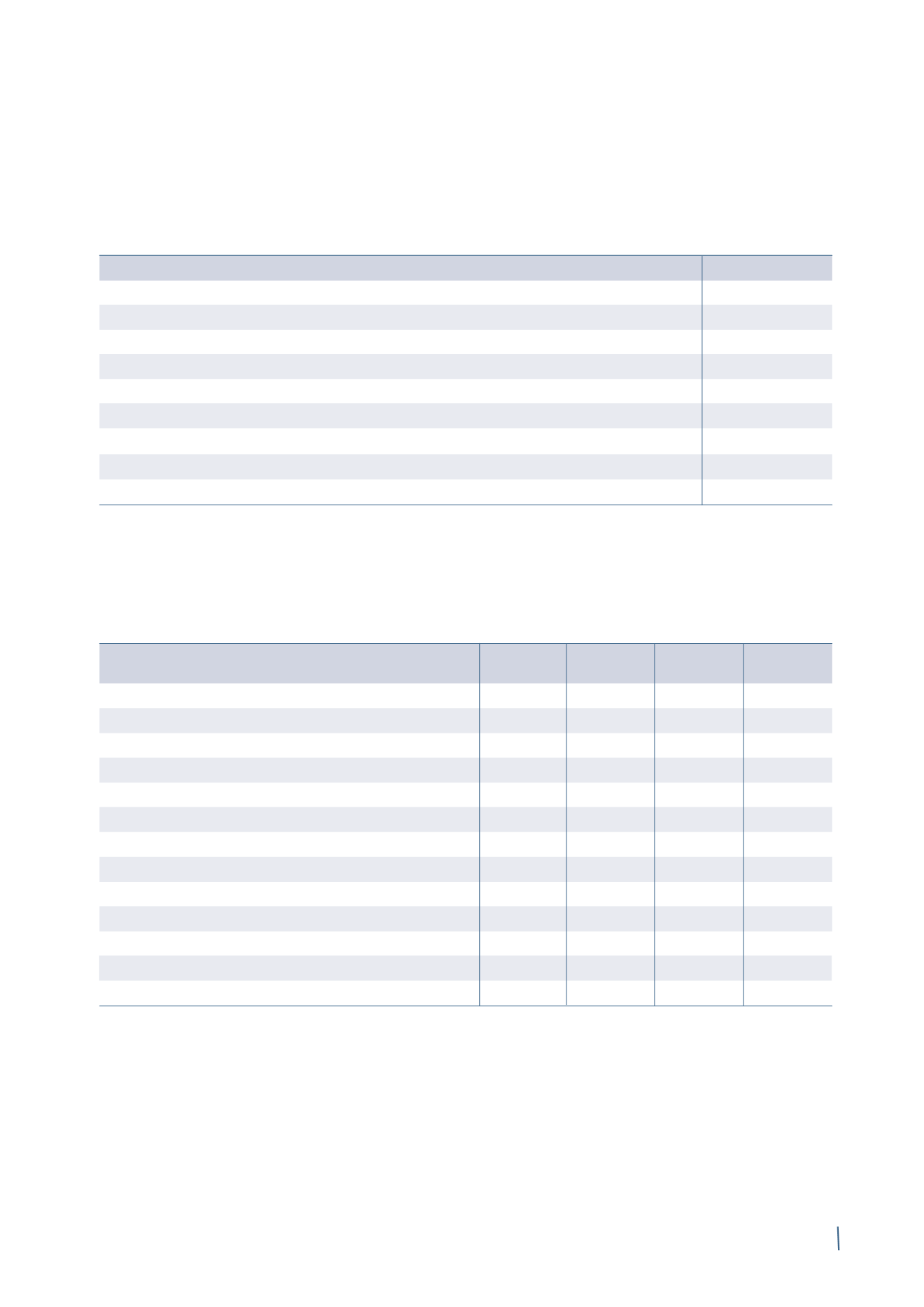

DEFERRED TAXES

These are detailed as follows:

31 December 2014

31 December 2013 (*)

Deferred tax assets:

- Deferred tax assets recoverable after more than 12 months

77

80

- Deferred tax assets recoverable within 12 months

38

50

Total deferred tax assets

115

130

Deferred tax liabilities:

- Deferred tax liabilities reversing after more than 12 months

(36)

(82)

- Deferred tax liabilities reversing within 12 months

(17)

(15)

Total deferred tax liabilities

(53)

(97)

Total net deferred tax assets (liabilities)

62

33

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

Movements in deferred taxes are detailed as follows:

Accumulated

Provisions

(1)

Tax

Other

Total

depreciation

losses

Balance at 31 December 2012

(163)

105

71

21

34

Business combinations

-

-

-

-

-

Currency translation differences

4

(4)

(1)

(5)

(6)

Impact on income statement

11

(24)

(1)

21

7

Impact on equity

-

(2)

-

-

(2)

Other and reclassifications

1

(6)

-

5

-

Balance at 31 December 2013 (*)

(147)

69

69

42

33

Business combinations

-

-

-

-

-

Currency translation differences

(5)

1

-

4

-

Impact on income statement

9

39

(8)

(24)

16

Impact on equity

-

11

-

1

12

Other and reclassifications

-

(1)

1

1

1

Balance at 31 December 2014

(143)

119

62

24

62

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

(1) These comprise Provisions for risks and charges (current and non-current) and Employee benefit obligations.

(in millions of Euro)

(in millions of Euro)