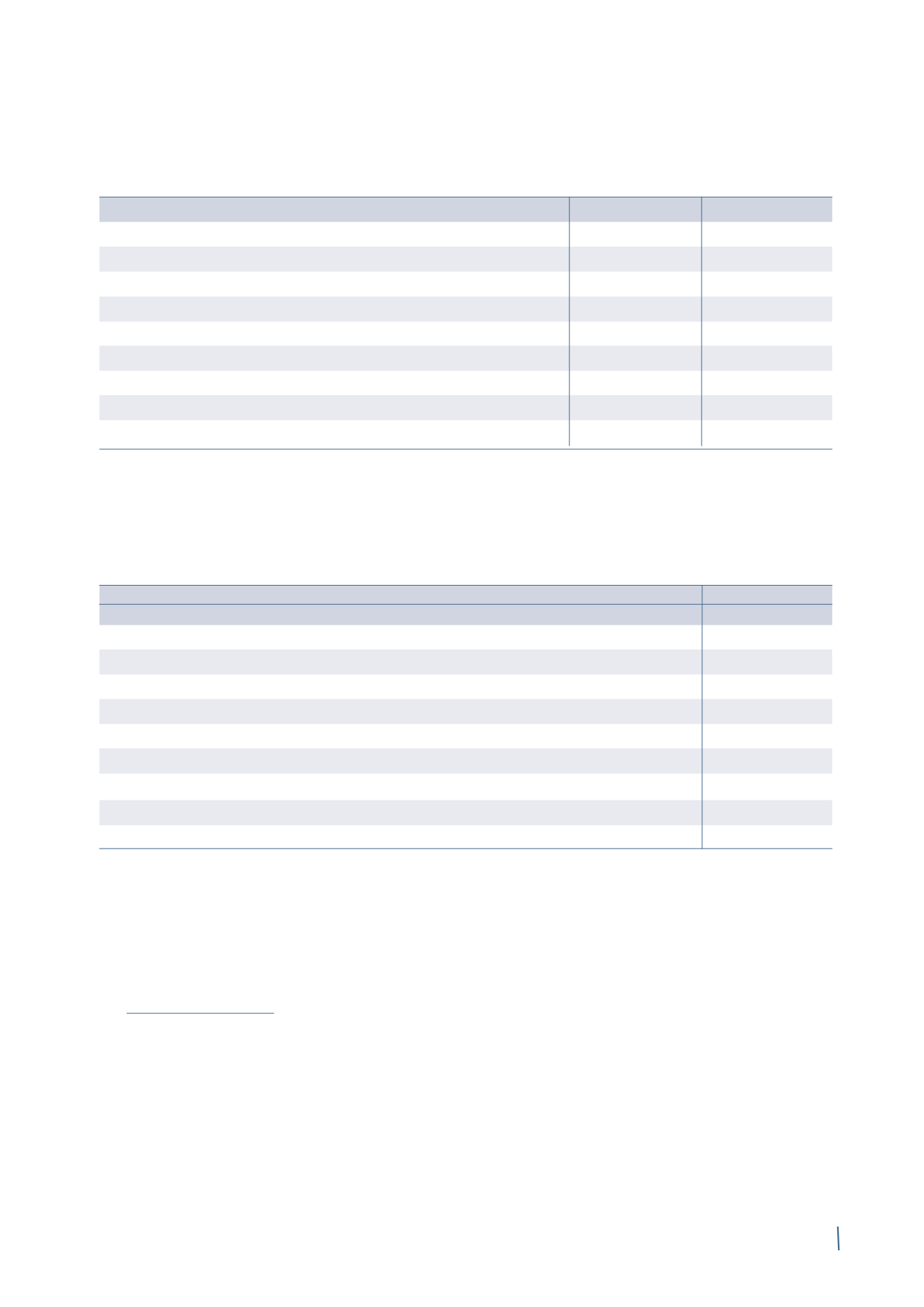

229

1st Window (2014)

2nd Window (2015)

3rd Window (2016)

Grant date

13 November 2013

13 November 2013

13 November 2013

Share purchase date

19 May 2014

19 May 2015

19 May 2016

End of retention period

19 May 2017

19 May 2018

19 May 2019

Residual life at grant date (in years)

0.35

1.35

2.35

Share price at grant date (Euro)

18.30

18.30

18.30

Expected volatility

29.27%

30.11%

36.79%

Risk-free interest rate

0.03%

0.05%

0.20%

Expected dividend %

2.83%

2.83%

2.83%

Option fair value at grant date (Euro)

18.04

17.54

17.11

A total of Euro 3 million in costs for the fair value of options

granted under this plan have been recognised as “Personnel

costs” in the income statement for the year ended 31

December 2014.

The following table provides additional details about

movements in the plan:

31 December 2014

31 December 2013

Number of options

Number of options

Options at start of year

300,682

-

Granted

(*)

43,725

300,682

Change in expected adhesions

(**)

(17,748)

-

Cancelled

-

-

Exercised

(162,650)

-

Options at end of year

164,009

300,682

of which vested at end of year

-

-

of which exercisable

-

-

of which not vested at end of year

164,009

300,682

(*) The number of options refers to the adhesions to the additional purchase windows reserved for Managers (actual numbers for the first year and expected

numbers for the next two years).

(**) The number of options has been revised for the actual number of adhesions in the first window.

The information memorandum, prepared under art. 114-bis of

Legislative Decree 58/98 and describing the characteristics of

the above plan, is publicly available on the Company’s website

at

www.prysmiangroup.com, from its registered offices and

from Borsa Italiana S.p.A..

As at 31 December 2014, there are no outstanding loans or

guarantees by the Parent Company or its subsidiaries to any

of the directors, senior managers or statutory auditors.

Long-term incentive plan 2014-2016

The Shareholders’ Meeting held on 16 April 2014 approved an

incentive plan for the Group’s employees, including members

of the Board of Directors of Prysmian S.p.A., and granted

the Board of Directors the necessary powers to establish and

implement this plan.

As a result of the effects of the Western HVDC Link contract

(UK), the Board of Directors has decided not to execute the

mandate received from the shareholders allowing implemen-

tation of this plan.

The fair value of the options has been determined using the Montecarlo model, based on the following assumptions: