Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

224

The Group has not recognised any deferred tax assets for

carryforward tax losses of Euro 757million at 31 December 2014

(Euro 651 million at 31 December 2013), or for future deductible

temporary differences of Euro 228 million at 31 December 2014

(Euro 180 million at 31 December 2013). Unrecognised deferred

tax assets relating to these carryforward tax losses and deduc-

tible temporary differences amount to Euro 298 million at 31

December 2014 (Euro 240 million at 31 December 2013).

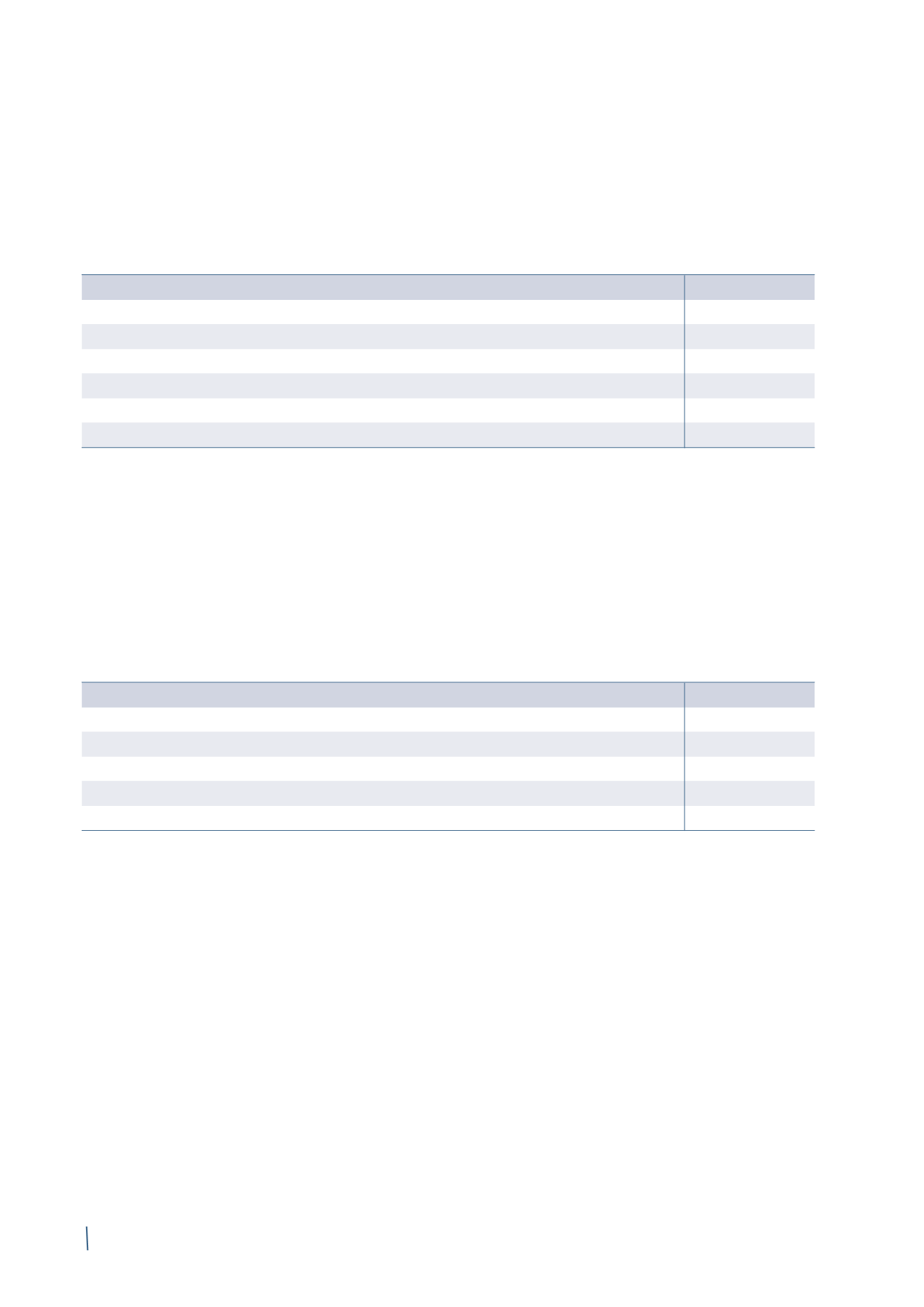

The following table presents details of carryforward tax losses:

31 December 2014

31 December 2013 (*)

Carryforward tax losses

978

953

of which recognised as assets

221

302

Carryforward expires within 1 year

17

9

Carryforward expires between 2-5 years

144

110

Carryforward expires beyond 5 years

145

307

Unlimited carryforward

672

526

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

17.

SALES OF GOODS AND SERVICES

These are detailed as follows:

2014

2013 (*)

Finished goods

5,499

5,640

Construction contracts

837

912

Services

110

85

Other

394

358

Total

6,840

6,995

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

(in millions of Euro)

(in millions of Euro)