233

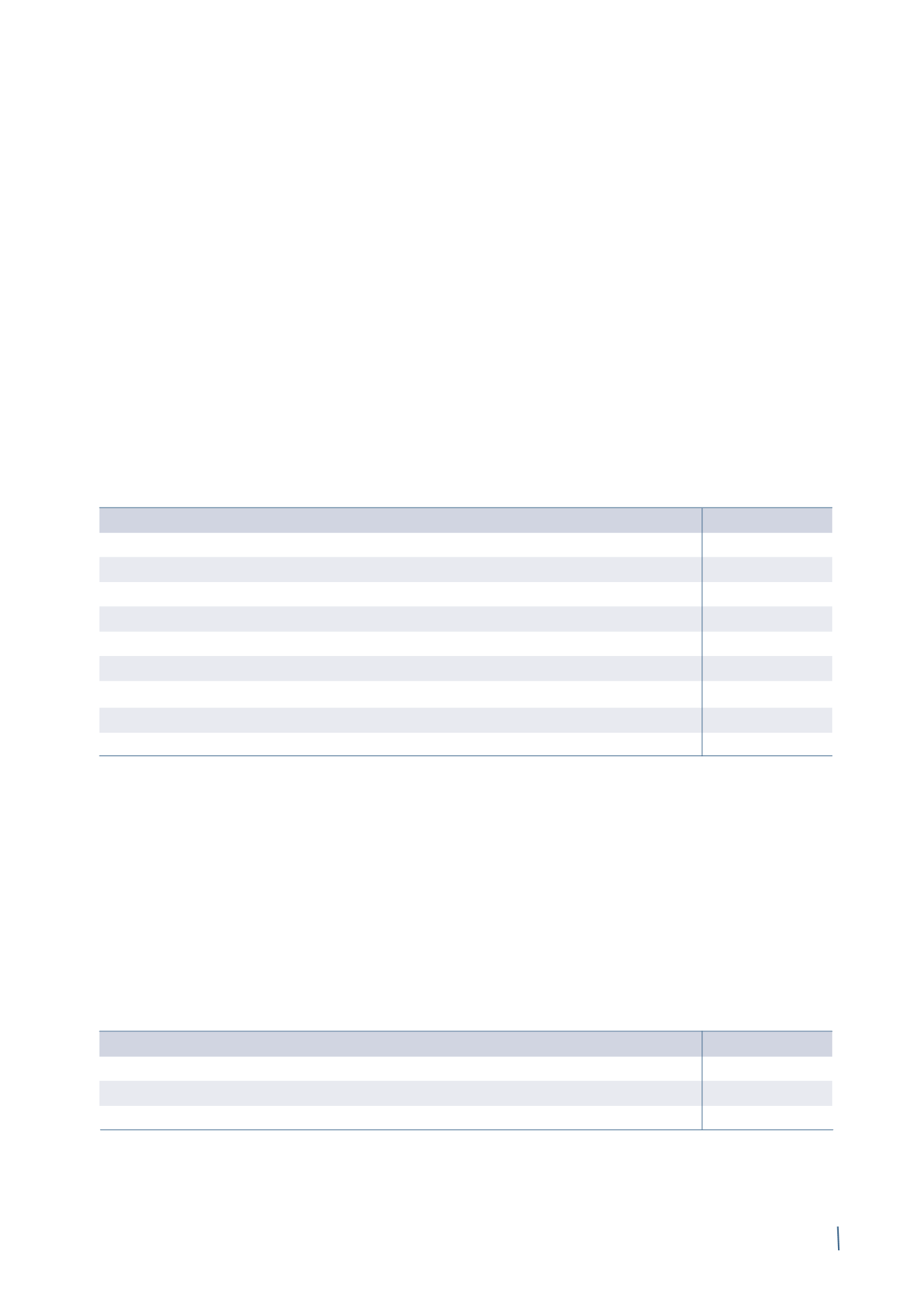

26. FINANCE INCOME

This is detailed as follows:

2014

2013 (*)

Interest income from banks and other financial institutions

7

7

Other finance income

1

2

Non-recurring other finance income

4

-

Finance income

12

9

Net gains on interest rate swaps

14

6

Net gains on forward currency contracts

-

7

Gains on derivatives

14

13

Foreign currency exchange gains

313

263

Total finance income

339

285

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

Non-recurring other finance costs report Euro 2 million for the

accelerated amortisation of bank fees relating to the Credit

Agreement 2010, after repaying the Term Loan Facility 2010

early and extinguishing the Revolving Credit Facility 2010.

This early repayment has also led to the discontinuance of

cash flow hedge accounting, resulting in the recognition of

net losses of Euro 4 million on interest rate swaps, which

have been classified in “Non-recurring net losses on interest

rate swaps”.

“Other” finance costs include Euro 17 million for differentials

accruing on interest rate swaps, of which Euro 14 million in

relation to instruments for which hedge accounting was

discontinued following the early repayment above. This last

figure is largely offset by the fair value measurement of the

related derivatives, reported in “Net gains on interest rate

swaps”.

In addition to the costs concerning the Credit Agreement

2010, non-recurring other finance costs include Euro 9 million

in interest and charges accruing on legal disputes.

Non-recurring other finance income includes Euro 4 million in interest received in connection with a legal dispute.

27.

TAXES

These are detailed as follows:

2014

2013 (*)

Current income taxes

73

72

Deferred income taxes

(16)

(7)

Total

57

65

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

(in millions of Euro)

(in millions of Euro)