237

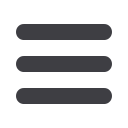

The covenants contained in the various credit agreements are as follows:

EBITDA/Net finance costs

(1)

Net financial position/EBITDA

(1)

not less than

not more than

Credit Agreement 2011

5.50x

2.50x

EIB Loan

5.50x

2.50x

Credit Agreement 2014

4.00x

3.00x

Revolving Credit Facility 2014

4.00x

3.00x

b) Non-financial covenants

A number of non-financial covenants have been established

in line with market practice applying to transactions of a

similar size and nature. These covenants involve a series

of restrictions on the grant of secured guarantees to third

parties, on the conduct of acquisitions or equity transactions,

and on amendments to the Company’s by-laws.

Default events

The main default events are as follows:

• default on loan repayment obligations;

• breach of financial covenants;

• breach of some of the non-financial covenants;

• declaration of bankruptcy or subjection of Group

companies to other insolvency proceedings;

• issuance of particularly significant judicial rulings;

• occurrence of events that may adversely and significantly

affect the business, the assets or the financial conditions

of the Group.

Should a default event occur, the lenders are entitled to

demand full or partial repayment of the amounts lent and not

yet repaid, together with interest and any other amount due.

No collateral security is required.

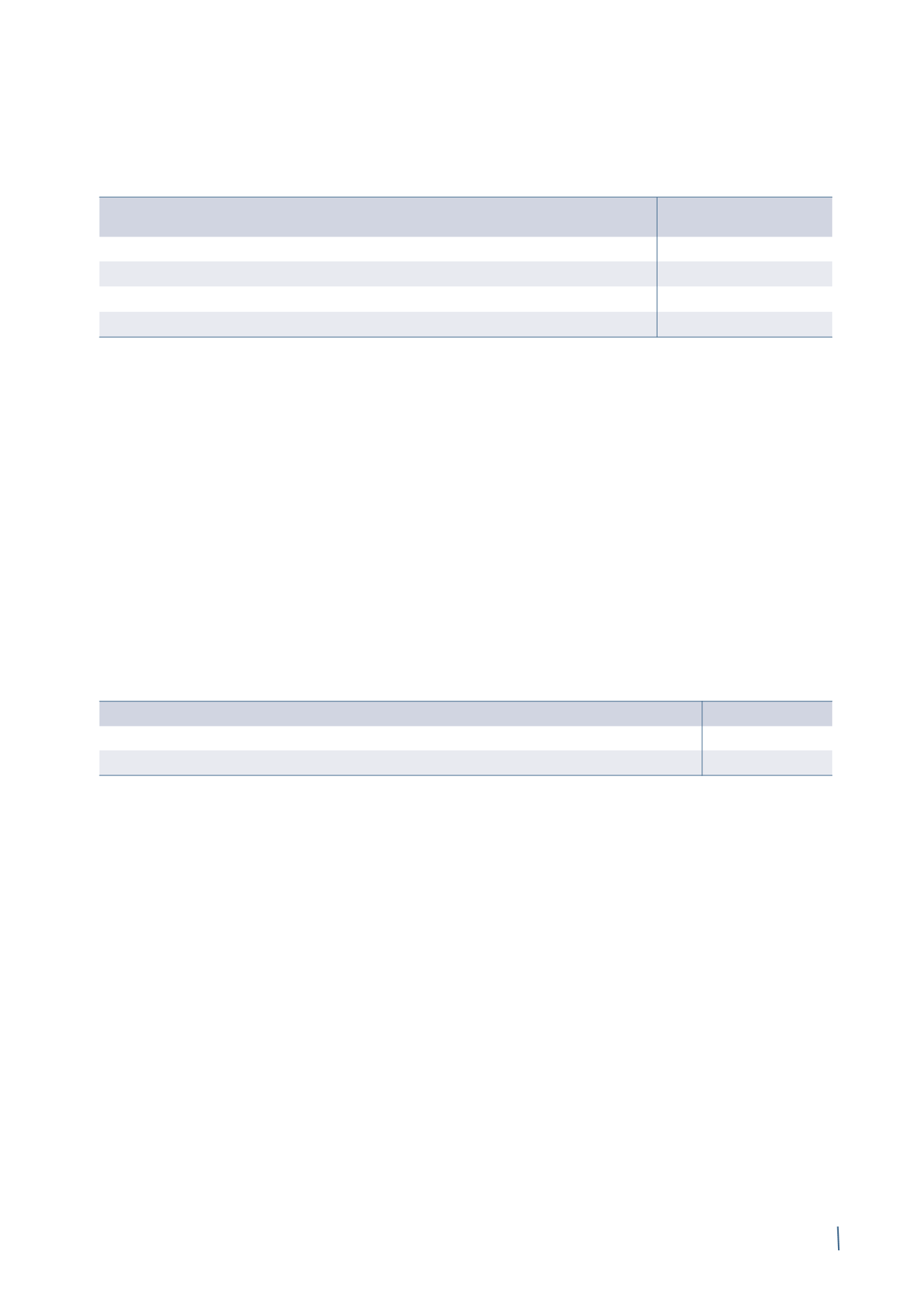

Actual financial ratios reported at period end are as follows:

(1) The ratios are calculated on the basis of the definitions contained in the relevant credit agreements.

31 December 2014

31 December 2013 (*)

EBITDA / Net finance costs

(1)

5.82

6.99

Net financial position / EBITDA

(1)

1.50

1.27

(1) The ratios are calculated on the basis of the definitions contained in the relevant credit agreements.

(*) The financial covenants have been recalculated following restatement of the previously published figures for the adoption of IFRS 10 and 11, the adoption

of a new method of classifying the share of net profit/(loss) of associates and joint ventures and of different timing for recognising the cash component of

the 2011-2013 incentive plan.

The above financial ratios comply with both the covenants contained in the relevant credit agreements and there are no

instances of non-compliance with the financial and non-financial covenants indicated above.