Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

236

30. COMMITMENTS

(a) Commitments topurchase property, plant and equipment

and intangible assets

Contractual commitments already entered into with third

parties as at 31 December 2014 and not yet reflected in

the financial statements amount to Euro 37 million for in-

vestments in property, plant and equipment (Euro 21 million

at the end of 2013) and to Euro 1 million for investments in

intangible assets (Euro 1 million at the end of 2013).

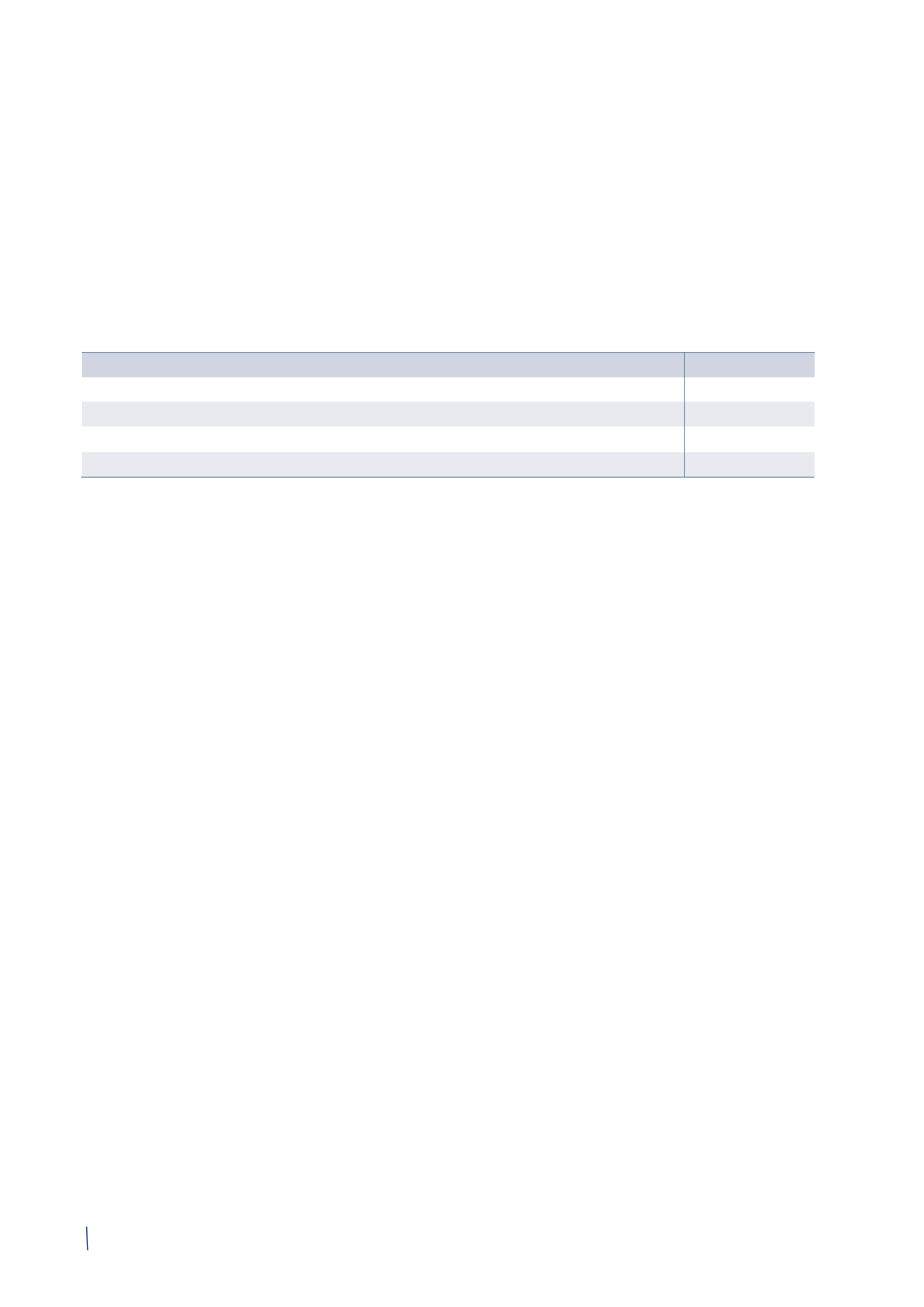

(b) Operating lease commitments

Future commitments relating to operating leases are as

follows:

2014

2013 (*)

Due within 1 year

18

40

Due between 1 and 5 years

30

20

Due after more than 5 years

7

16

Total

55

76

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

31.

RECEIVABLES FACTORING

With reference to factoring programmes, the Group has made

use of without-recourse factoring of trade receivables. The

amount of receivables factored but not yet paid by customers

was Euro 262 million at 31 December 2014 (Euro 290 million at

31 December 2013).

32. FINANCIAL COVENANTS

The credit agreements in place at 31 December 2014, details

of which are presented in Note 12, require the Group to

comply with a series of covenants on a consolidated basis.

The main covenants, classified by type, are listed below:

a) Financial covenants

• Ratio between EBITDA and Net finance costs (as defined

in the relevant agreements);

• Ratio between Net Financial Position and EBITDA (as

defined in the relevant agreements).

(in millions of Euro)