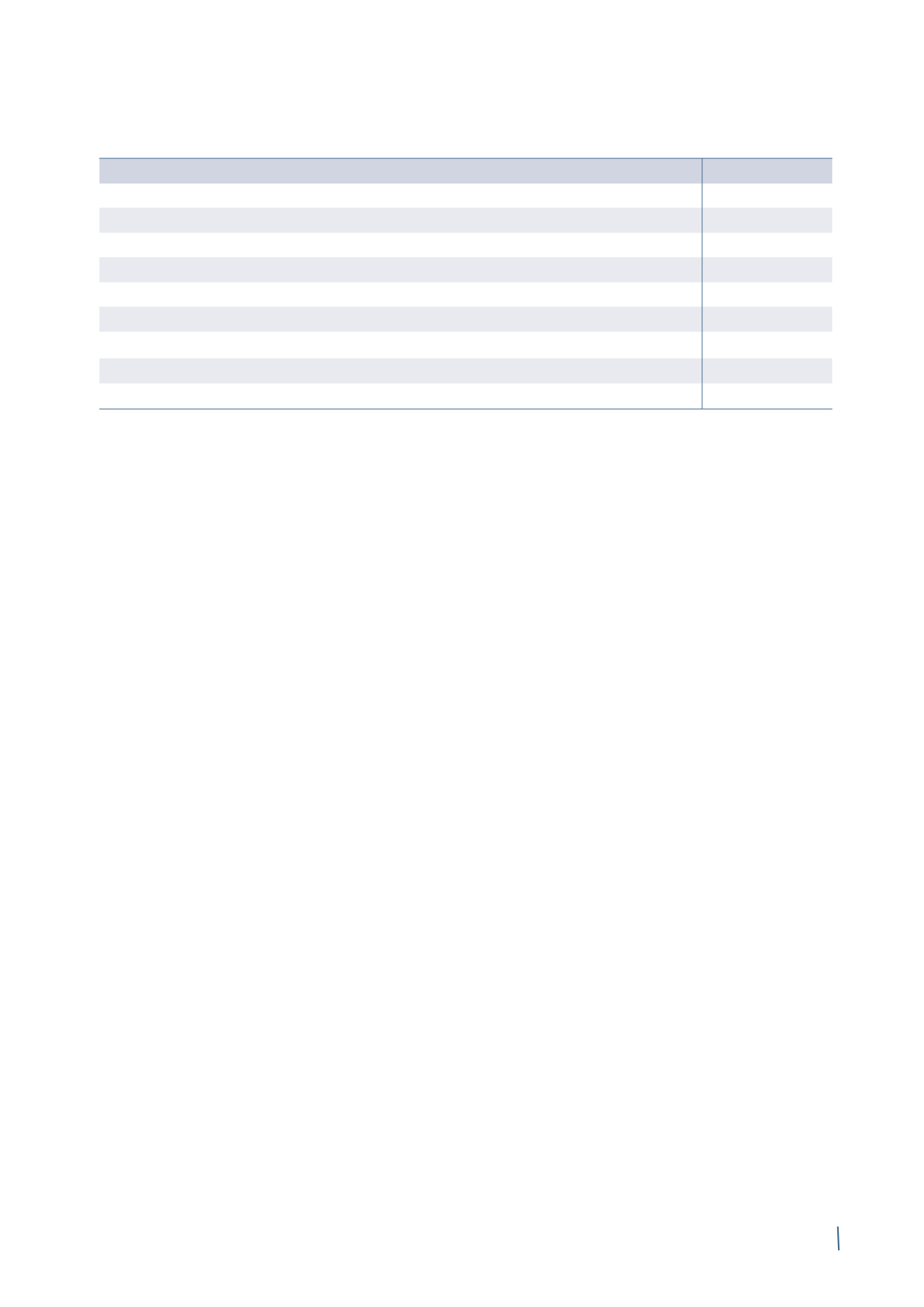

235

2014

2013 (*)

Net profit/(loss) attributable to owners of the parent

115

149

Weighted average number of ordinary shares (thousands)

212,373

211,835

Basic earnings per share (in Euro)

0.54

0.71

Net profit/(loss) attributable to owners of the parent

115

149

Weighted average number of ordinary shares (thousands)

212,373

211,835

Adjustments for:

Dilution from incremental shares arising from exercise of stock options (thousands)

164

6

Weighted average number of ordinary shares to calculate diluted earnings per share (thousands)

212,537

211,841

Diluted earnings per share (in Euro)

0.54

0.71

(*) Earnings per share for 2013 have been restated with respect to the previously published figure. Further details can be found in Section C. Restatement of

comparative figures.

The dividend paid in 2014 amounted to approximately Euro

89 million (Euro 0.42 per share). A dividend of Euro 0.42 per

share for the year ended 31 December 2014 will be proposed

at the annual general meeting to be held on 16 April 2015 in

a single call; based on the number of outstanding shares, the

above dividend per share equates to a total dividend payout

of approximately Euro 89 million. The current financial state-

ments do not reflect any liability for the proposed dividend.

29. CONTINGENT LIABILITIES

As a global operator, the Group is exposed to legal risks

primarily, by way of example, in the areas of product liability

and environmental, antitrust and tax rules and regulations.

The outcome of legal disputes and proceedings currently

in progress cannot be predicted with certainty. An adverse

outcome in one or more of these proceedings could result

in the payment of costs that are not covered, or not fully

covered, by insurance, which would therefore have a direct

effect on the Group’s financial position and results.

As at 31 December 2014, the contingent liabilities for which

the Group has not recognised any provision for risks and

charges, on the grounds that an outflow of resources is

unlikely, but which can nonetheless be reliably estimated,

amount to approximately Euro 15 million.

It is also reported, with reference to the Antitrust investi-

gations in the various jurisdictions involved, that the only

jurisdiction for which the Group has been unable to estimate

the risk is Brazil.

(in millions of Euro)