Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

232

24. SHARE OF NET PROFIT/(LOSS) OF EQUITY-ACCOUNTED COMPANIES

This is detailed as follows:

2014

2013 (*)

Share of net profit/(loss) of equity-accounted associates

26

16

Share of net profit/(loss) of equity-accounted joint ventures

17

19

Total

43

35

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

Futher information can be found in Note 3. Equity-accounted investments.

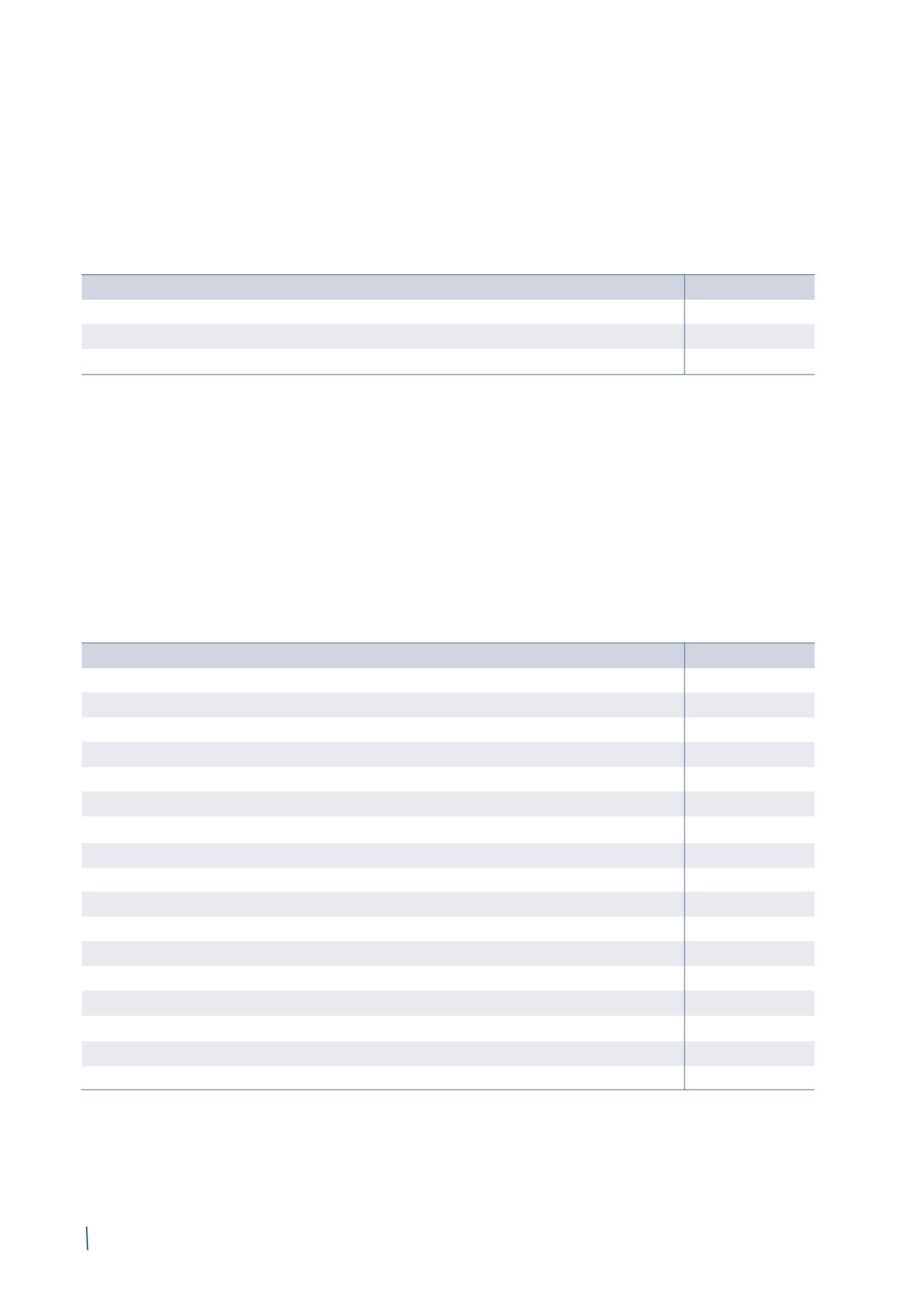

25. FINANCE COSTS

These are detailed as follows:

2014

2013 (*)

Interest on syndicated loans

9

12

Interest on non-convertible bond

21

21

Interest on convertible bond - non-monetary component

8

6

Interest on convertible bond - monetary component

4

3

Amortisation of bank and financial fees and other expenses

7

8

Employee benefit interest costs

11

11

Other bank interest

17

18

Costs for undrawn credit lines

5

4

Sundry bank fees

12

14

Non-recurring other finance costs

14

7

Other

22

26

Finance costs

130

130

Net losses on forward currency contracts

12

-

Non-recurring net losses on interest rate swaps

4

15

Losses on derivatives

16

15

Foreign currency exchange losses

333

290

Total finance costs

479

435

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

(in millions of Euro)

(in millions of Euro)