Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

218

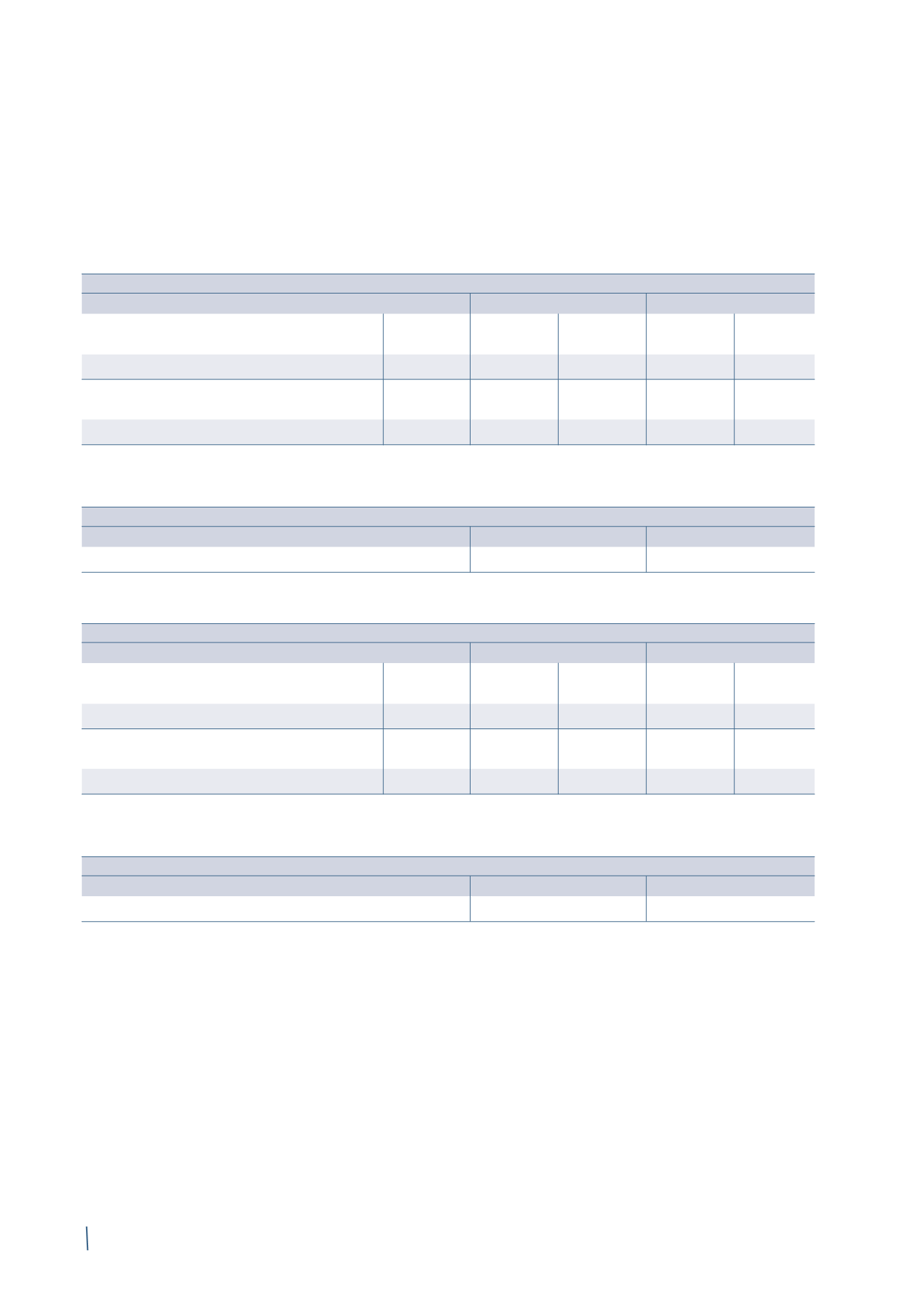

decrease

increase

decrease

increase

decrease

increase

- 0.50% + 0.50%

- 0.50% + 0.50%

- 0.50% + 0.50%

Interest rate

+8.03%

-7.24%

+10.31%

-9.24%

+5.13%

-4.70%

decrease

increase

decrease

increase

decrease

increase

- 0.25%

+ 0.25%

- 0.25%

+ 0.25%

- 0.25%

+ 0.25%

Inflation rate

-2.87%

+3.00%

-3.89%

+4.01%

n.a.

n.a.

decrease

increase

decrease

increase

decrease

increase

- 0.50% + 0.50%

- 0.50% + 0.50%

- 0.50% + 0.50%

Interest rate

+7.45%

-6.65%

+10.54%

-9.23%

+8.31%

-7.31%

decrease

increase

decrease

increase

decrease

increase

- 0.25%

+ 0.25%

- 0.25%

+ 0.25%

- 0.25%

+ 0.25%

Inflation rate

-2.79%

+2.93%

-3.72%

+3.93%

-3.83%

+4.08%

31 December 2014

31 December 2013

The following table presents a sensitivity analysis of the

effects of an increase/decrease in the most significant

actuarial assumptions used to determine the present value

of benefit obligations, namely the interest rate, inflation rate

and life expectancy.

The sensitivity of the inflation rate includes any effects

relating to assumptions about salary increases and increases

in pension plan contributions.

31 December 2014

31 December 2013

Germany

Great Britain

The Netherlands

Germany

Great Britain

The Netherlands

Germany

Great Britain

The Netherlands

1-year increase in life expectancy

+4.96%

+2.71%

n.a.

Germany

Great Britain

The Netherlands

1-year increase in life expectancy

+4.36%

+2.60%

+3.60%