Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

212

Liabilities for “Funded pension plans” are funded by con-

tributions made by the employer and, in some cases, by

employees, into a separately managed pension fund. The

fund independently manages and administers the amounts

received, investing in financial assets and paying benefits

directly to employees. The Group’s contributions to such

funds are defined according to the legal requirements esta-

blished in individual countries.

Liabilities for “Unfunded pension plans” are managed

directly by the employer who sees to providing the benefits to

employees. These plans have no assets to cover the liabilities.

At 31 December 2014, the most significant plans in terms of

accrued employee benefit liabilities are the plans managed in

the following countries:

• Germany;

• Great Britain;

• The Netherlands.

Pension plans in the above countries account for approxima-

tely 80% of the related liability. The principal risks to which

they are exposed are described below:

Germany

There are thirteen pension plans in Germany. These aremostly

final salary plans in which the retirement age is generally

set at 65. Although most plans are closed to new members,

additional costs may need to be recognised in the future. As

at 31 December 2014, the plans had an average duration of

15.7 years (14.8 years at 31 December 2013).

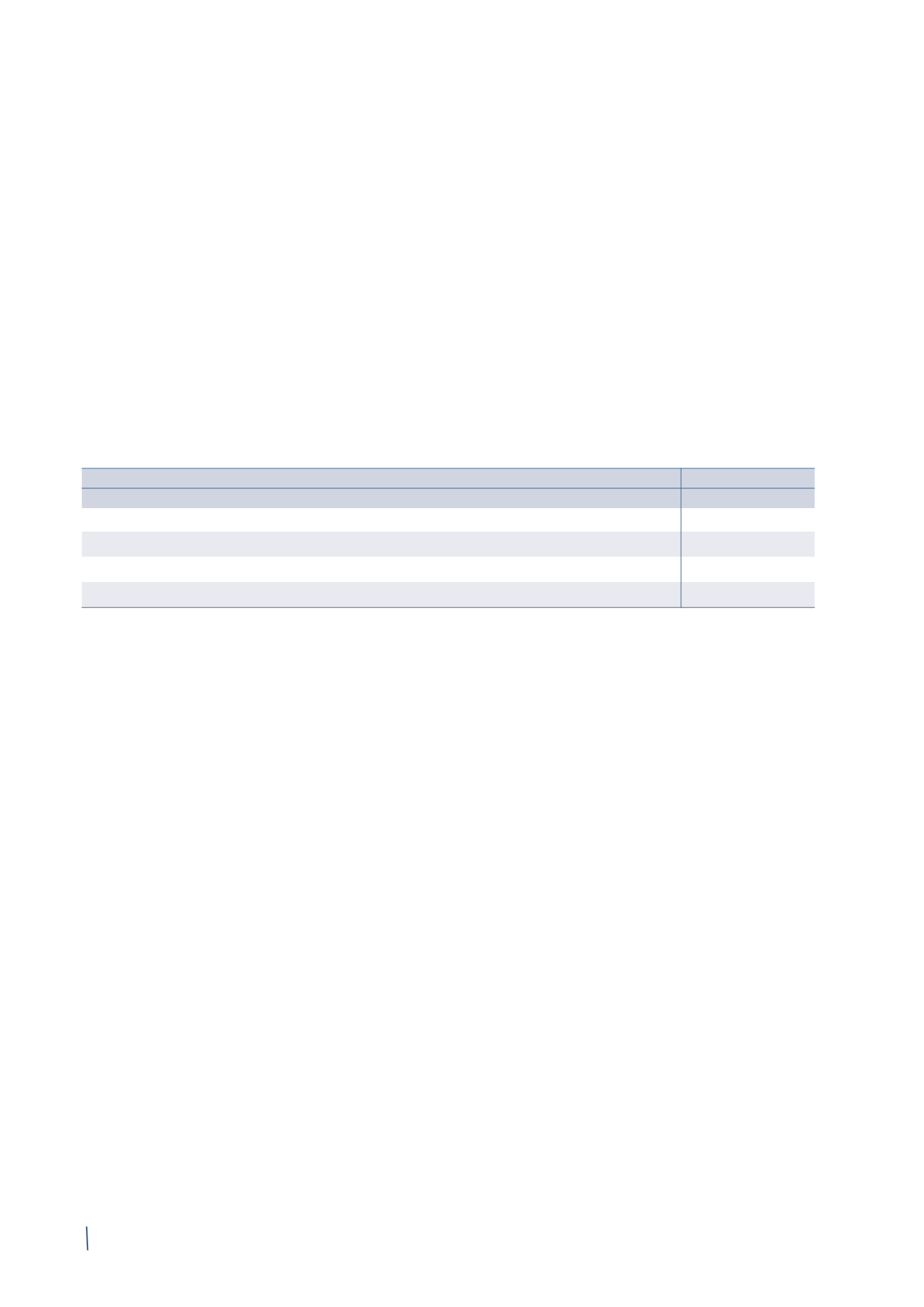

Total plan membership is made up as follows:

31 December 2014

31 December 2013

Number of participants Number of participants

Active

975

1,023

Deferred

1,067

1,118

Pensioners

1,724

1,644

Total membership

3,766

3,785

The German plans do not have any assets that fund the liabi-

lities; the Prysmian Group pays these benefits directly.

During the next year the benefits payable will amount to Euro

6 million (unchanged compared with 31 December 2013). The

increase in benefits, and so in the recorded liability and in

service costs, will mainly depend on inflation, salary growth

and the life expectancy of plan members. Another variable to

consider when determining the amount of the liability and of

service costs is the discount rate, identified by reference to

market yields of AA corporate bonds denominated in Euro.

Great Britain

Two defined benefit plans were in operation at 31 December

2014: the Draka pension fund and the Prysmian pension fund.

Both funds are final salary plans, in which the retirement age

is generally set at 65 for the majority of plan participants.

The plans will not admit any new members or accrue any new

liabilities after 31 December 2014.

As at 31 December 2014, the plans had an average duration

of approximately 20.3 years (approximately 20.9 years at 31

December 2013).