211

have filed actions in the High Court in London against certain

cable manufacturers, including certain Prysmian Group

companies, to obtain compensation for damages allegedly

suffered as a result of the alleged anti-competitive practices

condemned by the European Commission in the decision

adopted in April 2014.

The above events have led to the recognition in the 2014

income statement of a net release of Euro 31 million, classi-

fied as non-recurring items.

As at 31 December 2014, the amount of the provision is

approximately Euro 170 million.

Despite the uncertainty of the outcome of the investigations

underway and potential legal action by customers as a result

of the decision adopted by the European Commission, the

amount of this provision is considered to represent the

best estimate of the liability based on the information now

available.

15.

EMPLOYEE BENEFIT OBLIGATIONS

The Group provides a number of post-employment benefits

through programmes that include defined benefit plans and

defined contribution plans.

The defined contribution plans require the Group to pay, under

legal or contractual obligations, contributions into public or

private insurance institutions. The Group fulfils its obliga-

tions through payment of the contributions. At the financial

reporting date, any amounts accrued but not yet paid to the

above institutions are recorded in “Other payables”, while the

related costs, accrued on the basis of the service rendered by

employees, are recognised in “Personnel costs”.

The defined benefit plans mainly refer to Pension plans,

Employee indemnity liability (for Italian companies), Medical

benefit plans and other benefits such as seniority bonuses.

The liabilities arising from these plans, net of any assets

serving such plans, are recognised in Employee benefit obliga-

tions and are measured using actuarial techniques.

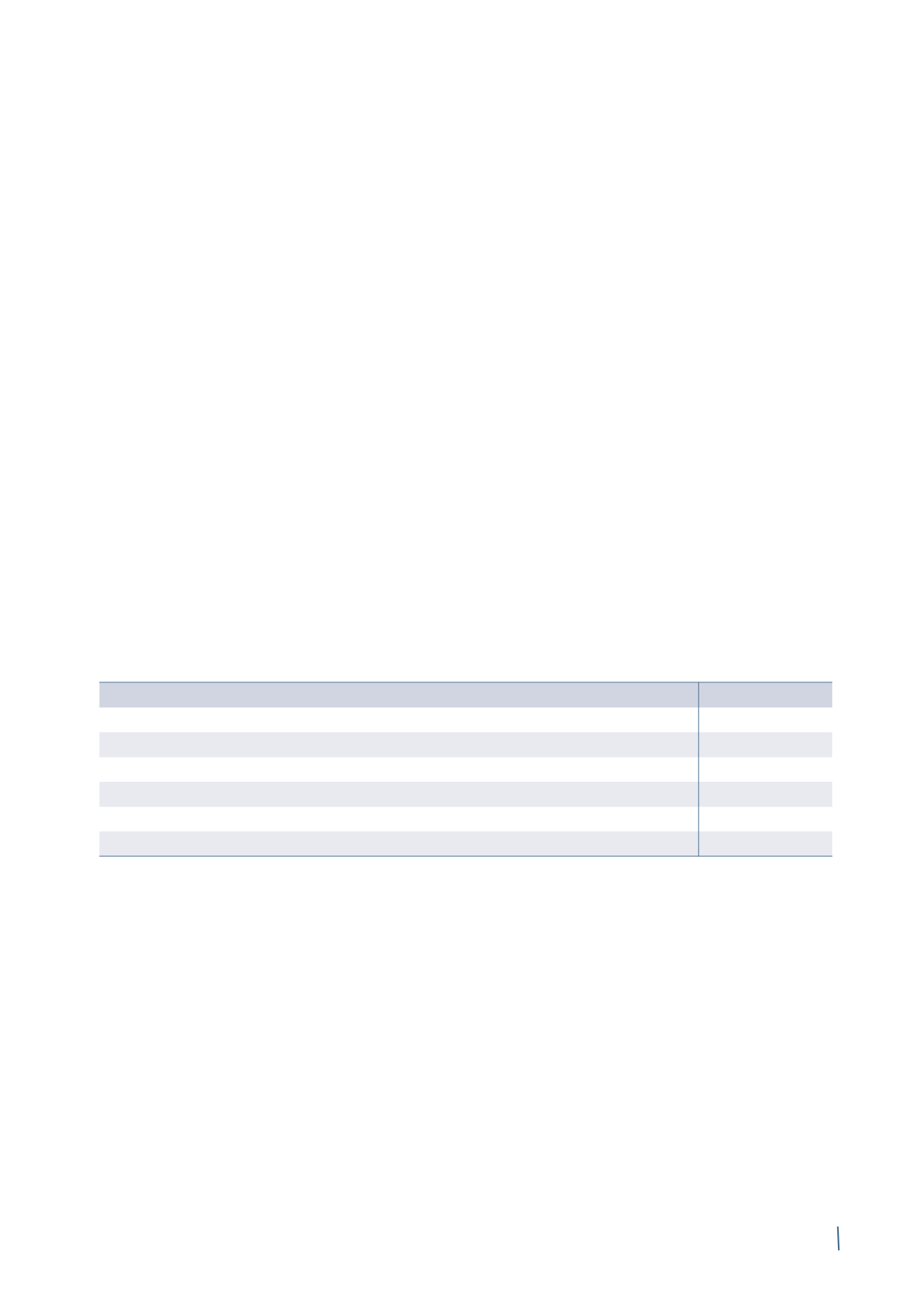

Employee benefit obligations are analysed as follows:

31 December 2014

31 December 2013 (*)

Pension plans

275

230

Employee indemnity liability (Italian TFR)

24

22

Medical benefit plans

25

23

Termination and other benefits

36

33

Incentive plans

-

-

Total

360

308

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

Pension plan amendments in 2014

During 2014, the liabilities accrued after 1996 relating to the

pension plan managed by Stichting Pensioenfonds Draka

Holding, to which three Dutch legal entities were party, were

transferred to Pensioenfonds van de Metalektro - PME, an

industry-wide multi-employer plan. Liabilities accrued before

1996 have remained with the employer companies and are

fully funded, meaning that the full value of this liability is

covered by the value of assets.

This transaction has resulted in the recognition in the 2014

income statement of the asset ceiling, deemed to be un-

recoverable, in accordance with the accounting treatment

prescribed by IFRIC 14. The related loss of Euro 8 million has

been classified as a non-recurring item.

PENSION PLANS

Pension plans relate to defined benefit pension schemes that

can be “Funded” and “Unfunded”.

Pension plan liabilities are generally calculated according

to employee length of service with the company and the

remuneration paid in the period preceding cessation of em-

ployment.

(in millions of Euro)