193

(*) The previously published prior year consolidated financial statements have been restated following the adoption of IFRS 10 and IFRS 11. Further details can

be found in Section C. Restatement of comparative figures.

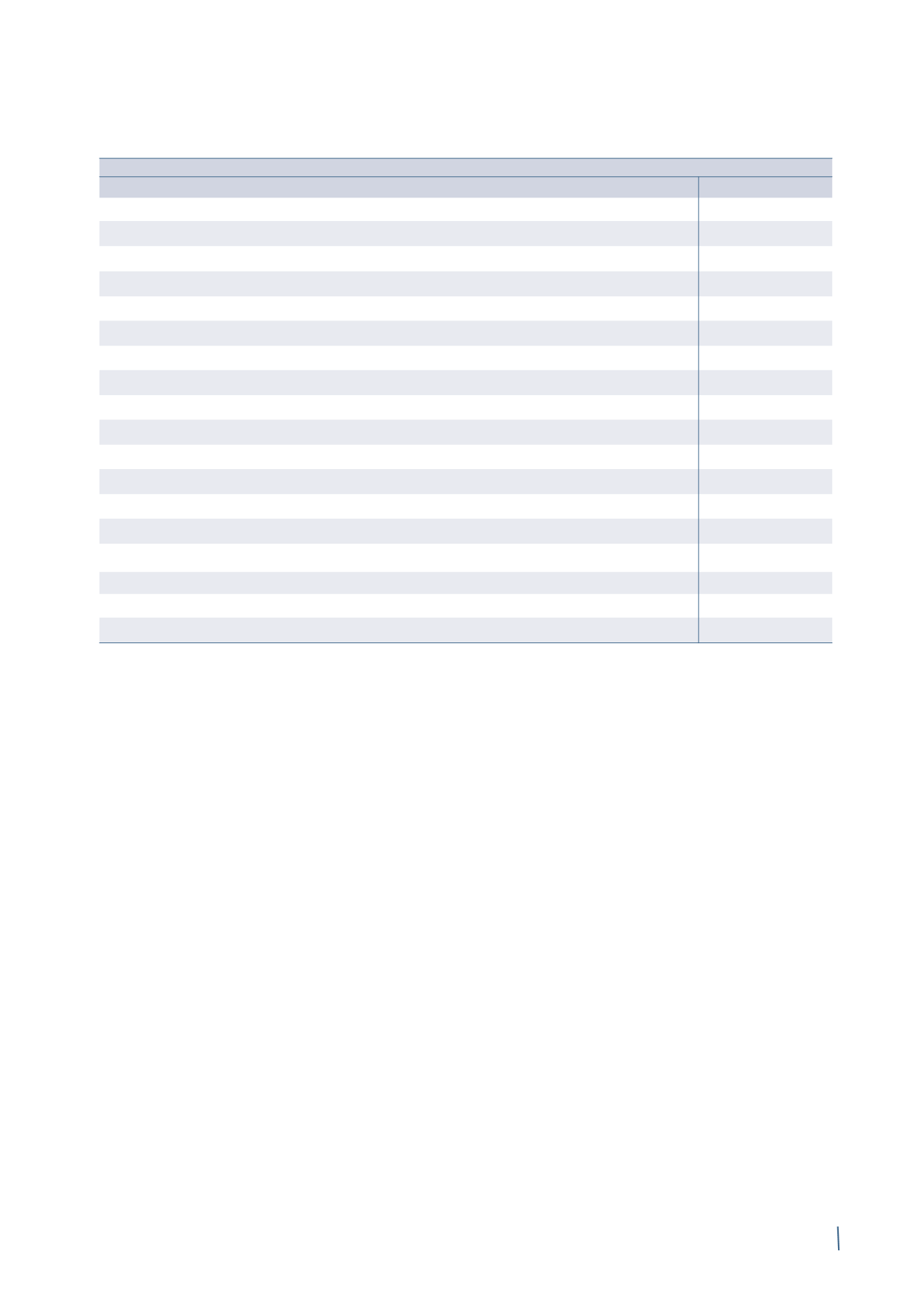

31 December 2013 (*)

Asset

Liability

Non-current

Interest rate swaps (cash flow hedges)

-

4

Forward currency contracts on commercial transactions (cash flow hedges)

1

1

Total hedging derivatives

1

5

Metal derivatives

1

2

Total other derivatives

1

2

Total non-current

2

7

Current

Interest rate swaps (cash flow hedges)

-

5

Forward currency contracts on commercial transactions (cash flow hedges)

4

3

Total hedging derivatives

4

8

Forward currency contracts on commercial transactions

9

3

Forward currency contracts on financial transactions

5

5

Interest rate swaps

-

9

Metal derivatives

5

17

Total other derivatives

19

34

Total current

23

42

Total

25

49

The Prysmian Group entered into no new interest rate swaps

during 2014.

The early repayment of the remaining balance on the Term

Loan Facility 2010, originally due to mature on 31 December

2014, has led to the discontinued effectiveness of the related

cash flow hedges outstanding as at the date of repayment.

The contracts for which hedge accounting was discontinued in

2014 expired on 31 December 2014 and had a notional value of

Euro 180 million. In addition, 31 December 2014 was the expiry

date of the interest rate swaps, with a notional value of Euro

300 million, for which hedge accounting was discontinued in

2013 following early repayment of the Term Loan Facility 2010.

Interest rate swaps have a notional value of Euro 200 million

at 31 December 2014 (down from Euro 480 million at 31

December 2013), all of which refer to derivatives designated

as cash flow hedges. Such financial instruments convert the

variable component of interest rates on loans received into a

fixed rate of between 1.1% and 1.7%.

Forward currency contracts have a notional value of Euro 1,679

million at 31 December 2014 (Euro 2,332 million at 31 December

2013); total notional value at 31 December 2014 includes Euro

512 million in derivatives designated as cash flow hedges (Euro

691 million at 31 December 2013).

At 31 December 2014, like at 31 December 2013, almost all

the derivative contracts had been entered into with major

financial institutions.

Metal derivatives have a notional value of Euro 523 million at

31 December 2014 (Euro 482 million at 31 December 2013).

(in millions of Euro)