Consolidated Financial Report |

EXPLANATORY NOTES

2014 Annual Report

Prysmian Group

192

8.

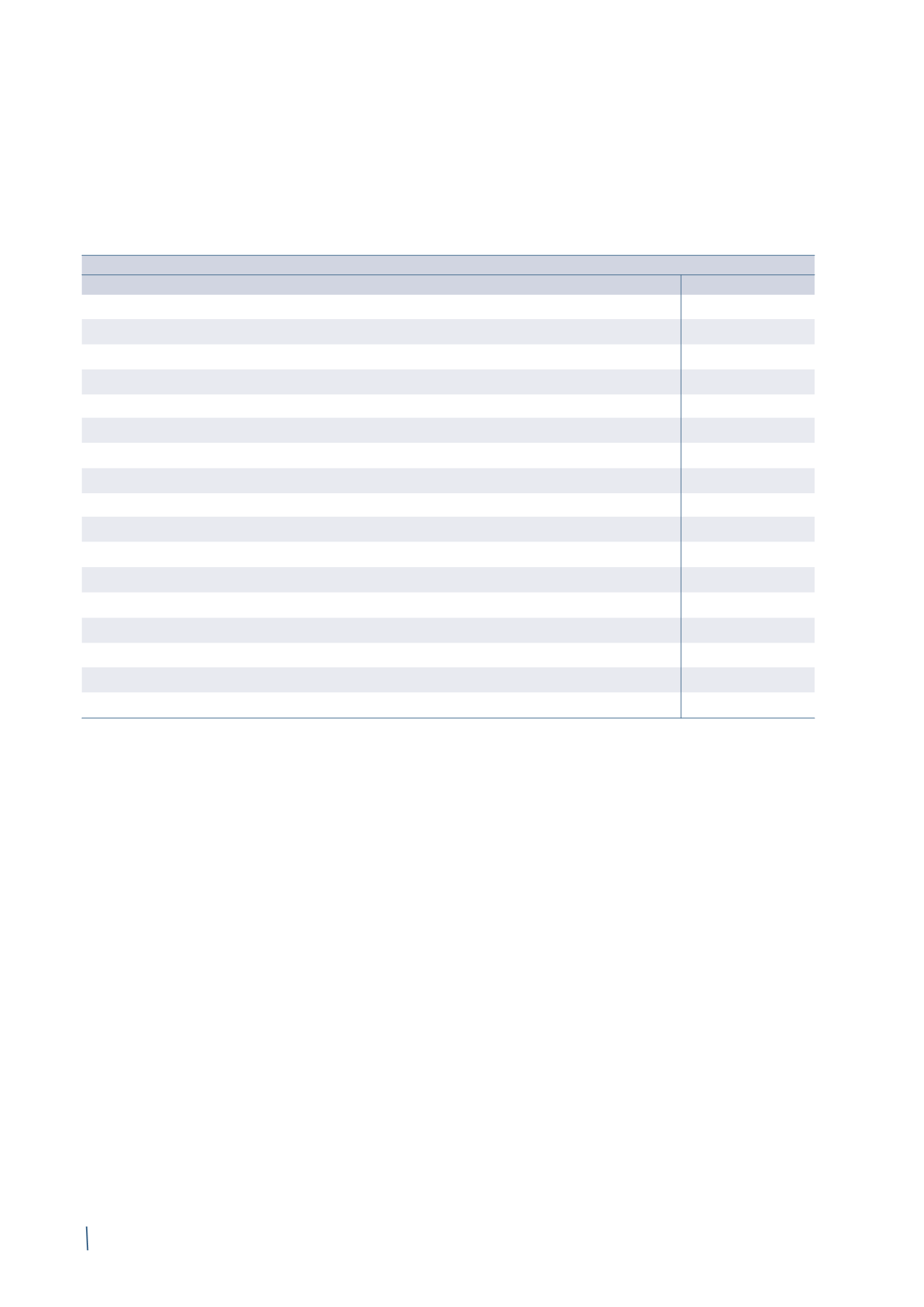

DERIVATIVES

These are detailed as follows:

31 December 2014

Asset

Liability

Non-current

Interest rate swaps (cash flow hedges)

-

3

Forward currency contracts on commercial transactions (cash flow hedges)

-

2

Total hedging derivatives

-

5

Metal derivatives

1

-

Total other derivatives

1

-

Total non-current

1

5

Current

Forward currency contracts on financial transactions (cash flow hedges)

-

1

Forward currency contracts on commercial transactions (cash flow hedges)

11

18

Total hedging derivatives

11

19

Forward currency contracts on commercial transactions

8

10

Forward currency contracts on financial transactions

5

7

Metal derivatives

5

11

Total other derivatives

18

28

Total current

29

47

Total

30

52

(in millions of Euro)