Consolidated Financial Report |

DIRECTORS’ REPORT

2014 Annual Report

Prysmian Group

28

PRYSMIAN AND THE FINANCIAL MARKETS

OWNERSHIP STRUCTURE

The listing of Prysmian's ordinary shares, resulting from the

sale of 46% of the shares held by the Goldman Sachs Group

Inc., took place on 3 May 2007 at a price of Euro 15.0 per

share, corresponding to a capitalisation of Euro 2.7 billion.

Subsequent to the listing, the Goldman Sachs Group Inc.

gradually reduced its interest in the company, control of

which it had acquired in July 2005, by placing the remaining

54% of the shares with institutional and selected investors

in several successive stages: i) approx. 22% in November

2007, ii) approx. 14% in November 2009, iii) approx. 17% in

March 2010. Valerio Battista, Prysmian's Chief Executive

Officer, announced on occasion of the last sale that he had

purchased 1,500,000 shares, corresponding to around 0.8%

of share capital and taking his total shareholding to 1.2%,

which he raised to approximately 1.5% during the course of

subsequent years.

At 31 December 2014, the Company's free float was equal to

100% of the outstanding shares and major shareholdings

(in excess of 2%) accounted for approximately 28% of total

share capital, meaning there were no majority or controlling

interests. Prysmian is now one of Italy’s few globally present

industrial companies to have achieved Public Company

status in recent years.

At 31 December 2014, the share capital of Prysmian S.p.A.

amounted to Euro 21,671,397.70, comprising 216,712,397

ordinary shares with a nominal value of Euro 0.10 each. The

ownership structure at this date is shown below.

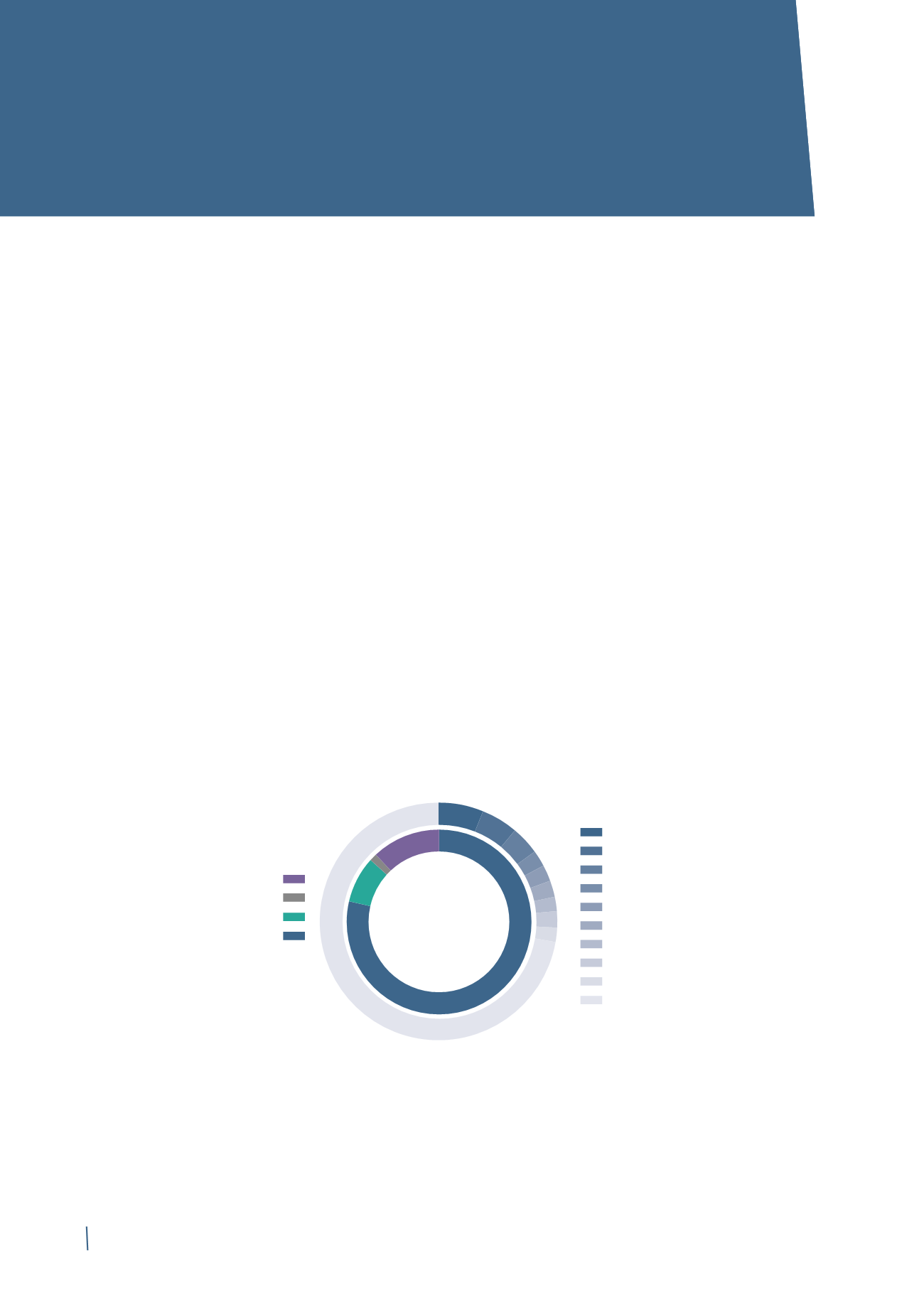

Institutional Investors

78.6%

Retail

8.1%

Treasury shares

1.3%

Other(*)

12.0%

6.2%

Clubtre S.p.A.

5.0%

BlackRock Inst. Trust NA

3.8%

Franklin Templeton IM Ltd.

2.3%

Norges Bank IM

2.2%

General Inv. Europe S.p.A.

2.2%

JPMorgan AM U.K. LTD

2.1%

Franklin Equity Group

2.1%

State Street GA France S.A.

2.0%

Gov. of People's Rep. of China

72.1%

Other

OWNERSHIP STRUCTURE BY TYPE AND MAJOR SHAREHOLDERS

Source: Nasdaq OMX, December 2014 (Ownership structure by type); Thomson One public sources, December 2014 (Major shareholders with over 2%).

(*) Mainly includes shares held by non-institutional investors and shares with third-party custodians held for trading.

Prysmian Group is a genuinely Public Company: its free float is equal to 100% of the shares,

with nearly 80% of its capital held by institutional investors.