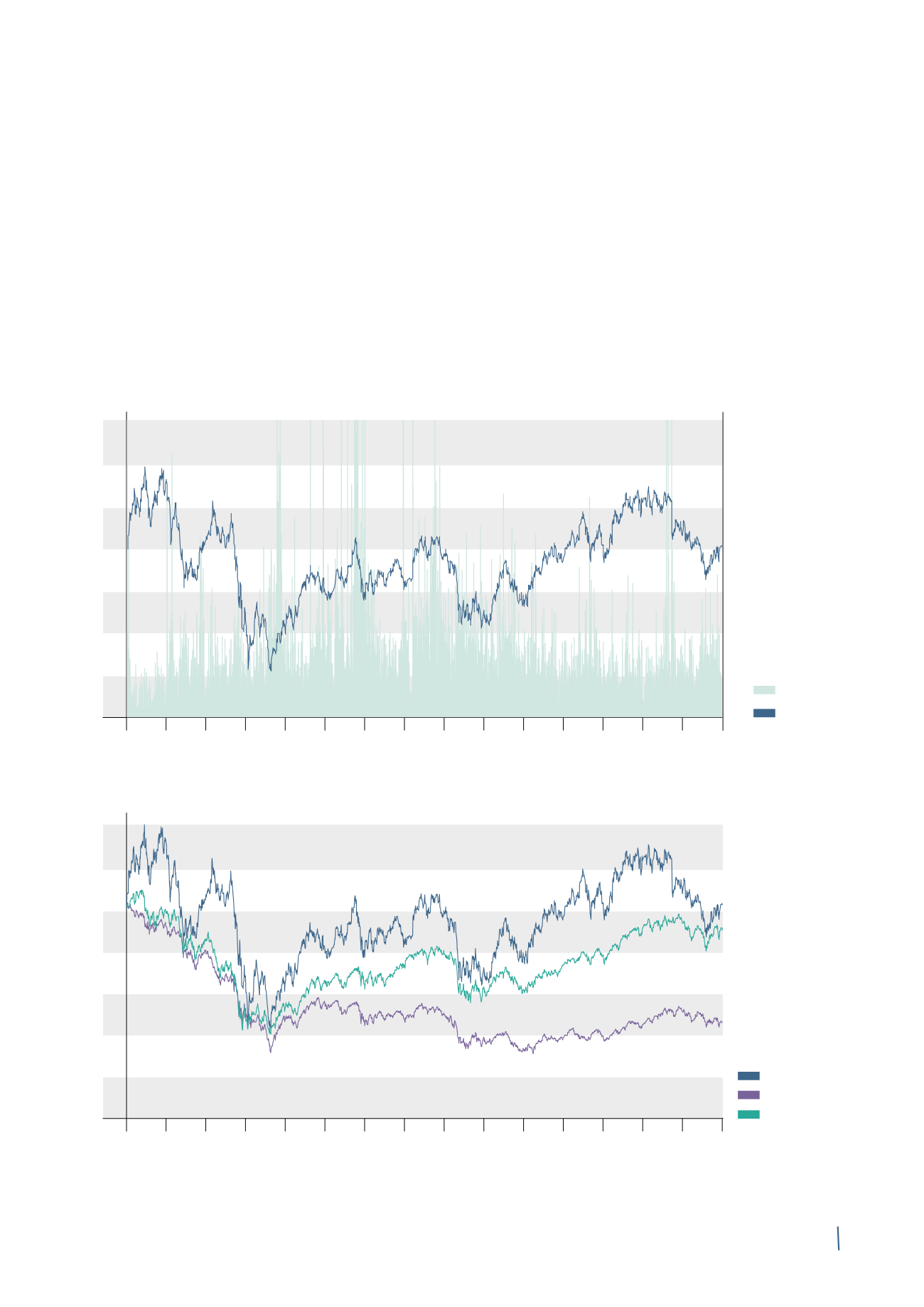

33

Prysmian stock was affected by this downward trend, as well

as by profit warnings by its main competitors, reaching a

low for the year of Euro 12.80 in mid-October. Conditions on

international financial markets and in the Eurozone slowly

improved in the last two months of 2014, thanks to growing

expectations of an imminent quantitative easing in Europe

by the ECB and to GDP growth in the United States, back

to +5% in the third quarter, a rate not seen since 2003. In

this context, the stock entered a bullish phase, supported

by publication of the Group's nine-month results for 2014,

confirmation of the full-year guidance and the ability to

manage the Western Link problem, as well as by a gradual

improvement in the recommendations of financial analysts,

67% of whom expressed Positive recommendations (the

remaining 33% maintained a Neutral rating and no one gave

a Negative rating). The Prysmian stock therefore closed 2014

at a price of Euro 15.15, down 19% from Euro 18.71 at the end

of 2013, but nonetheless higher than its original IPO price.

May-07 Nov-07 May-08 Nov-08 May-09 Nov-09 May-10 Nov-10 May-11 Nov-11 May-12 Nov-12 May-13 Nov-13 May-14 Nov-14

Volume - Mln shares

Price - Euro

24

21

18

15

12

9

6

3

6.0

7.0

5.0

4.0

3.0

2.0

1.0

0

Volumes

Prysmian

PERFORMANCE OF PRYSMIAN STOCK SINCE IPO

140

120

100

80

60

40

20

0

Prysmian

FTSE MIB

EURO STOXX Industrials

PERFORMANCE OF PRYSMIAN STOCK VERSUS BENCHMARKS SINCE IPO

May-07 Nov-07 May-08 Nov-08 May-09 Nov-09 May-10 Nov-10 May-11 Nov-11 May-12 Nov-12 May-13 Nov-13 May-14 Nov-14