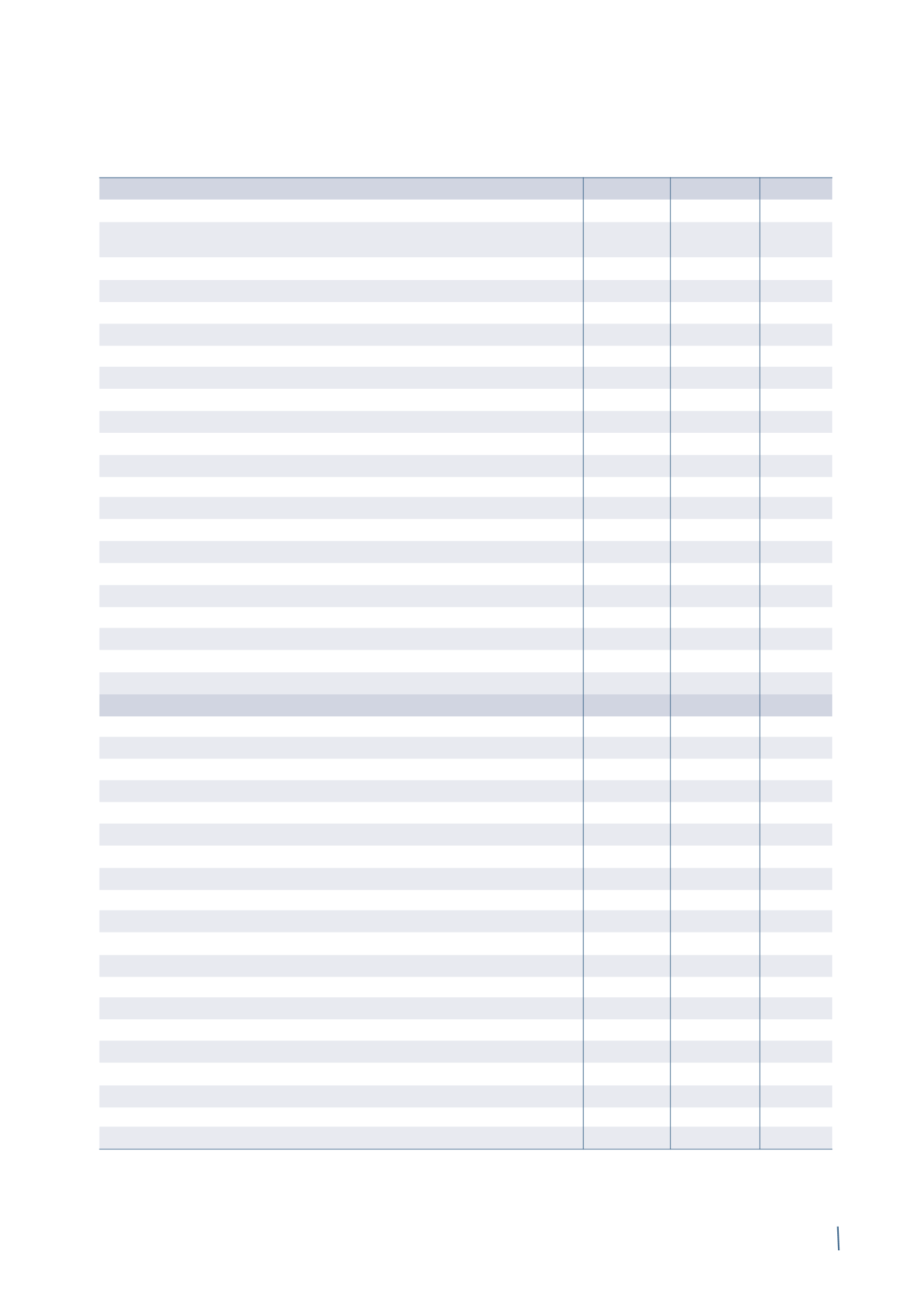

45

2014

2013 (*)

Change %

2012 (*)

Sales

6,840

6,995

-2.2%

7,574

Adjusted EBITDA before share of net profit/(loss)

of equity-accounted companies

466

578

-19.5%

619

% of sales

6.8%

8.3%

8.2%

Adjusted EBITDA

509

613

-17.0%

650

% of sales

7.4%

8.8%

8.6%

EBITDA

496

563

-12.2%

549

% of sales

7.2%

8.1%

7.2%

Fair value change in metal derivatives

7

(8)

14

Remeasurement of minority put option liability

-

-

7

Fair value stock options

(3)

(14)

(17)

Amortisation, depreciation, impairment & impairment reversal

(188)

(173)

(180)

Operating income

312

368

-15.6%

373

% of sales

4.5%

5.3%

4.9%

Net finance income/(costs)

(140)

(150)

(134)

Profit/(loss) before taxes

172

218

-21.3%

239

% of sales

2.5%

3.1%

3.2%

Taxes

(57)

(65)

(72)

Net profit/(loss) for the year

115

153

-24.7%

167

% of sales

1.7%

2.2%

2.2%

Attributable to:

Owners of the parent

115

149

166

Non-controlling interests

-

4

1

Reconciliation of Operating Income / EBITDA to Adjusted Operating Income / Adjusted EBITDA

Operating income (A)

312

368

-15.6%

373

EBITDA (B)

496

563

-12.2%

549

Non-recurring expenses/(income):

Company reorganisation

48

50

74

Antitrust

(31)

(6)

1

Draka integration costs

-

-

9

Tax inspections

-

-

3

Environmental remediation and other costs

-

(3)

3

Italian pensions reform

-

-

1

Gains on asset disposals

-

(5)

(3)

Effect of YOFC dilution

(8)

-

-

Acquisition price adjustment

(1)

(22)

-

-

Other net non-recurring expenses

26

14

13

Total non-recurring expenses/(income) (C)

13

50

101

Fair value change in metal derivatives (D)

(7)

8

(14)

Fair value stock options (E)

3

14

17

Remeasurement of minority put option liability (F)

-

-

(7)

Impairment and impairment reversal of assets (G)

44

25

24

Adjusted operating income (A+C+D+E+F+G)

365

465

-21.5%

494

Adjusted EBITDA (B+C)

509

613

-17.0%

650

FINANCIAL PERFORMANCE

(*) The previously published prior year comparative figures have been restated following the introduction of IFRS 10 and IFRS 11 and a new method of classifying

the share of net profit (loss) of associates and joint ventures.

(1) This refers to the acquisition in November 2012 of Global Marine Systems Energy Ltd (now renamed Prysmian PowerLink Services Ltd) from Global Marine

Systems Ltd.

(in millions of Euro)