Consolidated Financial Report |

DIRECTORS’ REPORT

2014 Annual Report

Prysmian Group

90

This comprehensive view of the Group's risks allows the

Board of Directors and Management to reflect upon the

level of the Group's risk appetite, and so identify the risk

management strategies to adopt, meaning the assessment

of which risks and with what priority it is thought necessary

to improve and optimise mitigation actions or simply to

monitor the exposure over time. The adoption of a particular

risk management strategy, however, depends on the nature

of the risk event identified, so in the case of:

• external risks outside

the Group's control, it will be

possible to implement tools that support the assessment

of scenarios should the risk materialise, by defining the

possible action plans to mitigate impacts (eg. continuous

monitoring activities, stress testing of the business plan,

insurance cover, disaster recovery plans, and so on);

• risks partially addressable

by the Group, it will be possible

to intervene through systems of risk transfer, monitoring

of specific indicators of risk, hedging activities, and so

on;

• internal risks addressable

by the Group, it will be possible,

being inherent in the business, to take targeted actions

to prevent risk and minimise impacts by implementing

an adequate system of internal controls and related

monitoring and auditing.

ERM is a continuous process that, as stated in the ERMPolicy,

forms part of the Group's three-year strategic and business

planning process, by identifying potential events that could

affect sustainability, and that are updated annually with the

involvement of key members of management.

In 2014 this process involved more than 30 business

managers, allowing the most significant risk factors to be

identified and assessed; themain information emerging from

this process, along with the strategies adopted to mitigate

the impacts, are reported in the following paragraphs.

The classification used in the Risk Model just described is

used to discuss the significant risk factors for each category

and the strategies adopted to mitigate such risks. Financial

risks are discussed in detail in the Explanatory Notes to the

Consolidated Financial Statements in Section D (Financial

Risk Management).

As stated in the Explanatory Notes to the Consolidated

Financial Statements (Section B.1 Basis of preparation), the

Directors have assessed that there are no financial, operating

or other kind of indicators that might provide evidence of the

Group's inability to meet its obligations in the foreseeable

future and particularly in the next 12 months. In particular,

based on its financial performance and cash generation in

recent years, as well as its available financial resources at

31 December 2014, the Directors believe that, barring any

unforeseeable extraordinary events, there are no significant

uncertainties, such as to cast significant doubts upon the

business's ability to continue as a going concern.

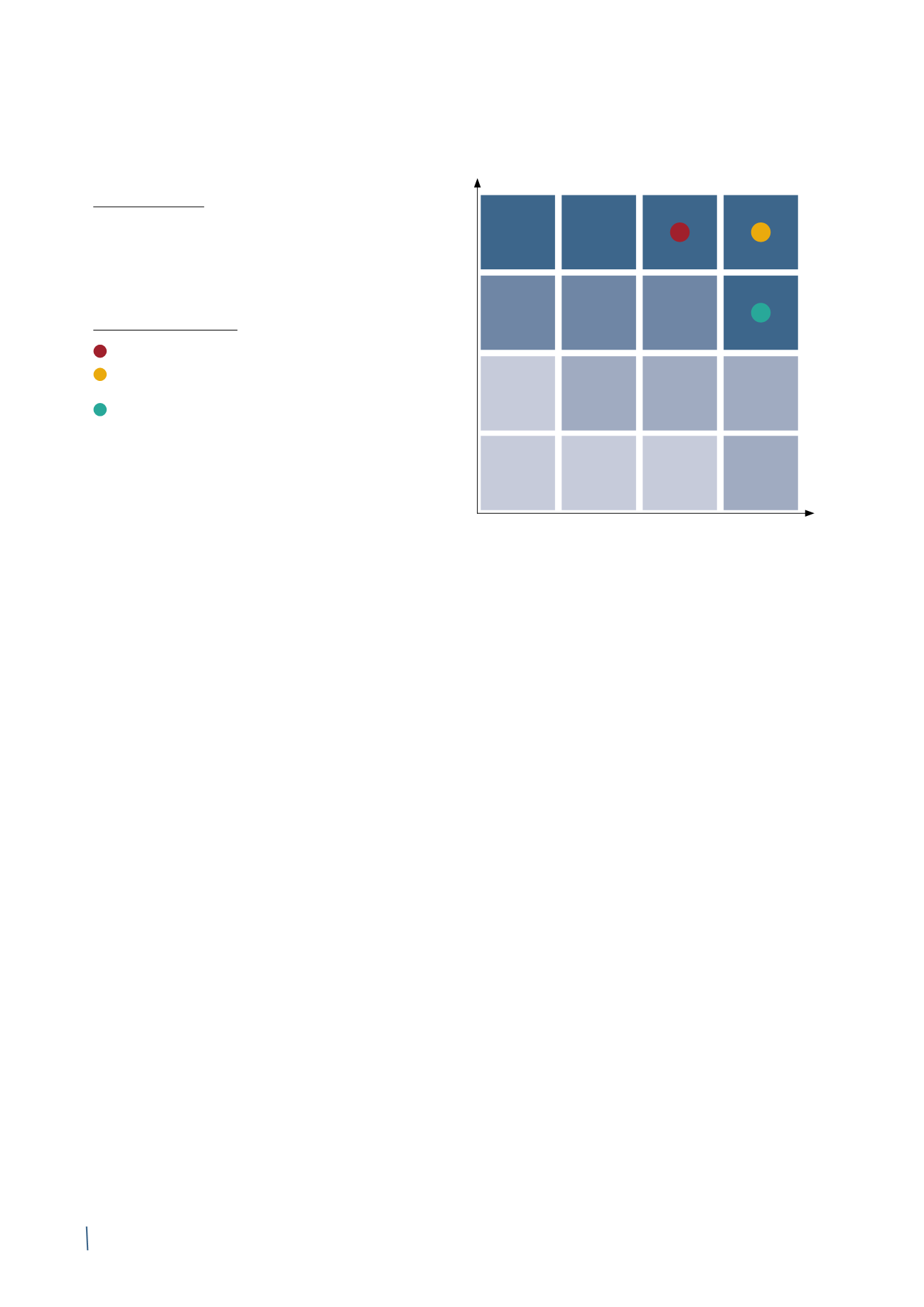

RISK ASSESSMENT CRITERIA

Assessment Criteria

IMPACT

Level of Risk Management

• Impact

• Probability

• Level of Risk Management

Risk INADEQUATELY covered and/or managed

Risk covered and/or managed but

with ROOM FOR IMPROVEMENT

Risk ADEQUATELY covered and/or managed

Remote

Negligible

Low

Moderate

Medium

High

High

Critical

PROBABILITY