QUARTERLY OVERVIEW

4

Prysmian Group Insight

Slightly positive organic growth

Continued increase in Telecom volumes

The approved financial

results for Prysmian Group’s first nine monthsof 2014 showed generally stable

profitability, excluding the adverse

impact of the Western Link project.

CEO Valerio Battista explained that

the pace of volume recovery in the

telecom cables business continued

to exceed expectations, while the

building cables market is showing a

slight improvement in volumes.

Positive performance in North

America and Asia has served as

a partial counterbalance to the

weak environment in Europe and

deterioration in South America.

Group sales amounted to

€

5,014

million, compared with

€

5,297

million one year earlier, posting

organic growth of +0.2% assuming

the same group perimeter and

excluding metal price and exchange

rate effects. Without the Western

Link effect, organic growth would

have been +1.7%, confirming an

upsurge in volumes in the Trade &

Installers and Telecom businesses.

Adjusted EBITDA was

€

355 million,

or

€

438 million excluding Western

Link, which is basically in line with

the first nine months of 2013 (

€

442

million).

The policy of targeted investments

in the higher value-added

businesses has also continued,

with a new

€

40 million plan for

the submarine cable plants in Arco

Felice, Italy and Pikkala, Finland.

Adjusted operating income came

in at

€

249 million, or

€

332 million

excluding Western Link (in line with

€

333 million in the first nine months

of 2013). Net finance income and

costs reported a negative balance

of

€

108 million, down from

€

114

million in the first nine months of

2013, thanks to the improvements

in financial structure and in the

cost of Group debt. Adjusted net

profit was

€

134 million; however

excluding the Western Link project,

it would have been

€

191 million,

up +6.7% from the first nine

months of 2013. The net financial

position at the end of September

2014 was

€

1,292 million, compared

with

€

1,193 million at the end of

September 2013, with the target

to achieve approx.

€

900 million by

year end.

The Board of Directors also

decided to launch a share buy-

back programme with a maximum

total value of

€

50 million, with the

purpose of providing the company

with a ‘pool of securities’ to be used

for possible extraordinary corporate

actions, meeting obligations arising

from debt instruments convertible

or supporting the share-based

incentive plans for the Group’s

employees.

Good performance for Power

Transmission and Telecom.

Ongoing volume improvement

in Trade & Installers. The

launch of a share buy-back

programme.

Sales at €5,014 million and ADJ. EBITDA at €355 million in the first nine months

Profitability in line with last year, excluding the WL effect

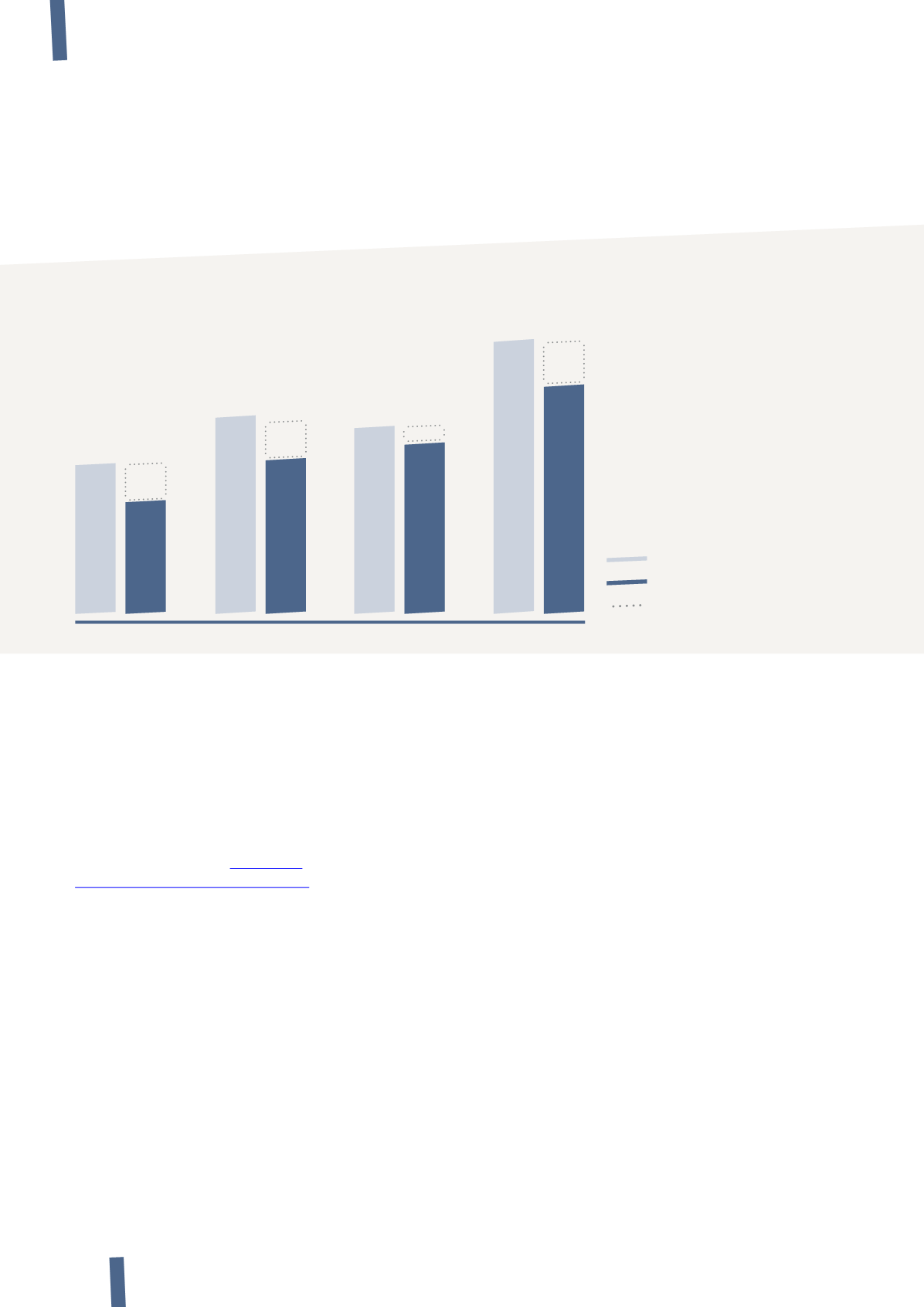

Adj. EBITDA evolution (Euro million)

2013

Q1

Q2

Q3

9M

2014

Western Link

114 115

168

160

442 438

160

151

126

355

163

78

37

37

83

9